-

Citi is holding its first investor day since the financial crisis, plugging credit cards and its Mexican business; Morgan Stanley's market cap tops Goldman's for the first time.

July 25 -

On March 31, 2017. Dollars in thousands

July 24 -

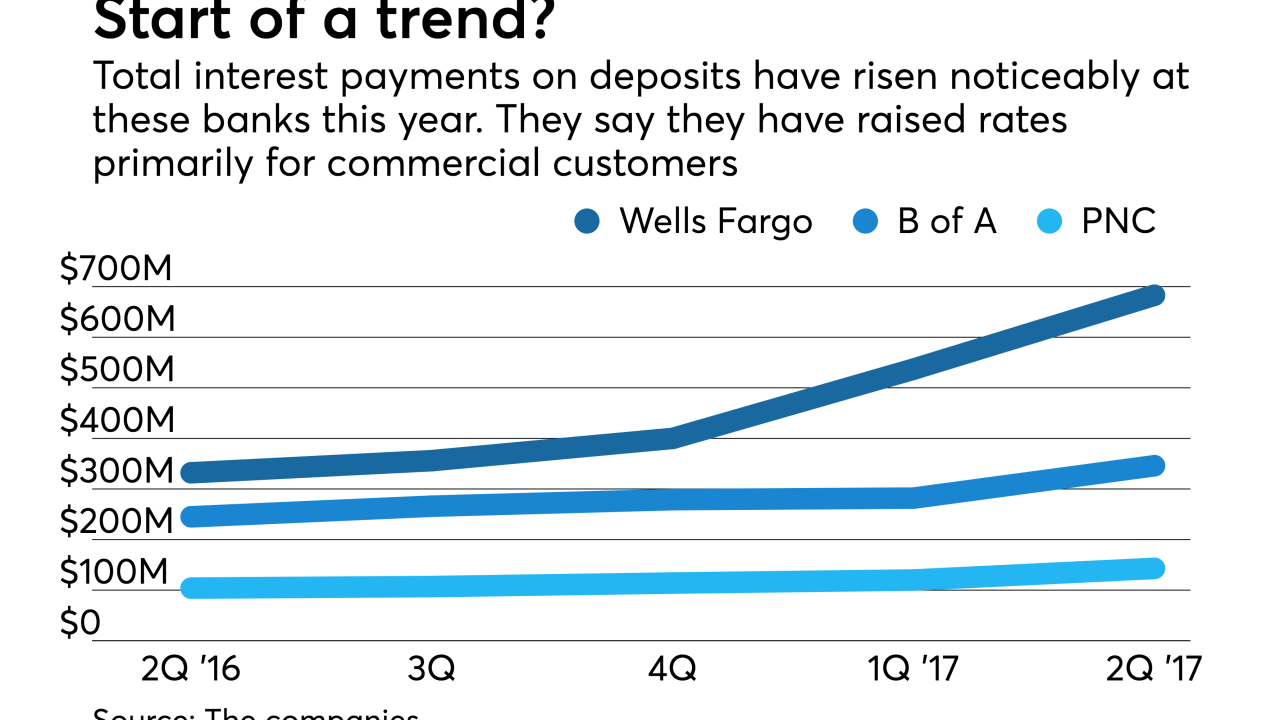

Now that the Federal Reserve has raised short-term rates four times in the past 18 months, all eyes are on deposit costs as banks seek to keep pricing low and fatten margins. But that effort is complicated by the fact that banks must prepare for the unwinding of the Fed's balance sheet and consumers' rapid adoption of mobile deposits.

July 21 -

In a sign of broader competition ahead, bigger banks are raising the interest they pay on deposits held by business customers. The big question is how hard will it be for banks to maintain margins and to stave off consumer demands for better rates.

July 18 -

The FDIC is watching banks that use wholesale funds to support CRE lending. The warning comes as brokered deposit levels at community banks are at their highest level in nearly six years.

July 18 -

The firm’s latest financial outlook suggests an opportunity to earn profits comparable to those recorded by large, well-established credit card issuers.

July 18 -

Net interest margins are on the rise and banks have the green light to return more capital to shareholders, but commercial lending and consumer credit quality remain trouble spots.

July 3 -

In 1981, a Louisiana banker sarcastically offered advice to a money market fund chasing deposits in his market, presaging today’s battles over nonbanks encroaching on banks' turf.

June 20

-

The online lender, which focuses on high-earning millennials, is offering assurances that it will also serve Americans who make less money. But the company has not convinced critics, who say the plans are inadequate.

June 15 -

The city has spent more than a decade working with nonprofits and banks to encourage people to open deposit accounts. Outreach and special products have lowered the unbanked rate in San Francisco to 2.1% in 2015 from 5.9% in 2011.

June 12 -

On March 31, 2017. Dollars in thousands

June 12 -

Mobile remote deposit capture is said to be just the first of many tech patents the company will seek to enforce. That could cost banks that use its technologies a lot of money.

June 9 -

The nonprofit Bank On certifies banks that offer deposit accounts with minimal fees. It is one of many initiatives designed to bring more consumers into mainstream banking.

May 30 -

Aggressive restructuring moves and stock buybacks are giving CIT time to remold itself, but it will need to show core-banking growth to stave off calls for the company to sell itself.

May 30 -

Thanks to the Federal Reserve's unwinding of post-crisis policies, the next wave of mergers will be driven in part by a drop in deposits.

May 26 Adjoint

Adjoint -

The Toronto bank said increases in deposits and loans spurred a 20% rise in profit at its U.S. retail bank from a year earlier.

May 25 -

Attractive demographics, a large supply of startups that appeared built to sell and a surplus of smaller banks struggling with high expenses have combined to make the Mid-Atlantic one of the most active regions for mergers and acquisitions.

May 17 -

JPMorgan Chase has some advice for regional banks: A deposit drain is coming, so merge while you can.

May 9 -

On Dec. 31, 2016. Dollars in thousands.

May 8 -

Loan demand disappointed as optimism for economic growth under President Trump gave way to uncertainty over the prospects for regulatory relief and tax reform. Credit quality held up, but the retail and health care sectors have become potential trouble spots. Here’s a recap drawn from banks’ quarterly earnings calls.

April 28