-

Andres Wolberg-Stok at Citi and Sam Taussig at Kabbage debate openness, privacy, control, and how much say consumers should have over their banking information.

September 24 -

Growers Edge is adapting retail financial technology to compete with traditional banks in ag lending and crop insurance.

August 8 -

Credit unions are slowly embracing the impact data analytics can have on the bottom line, but experts say goal-setting and measurable achievements must also be a part of the process.

July 17 -

The Gramm-Leach-Bliley Act is a successful privacy law that ought to govern all financial services providers, not just banks.

July 10

-

A centralized rules-based system can produce insights into how staff pay when traveling, which can inform broader vendor management, contends Yash Madhusudan, co-founder and CEO of Fyle.

July 5 Fyle

Fyle -

The Credit Union National Association’s summer conference in Orlando offered attendees insights into service, succession planning, collaboration and more.

June 21 -

For four years running, consumer complaints about the three national credit reporting agencies — Experian, Equifax and TransUnion — have dominated the CFPB’s database. What do they keep doing wrong?

June 4 -

As CFPB mulls privatizing database, consumer complaints are on the rise; an argument for continued human oversight of artificial intelligence; how some banks are luring talent from big tech; and more from this week's most-read stories.

May 17 -

The bank is one of many to realize that artificial intelligence is only as good as the data fed into it.

April 1 -

The central bank said the supplemental document “provides significantly more information on the stress test models that are used to project bank losses, compared to disclosures from past years.”

March 28 -

Trying to keep pace with big banks that digitize as many processes as possible will undercut community banks’ strengths, according to speakers at this year’s ICBA convention.

March 21 -

To take full advantage of AI’s opportunities, employers must understand and overcome lingering doubts from their employees.

February 15 -

Traditional compliance data handling tools and procedures are mostly not efficient enough to handle the mounting data in the right way, which makes the analysis extremely difficult, writes Srinivasan Pandurangan is senior manager of business consulting at Virtusa.

December 14 Virtusa

Virtusa -

An effective data analytics strategy could require rethinking all your institution's processes and touch points.

November 12 -

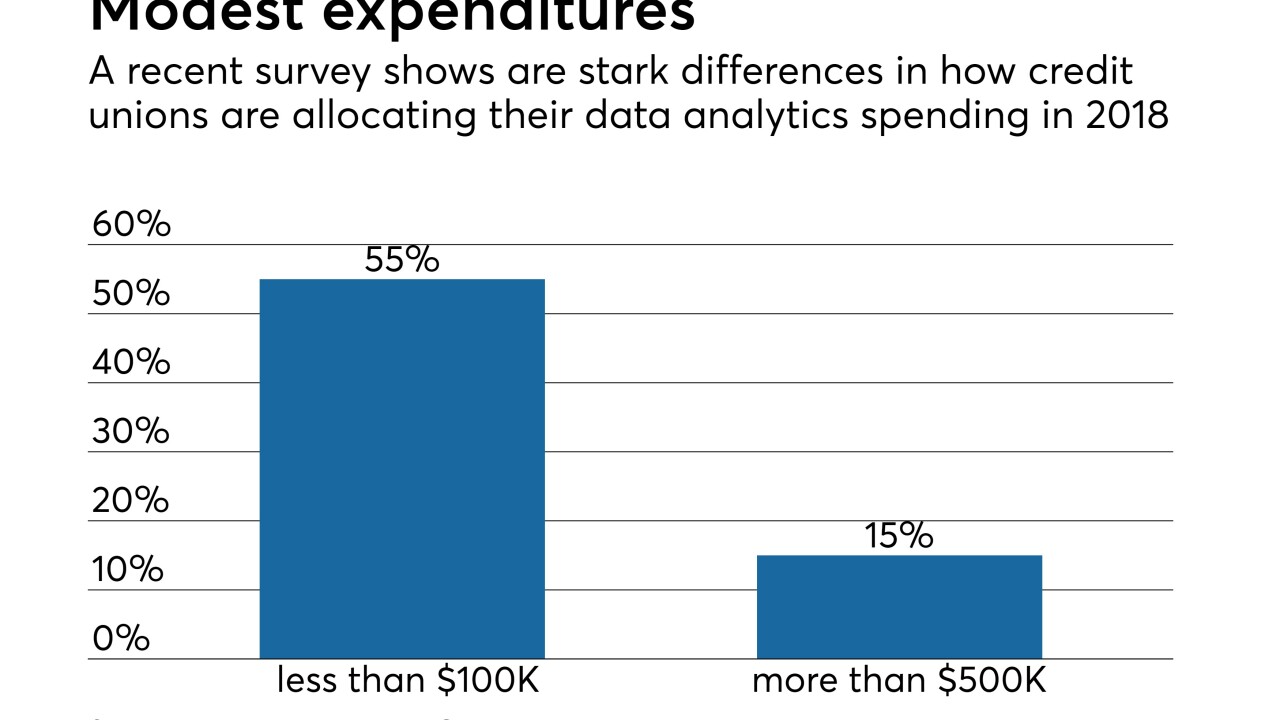

A recent report from Best Innovation Group reveals a significant number of credit unions don't have a data analytics plan, and many that do are putting off spending money on it.

November 8 -

The law gives residents more — and welcome — control over their data. But it will take work for credit unions to meet the new requirements, such as possibly having to amend third-party vendor agreements.

September 27 Samaha & Associates

Samaha & Associates -

The bureau's findings and request for information came after acting Director Mick Mulvaney had cited data security as a flaw at the agency.

September 26 -

It's good advice in any relationship context. SunTrust's Bryce Elliott wants transparency from his technology partners. "It's OK to tell me no."

September 18 -

Two of the credit union movement's biggest names are teaming up to help CUs better tackle big data.

September 13 -

Credit unions face a delicate balancing act in their technological initiatives, including satisfying members, navigating vendor contracts and more.

August 29