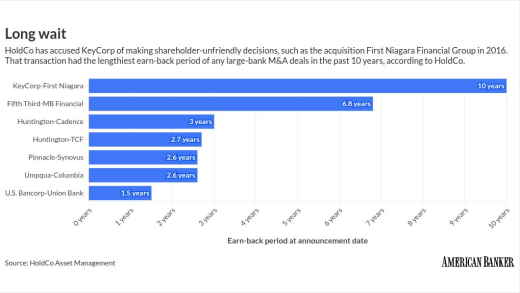

The activist investor HoldCo Asset Management said Monday that it doesn't plan to pursue proxy battles this spring at either Key or Eastern. It had been agitating publicly over the banks' M&A strategies.

Some traditional bankers are unsettled by the wave of crypto and fintech banks getting bank charters. This Nashville bank CEO sees opportunity.

-

The district's appeals court let stand a May 2025 ruling that dismissed most of the D.C. Attorney General's claims against EarnIn in a major win for the firm and good news for fintechs looking for favorable regulatory treatment.

-

Delinquencies on credit-card debt mostly held steady at the end of last year, but certain groups of consumers are faring better than others.

-

The iOS technology enables payments without requiring merchants to add extra hardware. The card network is embedding the option into a broader suite of merchant technology to bolster its services strategy amid competition from Mastercard and fintechs like Block and Stripe.

Top takeaways from American Banker's 2026 Predictions report finds that midsize bankers push for app investments and are concerned about wire transfer fraud.

Bank-favored provisions that were included into the House's version of a bipartisan housing bill threaten to derail Senate passage, but Senate Banking Committee moderates seem skeptical of the combination.

The Government Accountability Office was tasked with investigating the Consumer Financial Protection Bureau's stop-work order, but CFPB officials refused to meet with or provide information to Congress' investigative arm.

-

An immediate effort to unload some of the central bank's assets could do more harm than good. Fed chair nominee Kevin Warsh should first turn his attention to problems affecting banks' liquidity.

-

The federal government should step in to prevent an emerging patchwork of state regulations from stifling the benefits of applying the tools of generative artificial intelligence to the mortgage market.

-

In a future world where AI agents transacting in stablecoins are a major factor in the U.S. economy, the Fed's traditional metrics for identifying an economic downturn will leave policymakers dangerously behind the curve.

-

Fifteen banks have failed since November 2019, with the most recent one occurring on Jan. 30.

-

The letter claims the flood insurance premium pricing change has made the product unaffordable, resulting in a large drop off in the number of policies.

-

Check fraud has risen 385% since the pandemic, with criminals using stolen mail and digital tools to deceive major financial institutions.

-

Jack Dorsey's payments company also laid off employees early in 2025 and 2024 following a self-imposed employee cap of 12,000 in November 2023.

-

Some distressed companies that tapped the Federal Reserve's Main Street Lending Program say they've been crushed by the agency's hard-line stance on modifications.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The annual rankings honor the notable performances of individuals in banking and finance and as teams.

Call for submissions for women 40 years and younger who are rising leaders at their bank or financial institution.

The 23rd annual ranking of women leaders in the banking industry.

- Partner Insights from Elastic

- Partner Insights from Oracle America

-

-