-

Automation and technology allow lenders to handle an evolving situation that changes by the day: adjustments are easily made to terms, timing and required data for loan forgiveness, says PayNet’s William Phelan.

June 3 PayNet, an Equifax company

PayNet, an Equifax company -

The takeaway from the PPP rollout is that bankers must protect their reputations and limit their risk appetites as they participate in further government-backed rescue programs.

May 29 -

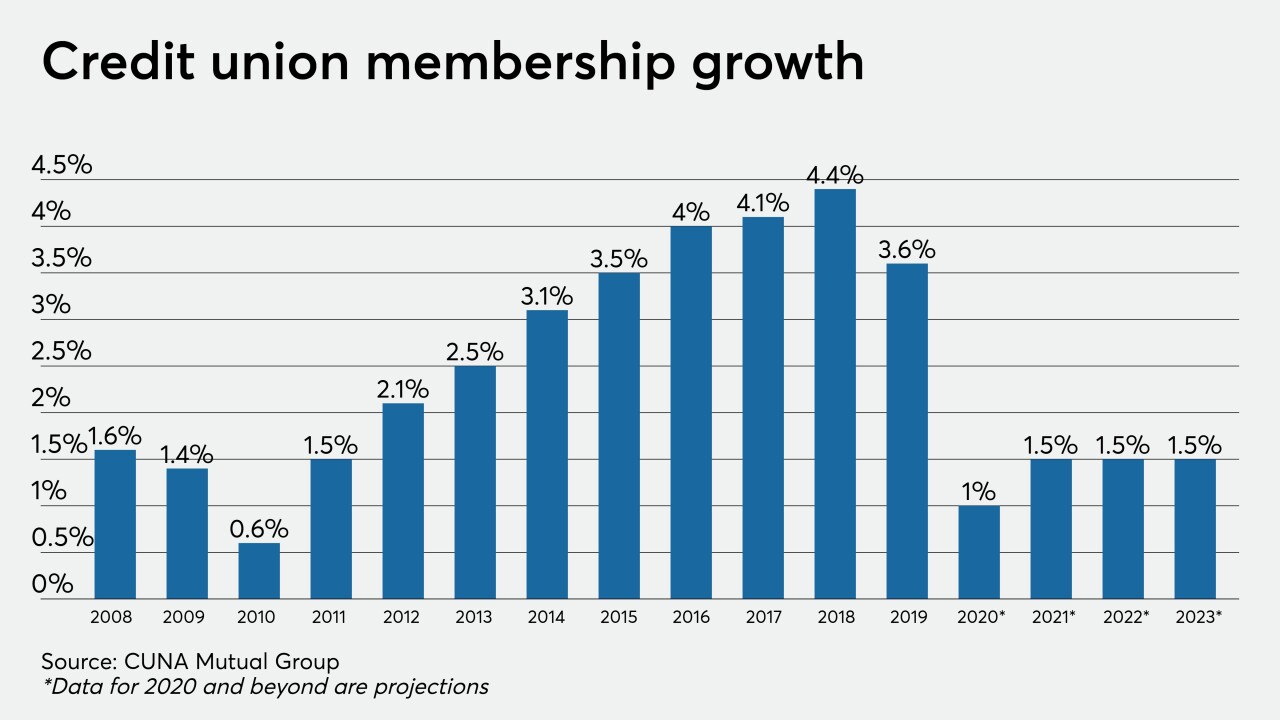

The latest Credit Union Trends Report from CUNA Mutual Group predicts interest rates will be at record lows for at least two years and earnings are also likely to take a hit from record-high unemployment.

May 28 -

The Baltimore-area credit union crossed the latest threshold despite a dip in net income during the first quarter as many organizations struggle with the coronavirus fallout.

May 19 -

The interim rule will allow institutions with over $250 billion of assets to exclude certain assets from the supplementary leverage ratio to help them respond to the economic fallout from the coronavirus pandemic.

May 15 -

The central bank will disclose information on a monthly basis about its Term Asset-Backed Securities Loan Facility and its Paycheck Protection Program Liquidity Facility.

May 12 -

Historical data doesn’t paint a sufficient picture in a business climate characterized by rapid, unexpected change and lingering uncertainty, says MSTS' Brandon Spear.

May 11 TreviPay

TreviPay -

Institutions need to think about revenue streams and portfolio diversification as the coronavirus affects much of the U.S. economy.

May 8 Alliant Credit Union

Alliant Credit Union -

The Federal Reserve also said in a supervisory report released Friday that it would conduct stress tests this quarter as planned, taking into account sudden deterioration in the economy brought on by the coronavirus pandemic.

May 8 -

On Dec. 31, 2019. Dollars in thousands.

May 4 -

Some megabanks are pushing New York lawmakers to add a legal safe harbor if lenders use the new Secured Overnight Financing Rate. Smaller banks would have little choice but to take that option.

May 4 Signature Bank of New York

Signature Bank of New York -

The Home Loan bank will make zero-interest loans, match charitable donations that members make to nonprofits and small businesses, and provide additional funding for economic development grants.

May 1 -

Rodney Hood, chairman of the National Credit Union Administration, told the Financial Accounting Standards Board that complying with the Current Expected Credit Losses standard could adversely impact the industry's net worth.

April 30 -

The Main Street Lending Program, announced on April 9 as an option to help U.S. businesses weather the coronavirus outbreak, will be available to a wider array of companies than previously planned.

April 30 -

The company’s latest Credit Union Trends Report predicts that membership and lending will stall as job losses rise and consumer demand for loans dries up.

April 29 -

Fintechs in the payments industry saw problems coming when the CARES Act’s SBA Paycheck Protection Program opened the floodgates for millions of coronavirus-stricken small businesses to apply for loans.

April 28 -

The FHFA will allow Fannie Mae and Freddie Mac, for a limited time, to purchase loans for which the borrower has sought to postpone payments because of the economic effects of the coronavirus.

April 22 -

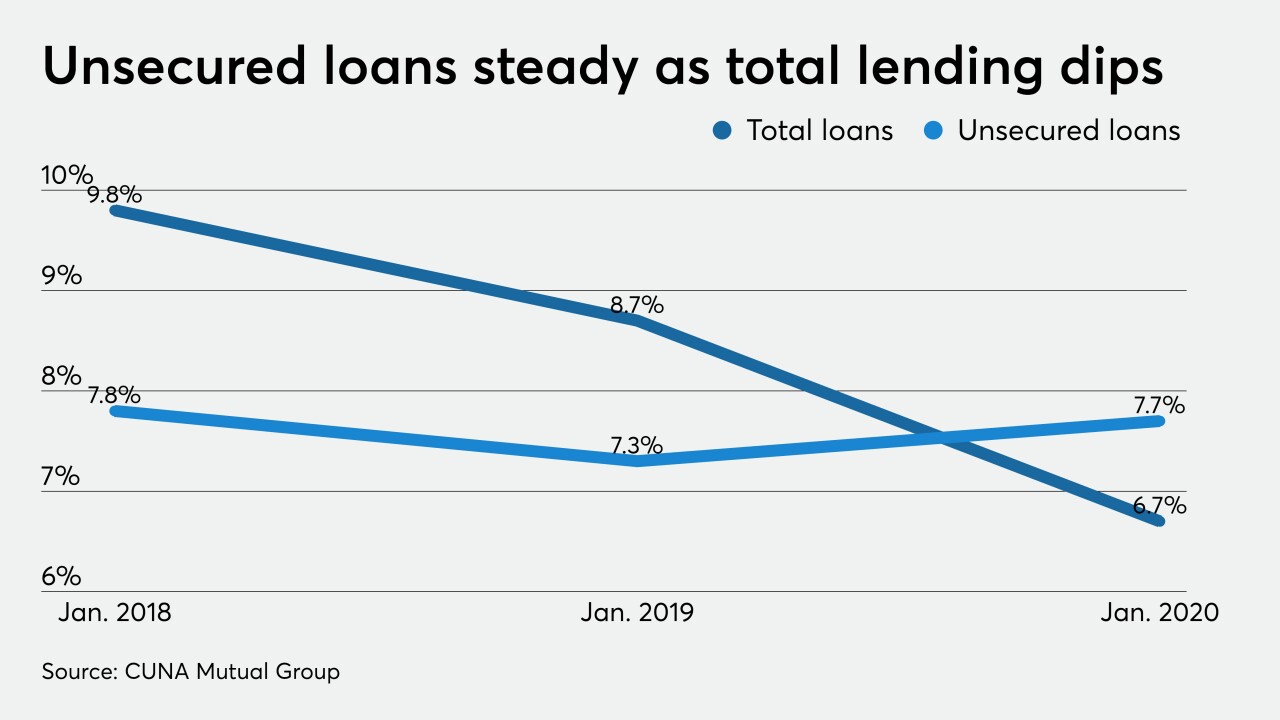

Consumers are increasingly looking to consolidate debt, while loans for more luxury expenditures, such as vacations, are a thing of the past.

April 13 -

Banks, which previously shunned unsecured small-dollar lending, are now embracing the product because of the outbreak. It's just a matter of whether the shift is permanent.

April 13 -

The $2 trillion coronavirus rescue package and other government moves are designed to provide a lifeline for small businesses, but they also create complications as businesses must quickly accumulate payment records and other information to apply for the loans.

April 13