-

In its lawsuit against Visa, the Justice Department alleges the card network's $5.3 billion deal to buy Plaid is meant to neutralize a competitive threat — even though Visa and Plaid do not see themselves as competing with each other.

November 5 -

While gift cards are often marketed as an easy way to send money to friends and family, during the pandemic they're transforming into a more versatile tool of commerce that can overtake the use cases commonly associated with cash.

October 29 -

U.K. fintech Currensea has launched its first open banking-based debit card for British small businesses trading internationally. The card, which links to users’ existing high street bank accounts, builds on the pre-open banking concept of a decoupled debit card.

October 29 -

The payments company reported a substantial increase in both credit and debit card usage for the annual shopping event as the pandemic has made consumers even more comfortable with online purchases.

October 26 -

Mexican payments startup Klar has raised $15 million in a Series A round in an effort to challenge traditional banks by expanding access to debit cards and credit lines.

October 20 -

MagicCube’s i-Accept is a hardware-free option for accepting card and electronic payments that could appeal to cost-conscious small businesses and open up a new market for banks that provide them payments services.

October 19 -

Credit unions' credit and debit card portfolios could see a surge this week as the online retailer offers two days of deals, while the industry's regulator is set for a cybersecurity update.

October 13 -

Atlanta-based fintech Greenlight has raised $215 million in a Series C round and announced that it has achieved a valuation of $1.2 billion, giving it unicorn status.

September 24 -

PayPal is bringing its contactless Business Debit Mastercard rewards card into five additional European countries.

September 23 -

The fintech, which spent most of the last decade touting various alternative ACH-powered faster payments approaches, is adding the more mainstream option of debit push payments in its latest iteration.

September 16 -

Square is entering the earned wage access (EWA) fray, but it’s taking a tailored approach that aims to drive transaction volume within its Cash App.

September 15 -

With the increase in bank transfers and e-wallets, consumers' payment preferences are heading in this direction, particularly during economic crises, says PPRO's James Booth.

September 3 PPRO

PPRO -

Part of the coronavirus’s economic story is the sudden boom in installment payment services — a sure sign of consumers and merchants wanting a haven from revolving debt. But the rush to simpler credit is also a reflection of how the crisis has changed the way people are living and managing their lives.

August 24 -

Consumers are reluctant to take on additional debt in the wake of the coronavirus, cutting into credit unions' revenue streams. That could spur more institutions to roll out rewards programs to promote debit card usage.

August 5 -

A new study from WalletHub finds nealry 40% of parents are planning to spend less in advance of the upcoming academic year.

July 23 -

As part of its effort to teach young adults about economic, social and environmental issues, Flowe is partnering with payments provider SIA Group to expand digital payments and other financial services through its app.

July 23 -

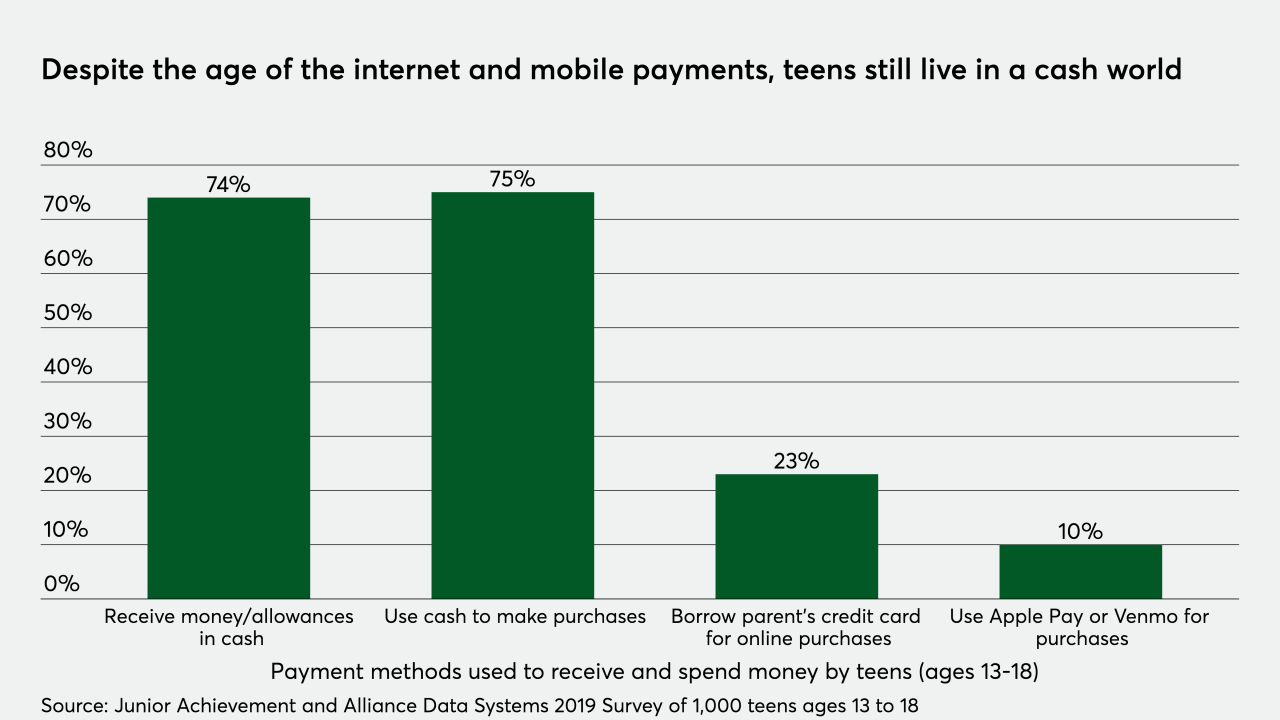

Fintechs like Greenlight and gohenry have drawn millions of teens with features like savings goal tracking and customizable debit cards.

July 16 -

Afterpay has launched a version of its online installment payment method for in-store use in the U.S. by leveraging Apple Pay and Google Pay.

July 14 -

The role of EMVCo — which is often seen as an extension of the card brands that deals only with chip-based EMV plastic cards— has come into sharper focus.

July 9 -

Some consumers have decided to stay home as celebrations have been canceled or scaled back to follow social-distancing guidelines.

July 3