-

Bank of Montreal's Bill Downe, the longest-serving chief executive officer among Canada's largest lenders, will retire Oct. 31 after spending a decade expanding the nation's oldest bank through acquisitions in the U.S. and overseas.

April 7 -

In a blog post published Thursday, Neel Kashkari criticized key parts of Jamie Dimon’s annual letter to JPMorgan Chase shareholders.

April 6 -

Big banks may have scoffed when a gaggle of financial technology upstarts promised to reinvent their business. Now they want to buy them.

April 6 -

Millennial homeowners are more likely to be current and future users of home equity lines of credit than either Gen-Xers or baby boomers.

April 5 -

Amid a rising rate environment, political uncertainty and rising delinquency, credit unions can still take steps to protect their bottom lines.

April 5 EFG Companies

EFG Companies -

Arizona, Nevada, Florida and North Carolina have lost more banks than other states, based on the percentage decline since 2010. Each has a unique set of reasons that goes beyond regulation and a dearth of de novo activity.

April 5 -

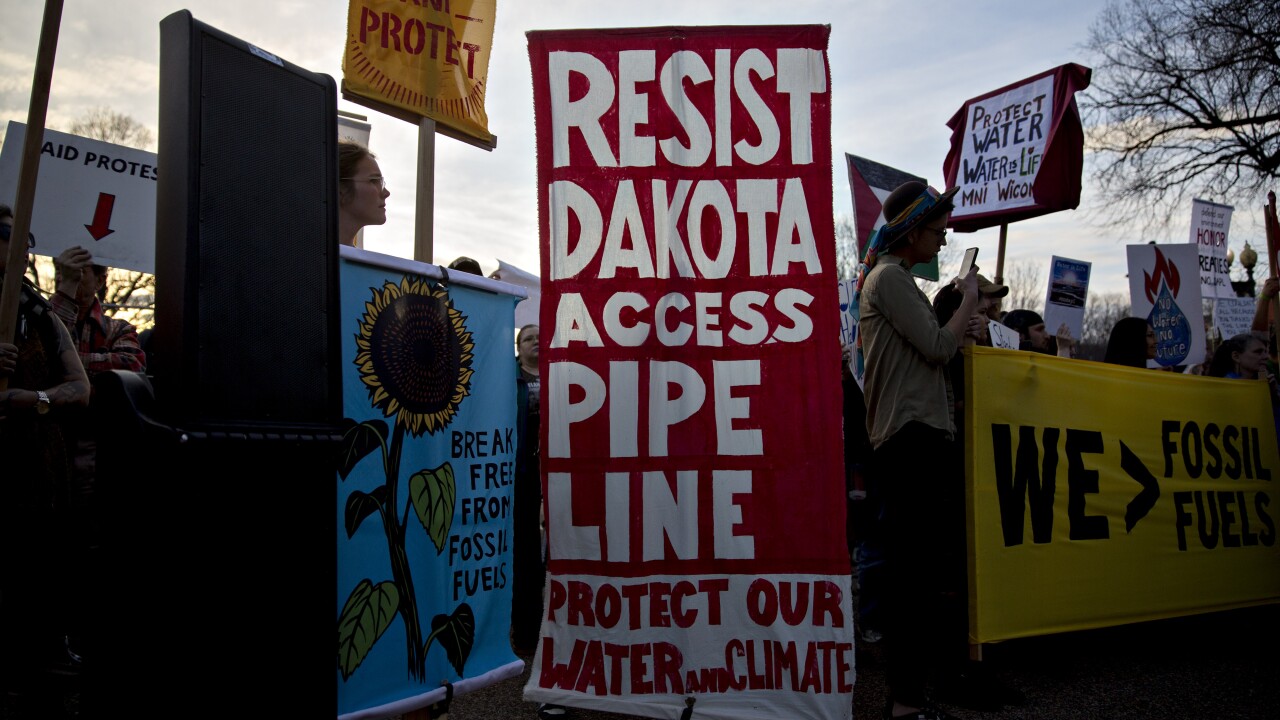

The French megabank has sold its $120 million stake in a $2.5 billion syndicated loan to build the controversial Dakota Access pipeline.

April 5 -

The publication won the Neal award for best news coverage and Washington Bureau Chief Rob Blackwell received the prestigious Timothy White award for editorial leadership.

April 5 -

Comptroller of the Currency Thomas Curry on Wednesday expressed support for community development financial institutions, even as the Trump administration is seeking to cut all government funding for them.

April 5 -

The U.S. merchant acquirer-processor arena is so mature that the only dramatic gains typically come from consolidation, leading to even more formidable combinations that make the next phase of growth even tougher. But there are also opportunities for companies that know how to specialize.

April 5 -

In his annual letter to shareholders, M&T Bank chief Robert Wilmers laid out in compelling detail how government policies intended to protect American families have ultimately stymied economic growth.

April 4 -

The megabank is looking to robotics and machine learning to save time and money.

April 4 -

The battle over screen scraping seems to be subsiding into a series of agreements between banks and fintechs using open APIs.

April 4 -

The JPMorgan CEO detailed the bank's $9.5 billion technology budget, forthcoming upgrades and more.

April 4 -

The Tennessee company has been working to resolve a memorandum of understanding tied to its CRE exposure.

April 4 -

Derek Corcoran of Avoka discusses how banks have embraced digital marketing but still struggle with digital sales. Author Randy Pennington talks about building corporate cultures that adapt and foster innovation.

April 4 -

Because the fates of banks and the communities they serve are so intertwined, the regulatory impacts borne by regional banks are inextricably linked to the repercussions experienced by their customers.

April 4M&T Bank -

As digital and mobile capabilities have taken hold on payments and data security, acquirers and independent sales organizations have needed to quickly ramp up their tech knowledge.

April 4 -

Blockchain Capital wants to raise $10 million by issuing its own digital token, a method the firm says is the future for startups, VCs and everybody else.

April 3 -

The concept of a primary bank that satisfies all customer needs is becoming a relic of the past, so banks must rethink their revenue models.

March 30 Liberty Bank

Liberty Bank