-

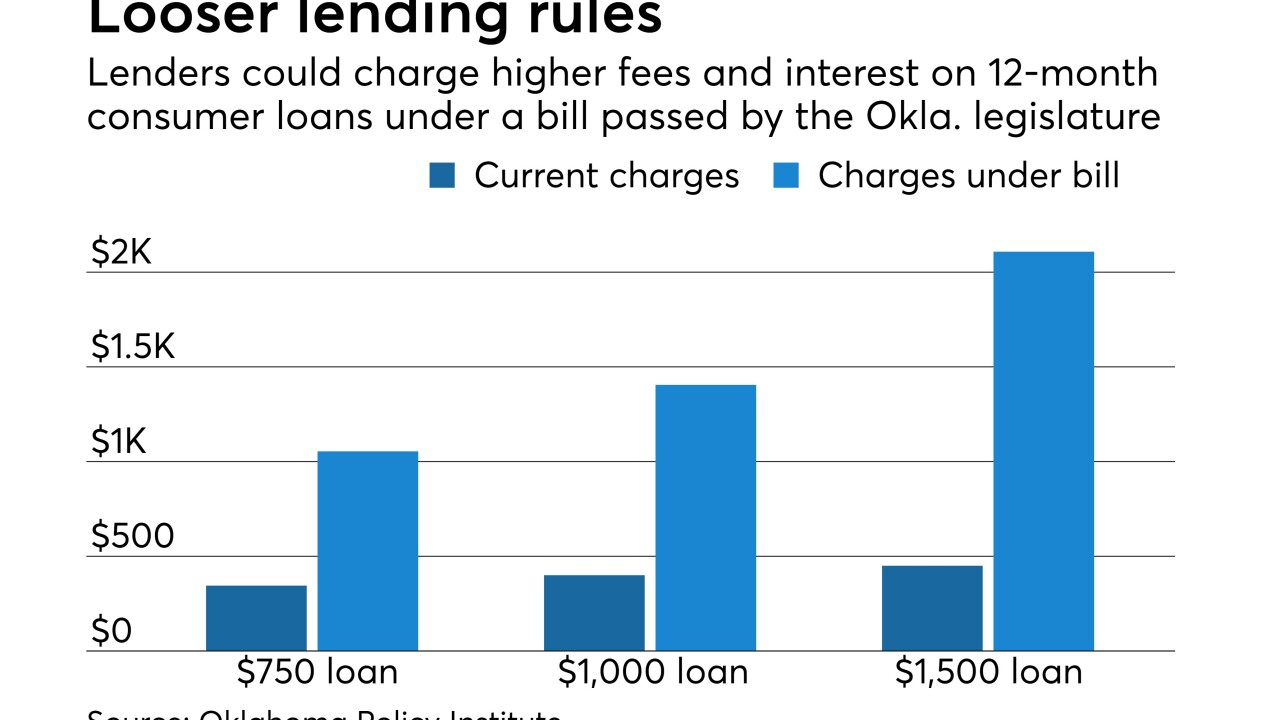

An industry-backed bill that is headed to the desk of Gov. Mary Fallin is seen by critics as an effort to minimize the impact of a potential CFPB crackdown.

April 28 -

The weakening car-loan market poses a big challenge for the Detroit-based lender, but it also could also present an opportunity, since other big banks are sharply reducing their exposure.

April 27 -

Depending whose money they're using, Wells Fargo and JPMorgan Chase either love subprime car loans or fear them.

April 27 -

All six big card issuers reported higher chargeoffs in their credit card businesses, a sign that the post-crisis era of exceptionally strong credit performance has run its course.

April 26 -

The Consumer Financial Protection Bureau ordered an auto loan servicer on Wednesday to pay $2.4 million for failing to live up to the terms of a 2015 consent order.

April 26 -

Profits at the Dallas lender plunged as it slashed originations and edged up the credit spectrum.

April 26 -

The era of exceptionally strong loan performance in the credit card business has come to an end, and the Riverwoods, Ill., firm is feeling the effects.

April 25 -

Most of the delinquencies and chargeoffs were in the bank’s credit card and auto loan portfolios

April 25 -

Northwest, which produced lackuster first-quarter results, said it will close all 44 offices of Northwest Consumer Discount Co. by mid-July. The unit’s loans will be transferred to Northwest’s bank for servicing and collections.

April 25 -

The startup Dave (just Dave) sells an app that forecasts short-term bank balances and sends users small-dollar advances when necessary, part of a wave of efforts to improve consumers’ financial health using digital tools.

April 25 -

The Cincinnati company’s 1Q profits were hurt as it scaled back in key consumer and commercial credits, paid higher severance and saw fee income fall.

April 25 -

The company that made its name refinancing student loans plans to delve deeper into originations after a trial run of sorts.

April 25 -

The marketplace for services to help struggling families balance their short-term and long-term financial needs is improving, but is still insufficient.

April 24 NYU Wagner Graduate School of Public Service

NYU Wagner Graduate School of Public Service -

Quarterly earnings at the Wayzata, Minn., company fell as gains from the sale of auto loans continued to slide.

April 24 -

A $26 million settlement by Santander Consumer is shining a light on the hard-to-measure problem of auto dealer fraud, while also raising questions about the adequacy of lenders' efforts to combat bad behavior.

April 21 -

Student loans are showing signs of growing too fast, perhaps the only market flashing a warning even as the economic recovery grows older, Citigroup Chief Financial Officer John Gerspach said.

April 20 -

At the heart of the push to roll back the Dodd-Frank Act are claims that the 2010 reform law is killing lending. But these assertions should be backed by data.

April 20 MRV Associates

MRV Associates -

New boss Andy Cecere's first year on the job will likely be defined by how he tackles the challenges in front of him, including keeping the company’s highly watched efficiency ratio in check and managing pitfalls in auto-lease financing.

April 19 -

JPMorgan Chase agreed to sell a $6.9 billion portfolio of student loans to Navient Corp., five days after the bank told shareholders it was looking to unload the holdings.

April 19 -

Lawmakers from both political parties are increasingly interested in forcing lenders that offer loans to upgrade home heating and cooling systems to issue better disclosures, a prospect that has some in the industry nervous.

April 18