-

Investors Bancorp in Short Hills, N.J., chased deposits in the third quarter in a move that drove up interest expenses and lowered profits.

October 27 -

The accord is the latest development in investigations by governments across the globe into banks’ manipulation of benchmark interest rates.

October 25 -

As many as a dozen financial institutions are deploying IBM’s Watson to search for signs of employee misconduct so they can avoid a Wells Fargo-size scandal. But the legal and technical limits of its use are major issues.

October 16 -

Wilmington Trust and some of its executives had been accused of intentionally understating past-due loans in 2009 and 2010.

October 11 -

The bank plans to contact all customers who paid fees for rate lock extensions during a three-and-a-half-year period and to refund any who believe they should not have been charged.

October 4 -

Ocwen Financial reached a settlement with 10 states under which it can't acquire servicing rights for eight months but will not face any financial penalties.

September 29 -

Both former credit union employees are prohibited from participating in the affairs of any federally insured financial institution.

September 29 -

Washington Federal is the latest bank to pull an application after being flagged for insufficient Bank Secrecy Act compliance.

September 29 -

Ellen Patterson is one of just 21 TD employees with an EVP title globally and the only female EVP based in the United States.

September 25 -

First Green Bank in Florida started researching the business after its chairman saw how medical marijuana had helped his wife cope with a severe injury. The bank is now turning a profit a year after adding its first pot-related client -- and there could be lessons there for credit unions.

September 21 -

The Florida bank started researching the business after Ken LaRoe, its chairman, saw how medical marijuana had helped his wife cope with a severe injury. First Green is now turning a profit on this business a year after adding its first pot-related client.

September 21 -

Unlike a visiting sports team, foreign banks can't just blame local referees they perceive as biased for penalties or fines.

September 21 IBM Global Business Services

IBM Global Business Services -

Armed heists are becoming less common, but the overall number of robbery attempts has ticked back up in recent years. The opioid epidemic is a likely reason, according to an industry expert.

September 19 -

By replacing human judgment with other identity technologies, higher levels of verification accuracy can be achieved in a fraction of the time, writes Romana Sachová, co-chair of the Security and Biometrics Workgroup at Mobey Forum.

September 14 Mobey Forum

Mobey Forum -

Credit bureau says records of 143 million consumers were compromised; state agency penalizes Habib Bank for enabling terror financing.

September 8 -

New York’s banking regulator ordered Habib Bank Ltd. to pay $225 million and surrender its license to operate in the state, effectively removing Pakistan’s largest lender from the U.S. financial system.

September 7 -

Husband and wife claim they were fired for raising concerns about the bank’s sales practices; commercial mortgage-backed securities on pace to top last year’s volume.

September 6 -

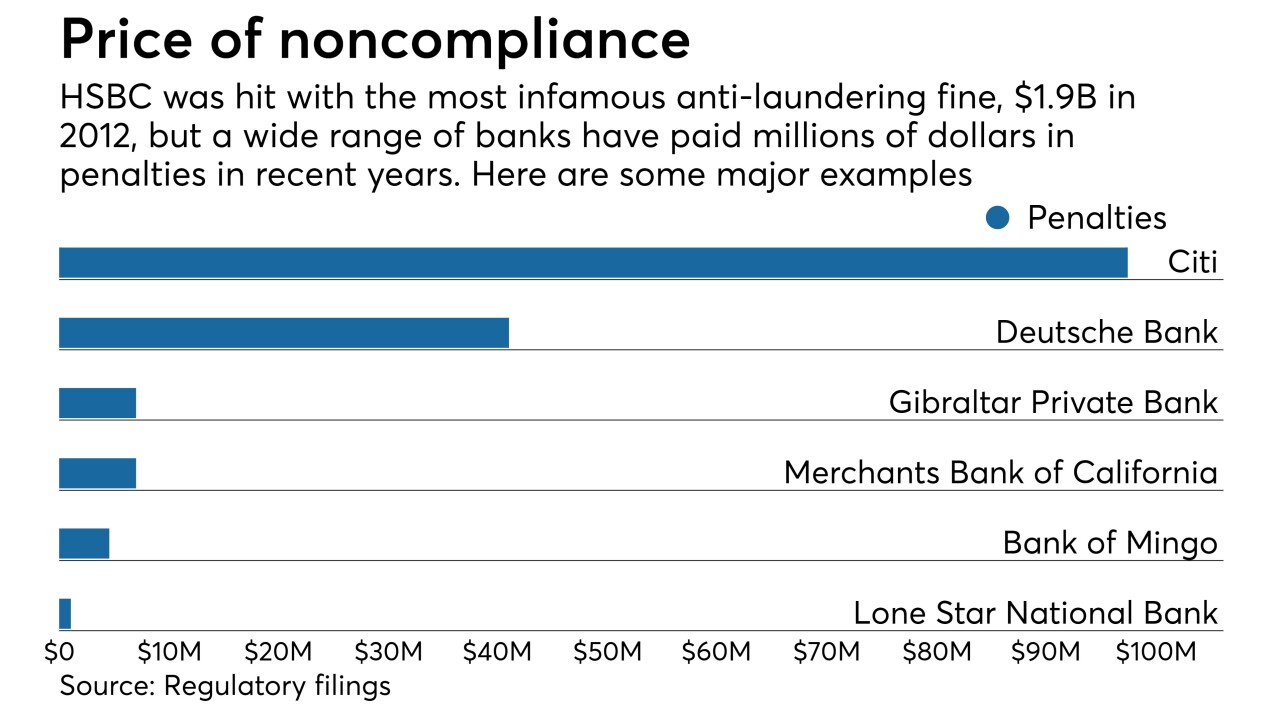

Nothing like revelations of a client’s Ponzi scheme that lead to your bank paying $4 million in anti-money-laundering fines. That’s what happened at Gibraltar Private Bank & Trust, but its CEO argues its compliance overhaul has given the bank a competitive advantage in cosmopolitan New York and South Florida.

September 5 -

The 3-year-old order was related to Discover Bank’s programs for combating money laundering. A related agreement with the Federal Reserve Bank of Chicago remains in effect.

August 30 -

A data-driven approach to money laundering prevention can help increase profits and improve regulatory compliance, writes Edmund Tribue, risk and regulatory practice leader at NTT Data Services.

August 30 NTT Data Consulting

NTT Data Consulting