-

Total revenue rose less than 1% to $21.8 billion, but expenses declined 2.5% to $13.1 billion. That computed to the highest profit at Bank of America in six years.

October 13 -

The company had strong gains in construction lending and trust fee income, but its business lending operation had flat results.

October 12 -

Overall net income rose 8% to $4.13 billion as cost control helped overcome shortcomings in global consumer banking profits and bond trading revenue.

October 12 -

The merger will create a bank with 13 branches and roughly $950 million in assets.

October 3 -

The Seattle company, which has cut about 130 positions in the business in recent months, pointed to lower originations tied to a shortage of new and resale housing.

October 2 -

The Ohio-based credit union relies heavily on employee input and an open-door policy to better craft the organization's strategic planning.

September 29 -

Mark Thompson had previously been a CenterState regional president overseeing the South Florida market.

September 26 -

In the newly created role, Jane Russell manages TD’s call centers, ATMs and digital operations, and directs all operations within its 1,250 U.S. branches

September 25 -

Synovus is widely regarded as one of the industry’s most admired companies, and it is up to Liz Wolverton to ensure that it does not rest on its laurels.

September 25 -

The Dallas company has extinguished talk of a potential sale after aggressively cutting costs over the past year. But concerns about its future — including its ability to find new sources of revenue — remain.

September 18 -

The banking companies agreed to terminate their planned merger after regulators withheld approval. The snag is tied to a previously disclosed issue with Hope's 2016 financial results.

September 15 -

The Indiana company could also use proceeds from the planned stock sale to pay off debt.

September 15 -

Chemical Financial's decision to shutter nearly 40 branches and cut more than 200 jobs is a result of improved technology and an effort to become more efficient after years of pursuing acquisitions.

September 13 -

The Michigan company said the branch closures will save it $20 million a year. It also plans to devote fewer resources to indirect auto, where returns have trailed other lending categories.

September 12 -

Associated's agreement to buy Whitnell & Co. comes just weeks after the company lined up its first bank deal since the financial crisis.

September 11 -

The acquisition will allow Eagle to expand into southwestern Montana.

September 6 -

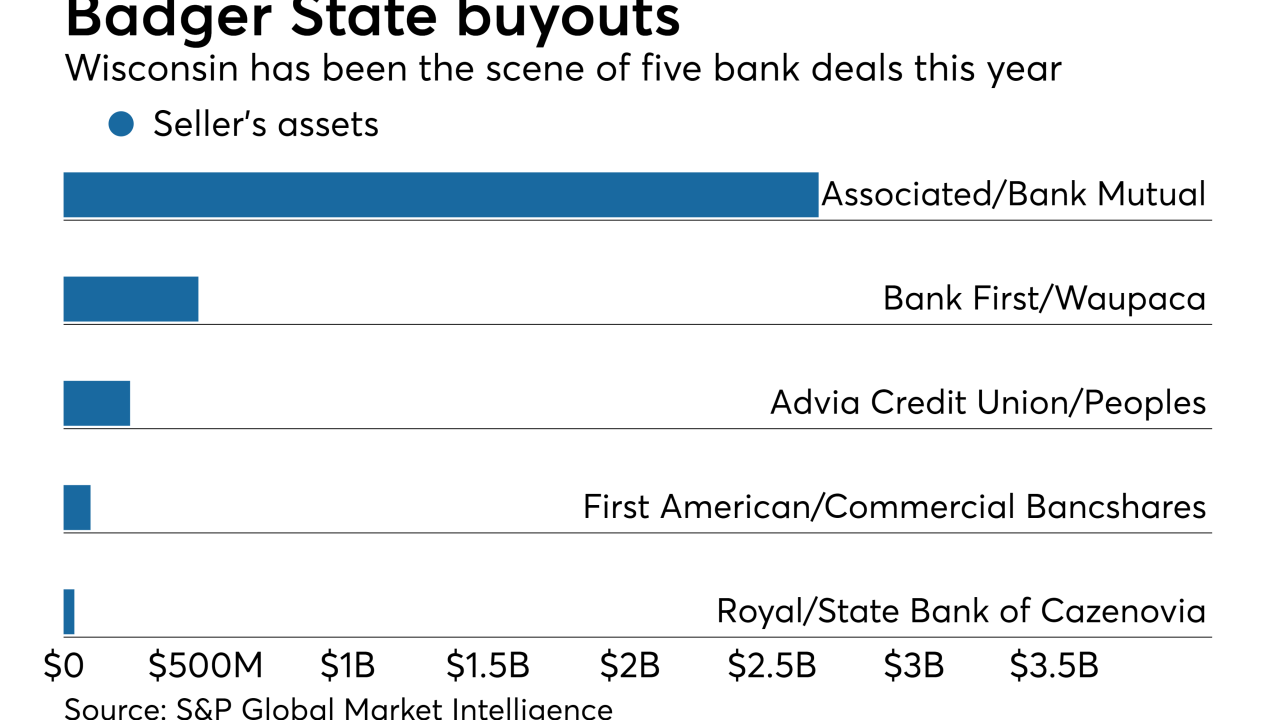

The Wisconsin company plans to shutter half of Bank Mutual's branches, including seven in Milwaukee.

September 1 -

Bank Mutual was still in talks to buy a bank roughly its own size when it began exploring a sale. The move allowed Bank Mutual to quickly find a buyer after its planned acquisition fell through.

August 24 -

From preparing for the next recession and digital disruption to better planning and what millennials want, CUNA Mutual Group’s 2017 Online Discovery Conference covered a lot of ground.

August 24 -

Bryn Mawr Bank has launched a mutual fund at a time when heightened competition and regulatory oversight are the norm.

August 22