-

Unlike a visiting sports team, foreign banks can't just blame local referees they perceive as biased for penalties or fines.

September 21 IBM Global Business Services

IBM Global Business Services -

The purpose of the stress tests program is to reassure the public that the banking system is safe, but the stress tests are not an independent assessment of financial institutions’ actual strength.

August 29 Durham University

Durham University -

U.S. Bank and Wells Fargo to use Blend software to speed up mortgage origination processes; Robert Kaplan wants to keep stress tests on big banks.

August 25 -

As banks press for deregulation, the debate over whether high bank capital standards are inhibiting loan growth has taken center stage.

August 8 -

Financial regulation is too complex and needs to be retooled to improve access to credit, President Trump’s nominees to two top banking regulators told Capitol Hill on Thursday.

July 27 -

Readers question acting comptroller Noreika, weigh in on SoFi’s charter application, defend Trump’s exit from the Paris Accord, and more.

July 21 -

With a heavy focus on the granular details of compliance, bankers and regulators might miss the big picture — not unlike New York City’s approach to fighting crime in the 1990s.

July 17 IBM Global Business Services

IBM Global Business Services -

American card processor has a deal for its British counterpart; after passing Fed tests, banks still stressed by weak lending, low interest rates.

July 5 -

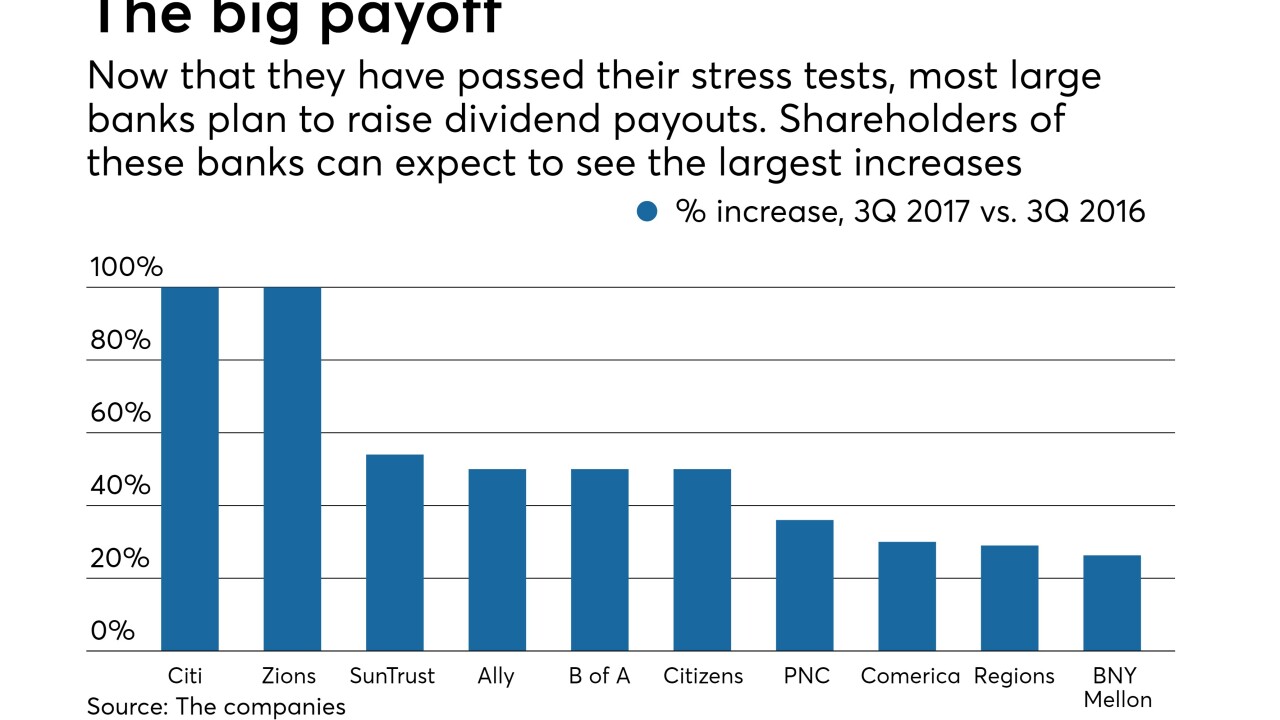

Higher dividends and more aggressive repurchase programs are bound to attract more investors, which could boost stock prices and prompt more dealmaking, analysts said.

June 29 -

The advanced approach has limited value, eliminating it has no downside risks and regulators have better tools at their disposal.

June 29

-

Six biggest banks set to return nearly $100 billion to shareholders; Capital One’s plan approved by Federal Reserve, but with conditions.

June 29 -

The largest banks announced plans to distribute capital back to shareholders after the Fed gave passing grades to everyone following this year’s CCAR stress tests.

June 28 -

All 34 banks passed the Fed’s CCAR stress test, fueling industry calls to dial back the intensity of the stress tests. But many of the changes have already been internalized by banks.

June 28 -

The research firm is set to release a report Tuesday that it says previews the results of the Fed’s 2017 Comprehensive Capital Analysis and Review stress test results for 16 superregional banks.

June 27 -

Though regulatory rigor has improved post-crisis, it would be hubris for the Fed to believe it has found a magic formula that will predict with accuracy how any of the big banks will truly perform in the next downturn.

June 26

-

Readers weigh in on chatbots, Amazon’s physical footprint expansion plans, alternative credit data and more.

June 23 -

All 34 big banks demonstrate they could survive a severe recession; credit cards emerge as the biggest vulnerability, with a projected $100 billion in losses.

June 23 -

The test showed that banks face potentially heavy losses in certain loan categories under economic stress, particularly in the area of credit cards, counterparty losses and commercial and industrial lending.

June 22 -

Regional banks with big commercial property portfolios may have a tough time passing stress tests; Fed governor, comptroller of the currency discuss easing bank regulation.

June 22 -

The Fed is preparing to release the results of its annual stress tests in what is likely to be the last iteration of the post-crisis supervisory program before sweeping changes are made.

June 19