-

The pioneering brand re-enters a market where fintechs now account for over 30% of personal loan originations.

January 30 -

Elizabeth Warren takes acting CFPB director Mick Mulvaney to task over his decision on data collecting; B of A gets heat from harrassment reveal and free checking halt; and more.

January 26 -

The bank tweeted that website and mobile app service were restored after an outage that lasted much of the day.

January 25 -

Digital alerts for clients aren't new, but they can still provide small banks a platform to reach new markets and appeal to younger clients.

January 25 -

Executives point out while they are fixing the online lender's very public problems, loan originations are still in the billions and it has expanded into wealth management.

January 24 -

SoFi's experience shows that the most prominent names in fintech, while generating massive financial support, still operate in a very volatile world.

January 23 -

As customers become more tech-savvy, the bank said it no longer needs to prod them to use its digital products by offering discounts. Account holders can avoid fees by enrolling in direct deposit.

January 22 -

Providing the default card in digital subscription services is one way banks can win back bill-pay business, save customers time and help them manage their data.

January 17 -

Capital One became the latest bank to feel customers' online wrath last week after reports that some customers were being charged twice for debit card activity. But it was hardly alone.

January 10 -

Customers saw transactions recorded multiple times and experienced drained accounts and long hold times. It’s a warning to all financial institutions as they head further into mobile-only banking — glitches are more visible and painful and need to be addressed faster than ever.

January 4 -

Rep. Emanuel Cleaver, D-Mo., has emerged as one of the most outspoken members of Congress when it comes to fintech, both embracing its potential and calling for regulatory guardrails.

January 3 -

Holiday loans are up significantly at Blue Federal Credit Union this year thanks to improvements to the CU's mobile and online banking apps that allowed members to apply for -- and fund -- loans in a matter of minutes.

December 21 -

It was a bad year for the CEO of Equifax, the founder of a high-flying fintech and the regulatory agency bankers love to hate.

December 20 -

Rather than charge set fees, Aspiration offers customers name-your-fee accounts and donates to charities based on the amount of money it makes.

December 12 -

The Trump administration’s curious decision to delay rules concerning disabled consumers’ access to websites would appear to give companies a pass on making their sites compliant with the Americans with Disabilities Act. Banking attorneys don’t see it that way.

December 8 -

With millions of Alexa and Google Home devices now in use, first-mover banks are rapidly developing services to let customers control their finances using only their voice — even if there are still many kinks to work out.

December 4 -

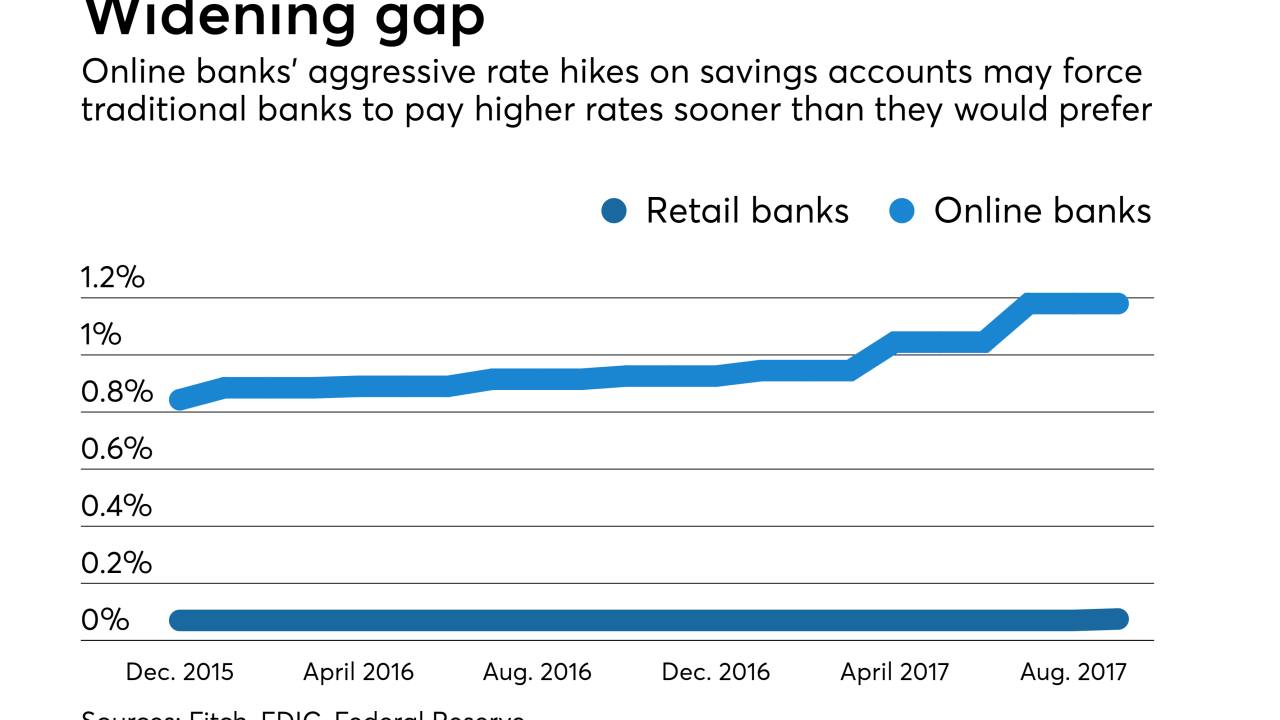

Online banks have been aggressively raising the rates they pay on consumer deposits, and that is forcing mainstream banks to consider following suit or risk losing valuable deposits to their more nimble competitors.

November 29 -

Brett Pitts joins from Wells Fargo, where he most recently was executive vice president and group head of digital.

November 21 -

As consumers’ personal information is compromised almost daily, hackers are increasingly targeting banks.

November 14 -

In mid-2015, several thousand banks registered for dot-bank domains. More than two years later, only a few hundred have converted.

November 10