-

Credit bureau says records of 143 million consumers were compromised; state agency penalizes Habib Bank for enabling terror financing.

September 8 -

Cybercriminals know people want to resolve tax payment issues, and they take advantage of it, writes Matthew Gardiner, senior product manager at Mimecast.

September 8 Mimecast

Mimecast -

Fifth Third's Melissa Stevens targets millennials with new app. Meanwhile, regulators are accused of ignoring millennials. Plus, a Goldman Sachs wealth manager sues for discrimination.

September 7

-

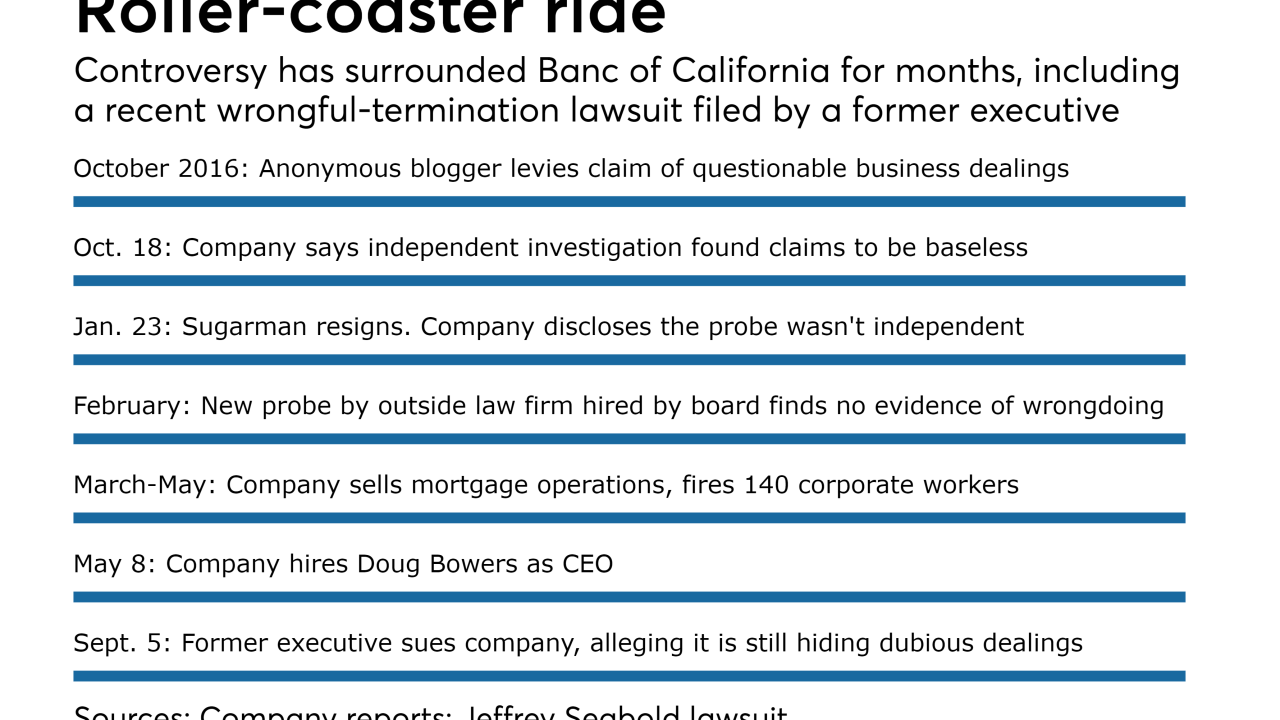

Jeffrey Seabold, Banc of California’s former vice chairman, alleges that he and ex-CEO Steven Sugarman were scapegoats for inappropriate behavior by certain directors and that the company manipulated its first-quarter earnings.

September 7 -

New York’s banking regulator ordered Habib Bank Ltd. to pay $225 million and surrender its license to operate in the state, effectively removing Pakistan’s largest lender from the U.S. financial system.

September 7 -

Husband and wife claim they were fired for raising concerns about the bank’s sales practices; commercial mortgage-backed securities on pace to top last year’s volume.

September 6 -

In a deregulatory environment, a rule that better enables consumers to bring class actions could lead to an explosion of litigation, which will affect product availability and pricing.

September 5 Davis & Gilbert LLP

Davis & Gilbert LLP -

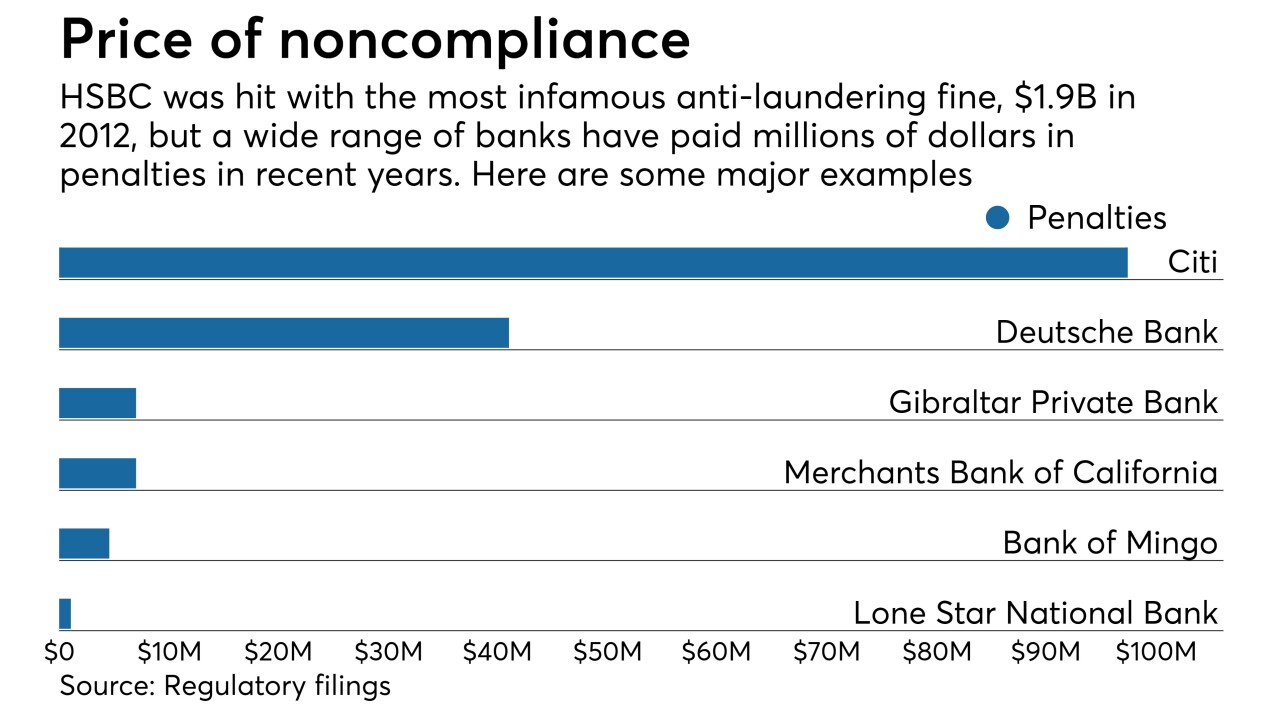

Nothing like revelations of a client’s Ponzi scheme that lead to your bank paying $4 million in anti-money-laundering fines. That’s what happened at Gibraltar Private Bank & Trust, but its CEO argues its compliance overhaul has given the bank a competitive advantage in cosmopolitan New York and South Florida.

September 5 -

Card testing is like thieves “playing the slots” with stolen card numbers to see what they can get from them, writes Rafael Lourenco, executive vice president of ClearSale.

September 4 ClearSale

ClearSale -

Bank of New York basically controls the market for clearing Treasuries and repos after Chase withdraws; compliance pushed back to July 1, 2019.

August 31 -

Competition from global giants like Amazon and Alibaba and millions of independent retailers, coupled with the constant threat of credit card fraudsters, makes it imperative that online retailers tick all the boxes to reduce risk, writes Suresh Dakshina, CEO of Chargeback Gurus.

August 31 Chargeback Gurus

Chargeback Gurus -

The 3-year-old order was related to Discover Bank’s programs for combating money laundering. A related agreement with the Federal Reserve Bank of Chicago remains in effect.

August 30 -

A data-driven approach to money laundering prevention can help increase profits and improve regulatory compliance, writes Edmund Tribue, risk and regulatory practice leader at NTT Data Services.

August 30 NTT Data Consulting

NTT Data Consulting -

Wells Fargo forced borrowers to pay millions of dollars in fees to extend interest rate locks that expired due to the bank's delays in processing mortgage applications, a lawsuit claims.

August 29 -

Heartland Bank had been operating under a regulatory order from the Fed since December.

August 29 -

CFPB and OCC are looking at auto lenders’ policies regarding so-called GAP insurance; banks want greater collateral from retailers.

August 29 -

This latest instance of Trickbot is a good time to remind consumers not to trust third-party sites even when directed by an email that seems legitimate, writes Lisa Baergen, director of marketing at NuData Security.

August 29 NuData Security

NuData Security -

The San Francisco bank is embroiled in a high-stakes legal battle over the use of arbitration in disputes involving overdraft fees at the same time that adversaries are portraying the scandal-plagued bank as the poster child for why reform is necessary.

August 25 -

U.S. Bank and Wells Fargo to use Blend software to speed up mortgage origination processes; Robert Kaplan wants to keep stress tests on big banks.

August 25 -

A woman who formerly worked for a Southern California credit union and her "online boyfriend" have been indicted by a federal grand jury of defrauding multiple banks to the tune of $2.6 million.

August 24