-

A recent tribute to Maggie Walker came more than a century after she founded St. Luke Penny Savings Bank in Richmond, Va. But it fittingly coincided with the first anniversary of the #BankBlack movement and offers a counterweight to the racial strife that just occurred less than 100 miles away in Charlottesville.

August 18 -

In times of economic stress, customers tend to flood the U.S. banking system with deposits. But the leverage ratio penalizes banks for conducting this core banking function.

August 18 American Bankers Association

American Bankers Association -

People’s United recently won the deposit business of the states of Massachusetts and Vermont, punctuating a multiyear plan to expand in government banking. But it’s a hard niche to succeed in, and, as other banks can attest, it can invite controversy.

August 15 -

Triumph Bancorp in Dallas has successfully taken chances on out-of-state acquisitions, factoring and other nontraditional strategies that many of its peers have avoided.

August 9 -

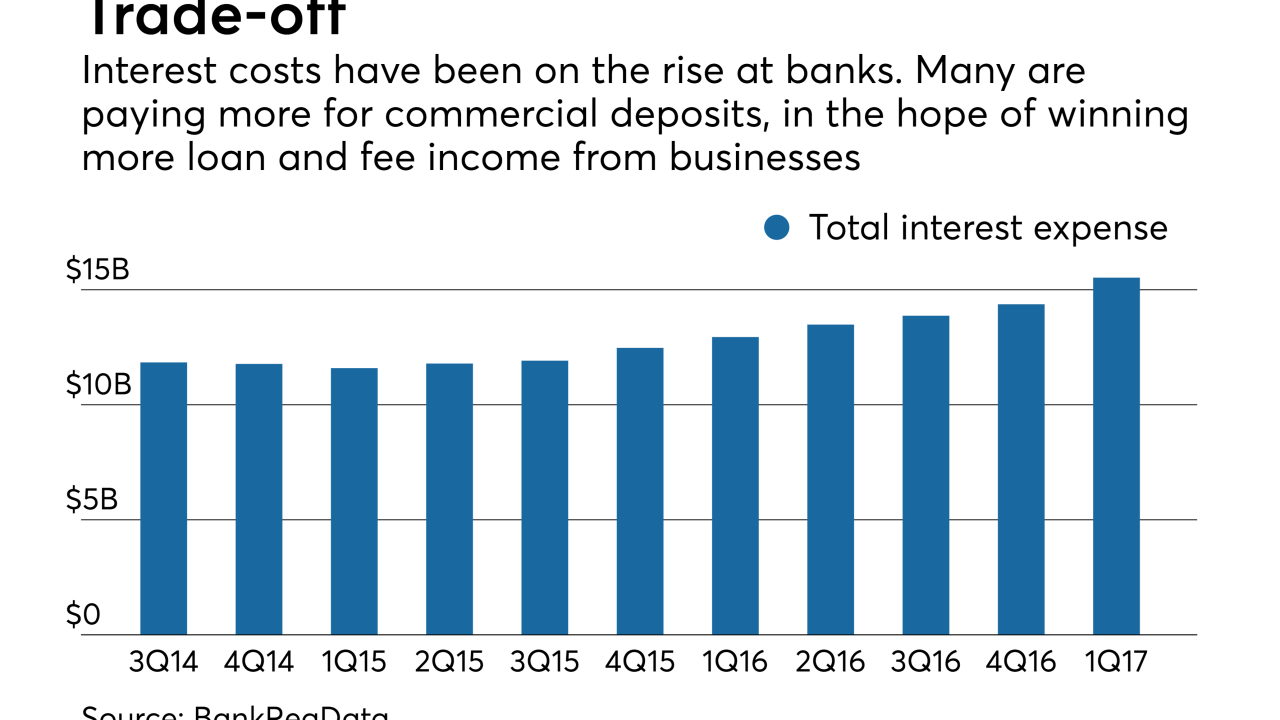

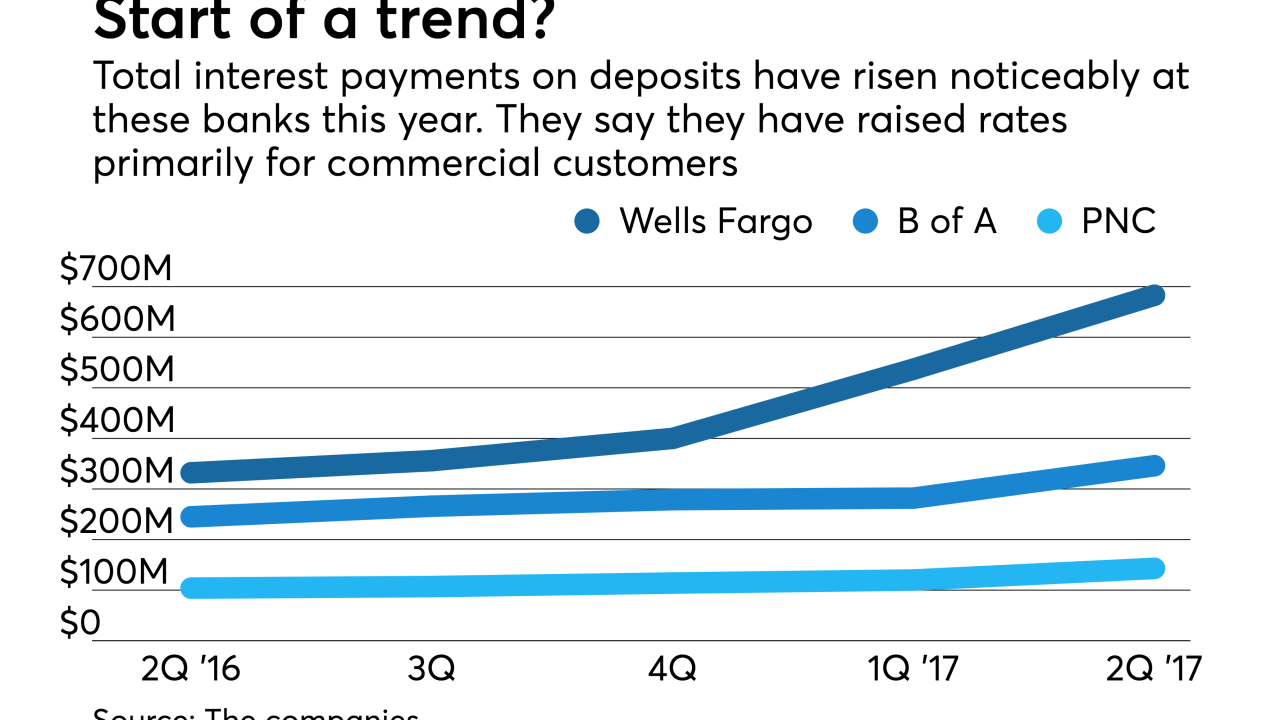

Many banks are adopting an “it takes money to make money” approach, paying more interest on deposits in exchange for loan growth, fee income and customer retention.

August 7 -

On March 31, 2017. Dollars in thousands

August 7 -

The global bank’s U.S. unit has bounced back, aided by growth in deposits and wealth management profits as well as a focus on international customers. A $125 million investment in tech and branches hasn’t hurt either.

August 4 -

Doug Bowers said the company has moved beyond past issues, including corporate governance shortcomings and the abrupt departure of his predecessor, and is ready to bring in more loans and core deposits.

August 1 -

As much as $2.5 trillion, or nearly half of bank deposit growth since the crisis, may be attributable to the central bank's quantitative easing. If investors start drawing down on their accounts to buy back assets from the Fed, the trend could dampen liquidity at certain banks, add upward pressure on deposit prices and reshape M&A.

July 31 -

The Detroit company is capitalizing on other banks' retreat from the auto sector.

July 27 -

Citi is holding its first investor day since the financial crisis, plugging credit cards and its Mexican business; Morgan Stanley's market cap tops Goldman's for the first time.

July 25 -

On March 31, 2017. Dollars in thousands

July 24 -

Now that the Federal Reserve has raised short-term rates four times in the past 18 months, all eyes are on deposit costs as banks seek to keep pricing low and fatten margins. But that effort is complicated by the fact that banks must prepare for the unwinding of the Fed's balance sheet and consumers' rapid adoption of mobile deposits.

July 21 -

In a sign of broader competition ahead, bigger banks are raising the interest they pay on deposits held by business customers. The big question is how hard will it be for banks to maintain margins and to stave off consumer demands for better rates.

July 18 -

The FDIC is watching banks that use wholesale funds to support CRE lending. The warning comes as brokered deposit levels at community banks are at their highest level in nearly six years.

July 18 -

The firm’s latest financial outlook suggests an opportunity to earn profits comparable to those recorded by large, well-established credit card issuers.

July 18 -

Net interest margins are on the rise and banks have the green light to return more capital to shareholders, but commercial lending and consumer credit quality remain trouble spots.

July 3 -

In 1981, a Louisiana banker sarcastically offered advice to a money market fund chasing deposits in his market, presaging today’s battles over nonbanks encroaching on banks' turf.

June 20

-

The online lender, which focuses on high-earning millennials, is offering assurances that it will also serve Americans who make less money. But the company has not convinced critics, who say the plans are inadequate.

June 15 -

The city has spent more than a decade working with nonprofits and banks to encourage people to open deposit accounts. Outreach and special products have lowered the unbanked rate in San Francisco to 2.1% in 2015 from 5.9% in 2011.

June 12