-

Visa research contends consumers are interested in biometrics and consider it superior to traditional usernames and passwords.

December 15 -

As shopping habits evolve, e-commerce and m-commerce methods such as in-app and one-click ordering are becoming increasingly popular. In addition, the exponential growth of the IoT is introducing a wealth of new payment use-cases, such as connected cars, writes André Stoorvogel, Director, Product Marketing in the Payments Group at Rambus.

December 15 Rambus

Rambus -

Some firms are investing in technology to help insurance clients shift to paperless payment processing.

December 14 -

Grupo Coppel and Insikt, an online lender, would appear to be cut from different cloth, but they share an expertise in providing credit to working-class, largely Hispanic consumers. The retail conglomerate also operates 1,000 bank branches in Mexico, mixing banking and commerce in a way that U.S. regulators have not allowed.

December 13 -

The case for real-time payments isn’t just about instant gratification. Truncating settlement times has enormous benefits to FIs, businesses and even governments.

December 13 -

Banks and fintechs are competing heavily to modernize cross-border payments, and Citi is using its upgraded treasury unit to add speed to its own international cross-border digital payments capabilities in more than 60 countries.

December 12 -

For merchants, a processor that’s a tad better, a bit more comprehensive, can make an enormous difference, writes Eric Grover, a principal at Intrepid Ventures.

December 12

-

Payment Rails is putting a tight focus on the emerging area of “influencer marketing,” where global brands are spreading money among individuals who use social media to promote products.

December 11 -

In the new role, Kenneth Montgomery will lead the Fed’s efforts to reduce fraud risk and improve the security and resiliency of the U.S. payments system

December 8 -

The concept is designed to free up workers to produce food and serve customers instead of handling payments.

December 8 -

Kenneth Montgomery will chair the Secure Payments Task Force, which is made up of more than 200 industry stakeholders who are working on a faster payment system in the U.S.

December 8 -

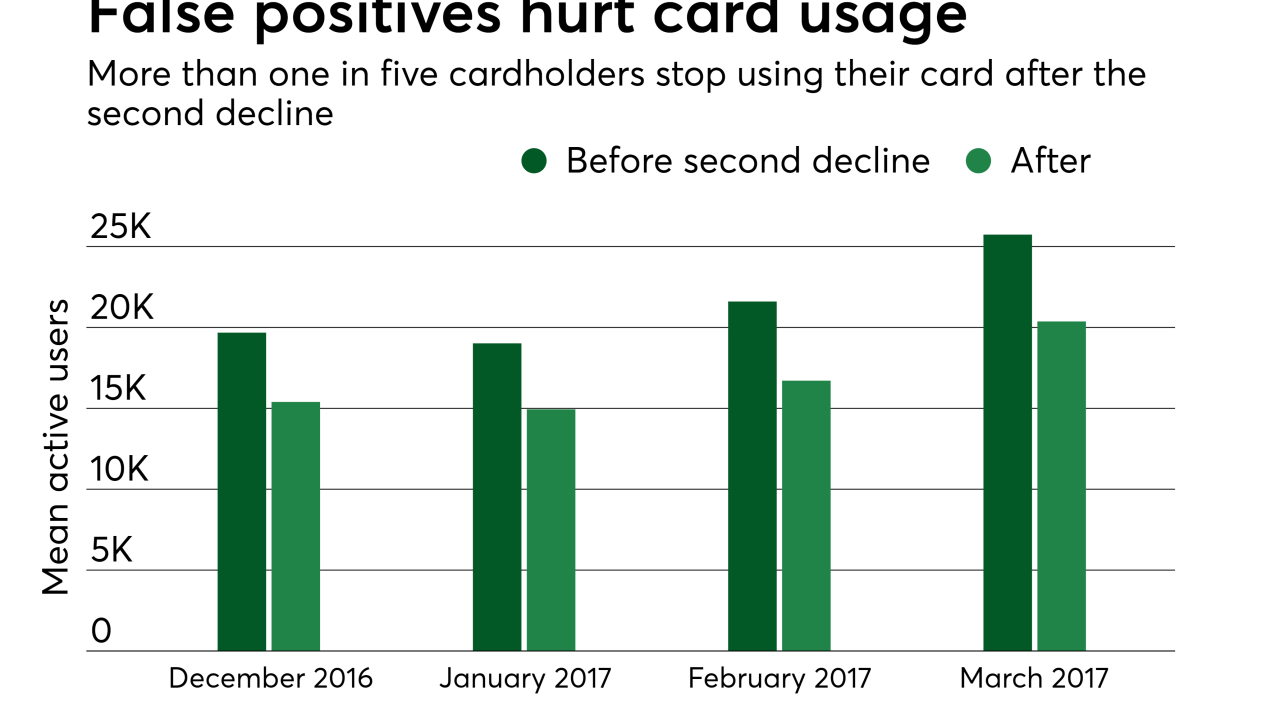

Card usage drops off fast after a false positive. In many cases, two false positives cause consumers to abandon a card permanently.

December 8 -

Airlink's knowledge of the local market and relationships with banks, acquirers and large merchants in region will help the Paris-based Ingenico grow in Taiwan and strengthen its position in Northeast Asia.

December 7 -

The collaboration gives Worldpay another e-commerce tool to battle Amazon's encroachment into traditional retail.

December 6 -

Innovative companies are working on ways to instantaneously convert cryptocurrency into the currency accepted by the merchant, writes Vladimir Gorbunov, COO and co-founder of Crypterium.

December 5 Cyrpterium

Cyrpterium -

A revamped site features a new investor page with updated company news and financial and stock information.

December 5 -

Empow's security platform, integrated into a company's network through APIs or by routing data to empow, breaks down the individual components of a security tool to create an "abstracted new layer" that talks to a set of artificial intelligence algorithms.

December 5 -

The U.K. challenger bank appeals to its customers to use a debit top up sparingly and for “last minute emergencies” since this feature will cost them around $30 per customer each year due to processing fees.

December 1 -

The deal will help First Data compete in the fast-growing "integrated payments" space as payment processors race to diversify products, markets and technology.

December 1 -

Mastercard Inc. will hire 470 people as the world’s second-largest payments network expands its technology hub in New York City.

November 30