-

The bank-owned person-to-person network formally went live Monday, enabling direct transfer of funds across 30 U.S. financial institutions. There are a lot of questions around whether it can compete with the current kings of P-to-P — Venmo and PayPal — but Zelle may not be aiming to take them head-on just yet.

June 12 -

This morning the bank owned P-to-P network, Zelle, is formally going live, enabling direct transfer of funds across thirty U.S. financial institutions over the course of the next twelve months. There are a lot of questions around whether it can compete with the current kings of P-to-P — Venmo and its parent company PayPal — but Zelle may not be aiming to take them head-on just yet.

June 12 -

Mobile remote deposit capture is said to be just the first of many tech patents the company will seek to enforce. That could cost banks that use its technologies a lot of money.

June 9 -

Readers chime in on banks being problem-solvers, Jamie Dimon’s ties to Trump, a new mortgage app, CFPB catching heat over the Wells Fargo account scandal, and more.

June 9 -

The following is a recap of the 2017 slate of honorees picked by the tech journalists at American Banker, led by Digital Banker of the Year Michelle Moore of Bank of America and including four finalists.

June 8 -

Alice Milligan has pushed Citi to introduce dozens of mobile enhancements intended to simplify customers' interactions with the bank.

June 6 -

At CIBC, Aayaz Pira is quickly turning ideas into apps, including its new mortgage one, with the help of its recently formed innovation hub.

June 5 -

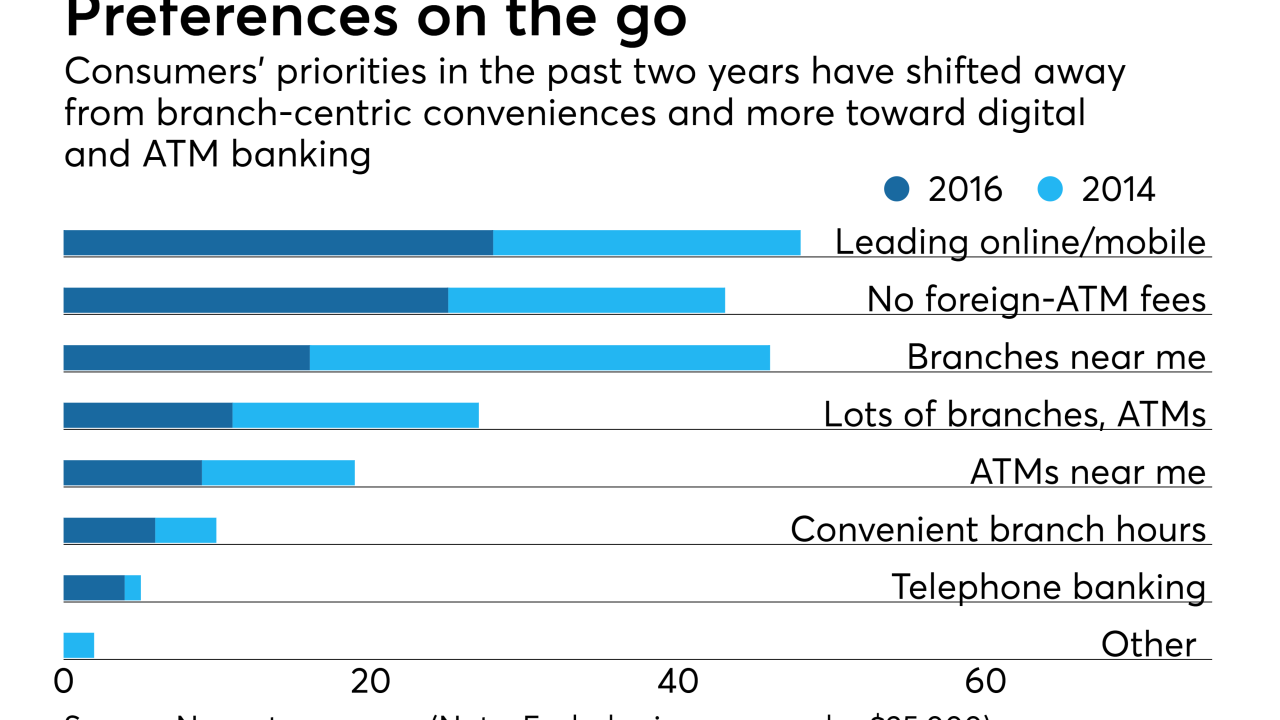

Two studies and mobile banking providers offer insights into what consumers want out of a mobile banking offering -- and the upcoming functionalities that are most likely to captivate users.

June 5 -

Regions Financial's tool that helps customers find the right account for themselves is among the reasons why Andy Hernandez is a Digital Banker of the Year finalist.

June 4 -

New fintech apps are interacting more and more with members financial lives, but many credit unions aren't part of the equation.

June 2 Credit Union Journal

Credit Union Journal -

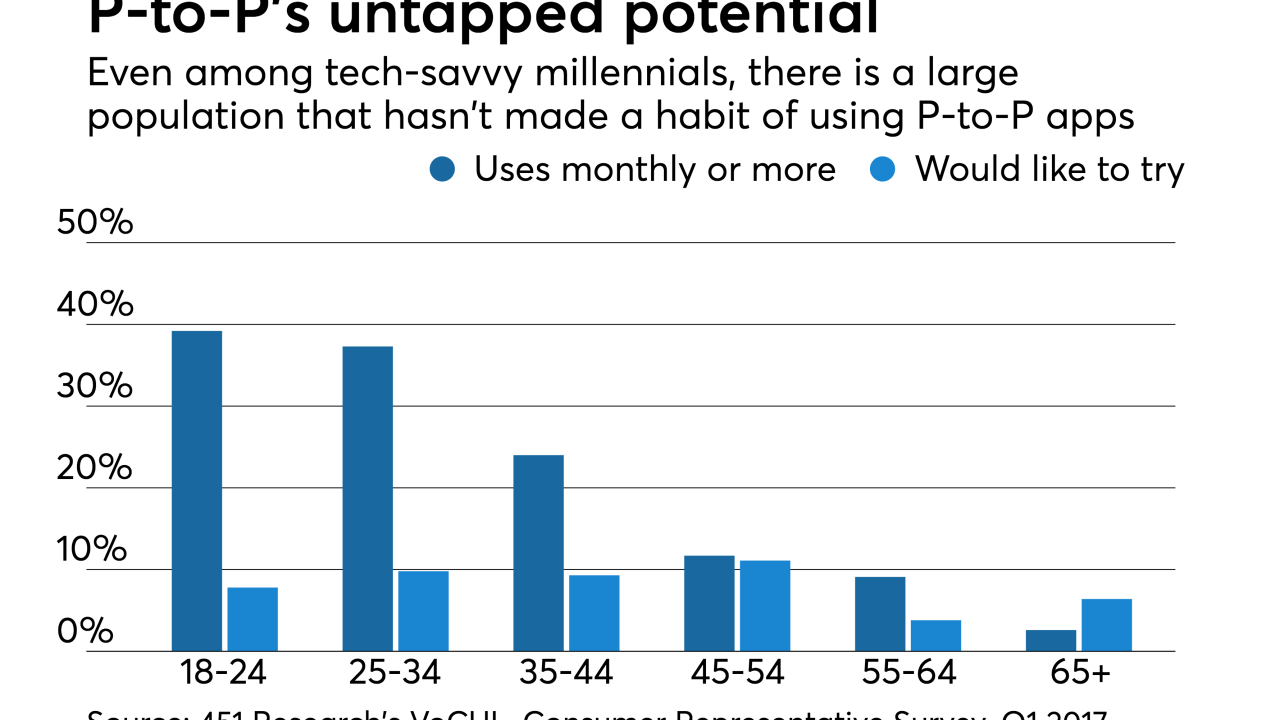

Here are some major ways that mobile banking, P-to-P payments and fintech are changing banking.

June 1 -

Bank of America has spent years catching up to peers on customer service. Its next objective: using insight from customer feedback to shape a top-tier digital experience. When the haters hate, Michelle Moore listens.

May 31 -

A new survey finds that 14% of small and medium-size businesses switched banks last year and 18% are considering switching this year. Doug Brown senior vice president of FIS, explains why, and what banks should do about this.

May 30 -

The Spanish bank is opening its APIs to outside developers as Bank of America tests a new data-sharing model with aggregators.

May 24 -

The gray-bearded ATM would seem like a goner since mobile usage is surging and cash withdrawals are flatlining. But banks such as JPMorgan, B of A and PNC are pouring money into overhauling them in a bid, oddly enough, to attract a younger generation of customer.

May 22 -

A dozen years after it pioneered the technology, the company now says any bank or credit union using RDC is infringing on its innovation.

May 22 -

Wells Fargo is expanding its fintech accelerator so it is better positioned to connect with customers through channels like the internet of things.

May 18 -

Bank of America is giving its "erica" chatbot more time to learn the nuances of language and banking basics. A profanity filter is one recent addition.

May 16 -

Current, an app debuting Tuesday, updates the joint account for an era of tweens with smartphones.

May 9 -

Readers weigh in the effect of Federal Reserve actions on wealth distribution, how a new startup could reduce overdraft fees, Watson's attempts to catch rogue traders, and more.

May 5