Digital banking

Digital banking

-

Moore led development of Bank of America's virtual assistant, Erica, and was American Banker's Digital Banker of the Year in 2017.

December 18 -

The bank scored highest on customers’ assessments of product offerings and satisfaction with digital channels among eight national banks studied.

December 17 -

The company adds to a growing list of banks shutting branches to invest in technology offerings.

December 17 -

The digital-only bank is running a new promotion in which it will set up and fund, with $250, an online savings account for any baby born on New Year’s Eve.

December 16 -

The community bank and fintech are offering the first live bank account and debit card that offer rewards in the form of bitcoin.

December 15 -

The mobile banking and paperless habits bank customers picked up during the pandemic are here to stay, and financial institutions are working to strengthen their digital offerings, speakers at an American Banker conference said.

December 14 -

The events of this year transformed banking, for better or worse. Smart bankers will build on the ways they learned to do their jobs better.

December 11 - AB - Technology

To get the word out to the Indian and Asian immigrants it's targeting, OnJuno is using social media influencers that include a well-known Japanese-American chess player and running ads during streamed cricket matches.

December 10 -

To improve a declining rating in the annual American Consumer Satisfaction Index, credit unions may have to make hefty investments in technology upgrades, something most of them can't afford.

December 10 -

Sells, American Banker's Digital Banker of the Year for 2020, says he will help the New York fintech startup create digital currency products for banks.

December 9 -

Citigroup looked to the success of Asian super-apps like Ant Financial and Paytm while developing its new checking-account offering with Google.

December 8 -

Fintech success stories have encouraged investors to back more startups, but newcomers will be hard-pressed to attract enough customers to compete while keeping expenses down.

December 7 -

The Waterbury, Conn., parent company of Webster Bank joins a fast-expanding list of banks reducing the size of their branch networks to save money and focus on digital capabilities.

December 4 -

Michael Moeser, senior analyst at PaymentsSource, talks to Brandon Thompson, EVP at Green Dot, about the drastic changes its audience has faced over the course of 2020.

December 3 -

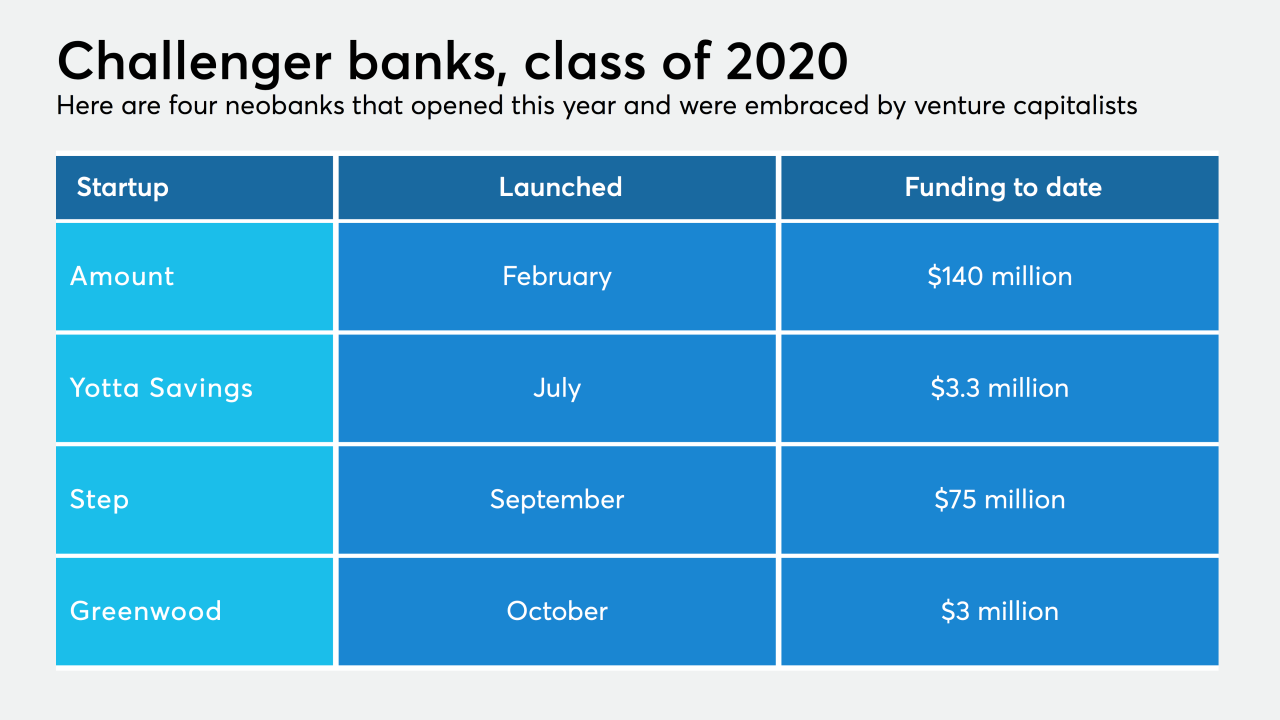

The tech firm spun off by Avant, which licenses its lending software to banks, has now raised $140 million this year.

December 2 -

Elizabeth Magennis recently served as the New Jersey company's chief lending officer. ConnectOne also hired Michael O'Malley, a former OnDeck Capital executive, as chief risk officer.

December 1 -

The 5-year-old company, which recently raised $131 million, says its strong growth reflects the timeliness of its mission: helping consumers who live paycheck to paycheck build wealth.

November 25 -

CEO Wendy Cai-Lee says Piermont Bank can do it all for financial technology firms: be their commercial banker, be their banking-as-a-service provider and develop APIs and other cutting-edge products for them.

November 24 -

Shawn Rose, chief digital officer, and Holly Pontisso, vice president of customer experience at Scotiabank at Toronto, share how they have adapted their digital offerings for people over 50, including making sure ageist attitudes don’t creep into digital channels or messaging.

November 24 -

The megabank and community bank recently announced they're offering accounts through the payment app. Both gave similar reasons: They need big tech to help them attract new customers.

November 23