-

Ned Handy, who will take the helm in March, wants to be more aggressive luring deposits in the company's home state. That should reduce its reliance on other funding sources to support loan growth.

September 28 -

How most banks obtain deposits has changed radically over the past 30 years, thanks in part to innovation. It is time for regulators to rethink their notion of what constitutes a quality deposit portfolio.

September 27 MainStreet Bank

MainStreet Bank -

American Banker's No. 3 Most Powerful Woman in Banking is embracing a major challenge in molding a commercial finance company with a spotty history into a profitable, middle-market bank.

September 26 -

Thasunda Duckett led Chase Auto Finance to record loan growth in her three-plus years as the unit’s CEO. Now she is looking to take JPMorgan Chase's consumer bank to similarly lofty heights.

September 25 -

A slight decline in core deposits in the second quarter stoked worries that tighter liquidity is around the corner. Bankers are exploring responses beyond the typical CD rate special if third-quarter results show the trend is continuing.

September 22 -

The third-largest U.S. metropolis is entrusting $20 million to Illinois Service Federal Savings & Loan Association, the city’s treasurer, Kurt Summers, announced Monday.

September 18 -

The Wall Street giant on Wednesday played up its customer service skills, saying that representatives of its Marcus personal-loan unit answer calls within 10 seconds.

September 6 -

It sounds like a crazy mix, but Fifth Third says its new app would help young consumers round up debit card purchases and apply the money to their burdensome student debts. The motivation to attract millennials is clear, but will it work?

September 4 -

An ex-banker running for governor has proposed the idea. It's a political perennial, but industry officials are nonetheless raising concerns.

August 25 -

Long Game is a mobile app that uses games to encourage its users to build a nest egg. Its example holds lessons for banks that are struggling to capture more of their customers' attention.

August 23 -

A recent tribute to Maggie Walker came more than a century after she founded St. Luke Penny Savings Bank in Richmond, Va. But it fittingly coincided with the first anniversary of the #BankBlack movement and offers a counterweight to the racial strife that just occurred less than 100 miles away in Charlottesville.

August 18 -

In times of economic stress, customers tend to flood the U.S. banking system with deposits. But the leverage ratio penalizes banks for conducting this core banking function.

August 18 American Bankers Association

American Bankers Association -

People’s United recently won the deposit business of the states of Massachusetts and Vermont, punctuating a multiyear plan to expand in government banking. But it’s a hard niche to succeed in, and, as other banks can attest, it can invite controversy.

August 15 -

Triumph Bancorp in Dallas has successfully taken chances on out-of-state acquisitions, factoring and other nontraditional strategies that many of its peers have avoided.

August 9 -

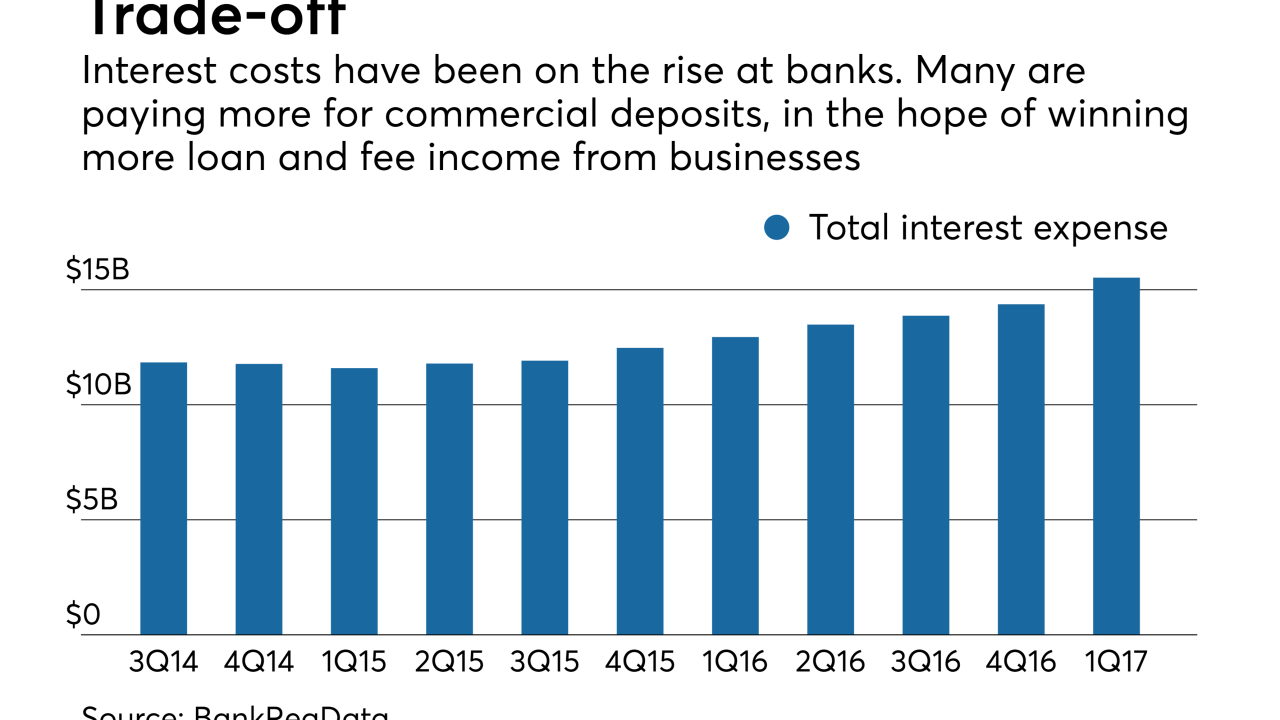

Many banks are adopting an “it takes money to make money” approach, paying more interest on deposits in exchange for loan growth, fee income and customer retention.

August 7 -

On March 31, 2017. Dollars in thousands

August 7 -

The global bank’s U.S. unit has bounced back, aided by growth in deposits and wealth management profits as well as a focus on international customers. A $125 million investment in tech and branches hasn’t hurt either.

August 4 -

Doug Bowers said the company has moved beyond past issues, including corporate governance shortcomings and the abrupt departure of his predecessor, and is ready to bring in more loans and core deposits.

August 1 -

As much as $2.5 trillion, or nearly half of bank deposit growth since the crisis, may be attributable to the central bank's quantitative easing. If investors start drawing down on their accounts to buy back assets from the Fed, the trend could dampen liquidity at certain banks, add upward pressure on deposit prices and reshape M&A.

July 31 -

The Detroit company is capitalizing on other banks' retreat from the auto sector.

July 27