The bank technology company, which faces market pressure from fintechs, cut its outlook by about 20% and restructured its leadership following the departure of former CEO Frank Bisignano to the Trump administration.

While much of artificial intelligence technology is about automating tasks, it also holds the possibility of enhancing bankers' ability to serve customers.

-

Buy now/pay later popularity has been on the rise as more consumers are turning to short-term installment lending to finance everyday purchases. The Swedish financier will find out if that momentum will be a winner with investors in the U.S.

-

Elevations Credit Union is paying athletes at the University of Colorado Boulder by way of a new credit card. The annual fee, plus two cents per transaction, will go to a collective that provides financial support to Buffaloes players.

-

The card brand uses a new form of generative AI that improves data sourcing, making human involvement less necessary.

As CFPB mulls privatizing database, consumer complaints are on the rise; an argument for continued human oversight of artificial intelligence; how some banks are luring talent from big tech; and more from this week's most-read stories.

Texas Capital Bancshares promotes Aimee Williams-Ramey to chief human resources officer; M&T Bank hires Wells Fargo veteran Krista Phillips for newly created post of chief customer officer; Paul Connolly and Paul Speiss age out of their positions on Eastern Bankshares' board; and more in this week's banking news roundup.

President Trump said his massive tax package is close to being finalized, but the White House has yet to win over a faction who want more spending cuts.

-

Who controls the administrative agenda is the most important outcome of the election for banks. But the road to controlling that agenda runs through the Senate, where the political dynamics are considerably different than at the top of the ticket.

-

Zeke Faux, a Bloomberg journalist, describes his two-year odyssey to better understand cryptocurrencies in his book "Number Go Up." His work proves to be an entertaining deep dive into an industry riddled with scams.

-

Organizations that emphasize not just coaching but the importance of remaining coachable, tend to develop more talented and engaged teams.

-

Zelle's parent Early Warning Services said Friday it was planning to take its peer-to-peer payments network international through a new stablecoin initiative. It says the details will come later.

-

Nicolet Bankshares has agreed to buy MidWestOne Financial in an $864 million, all-stock deal. The acquisition will move the Wisconsin-based buyer into Iowa and the Twin Cities, while also allowing it to vault past a key regulatory threshold.

-

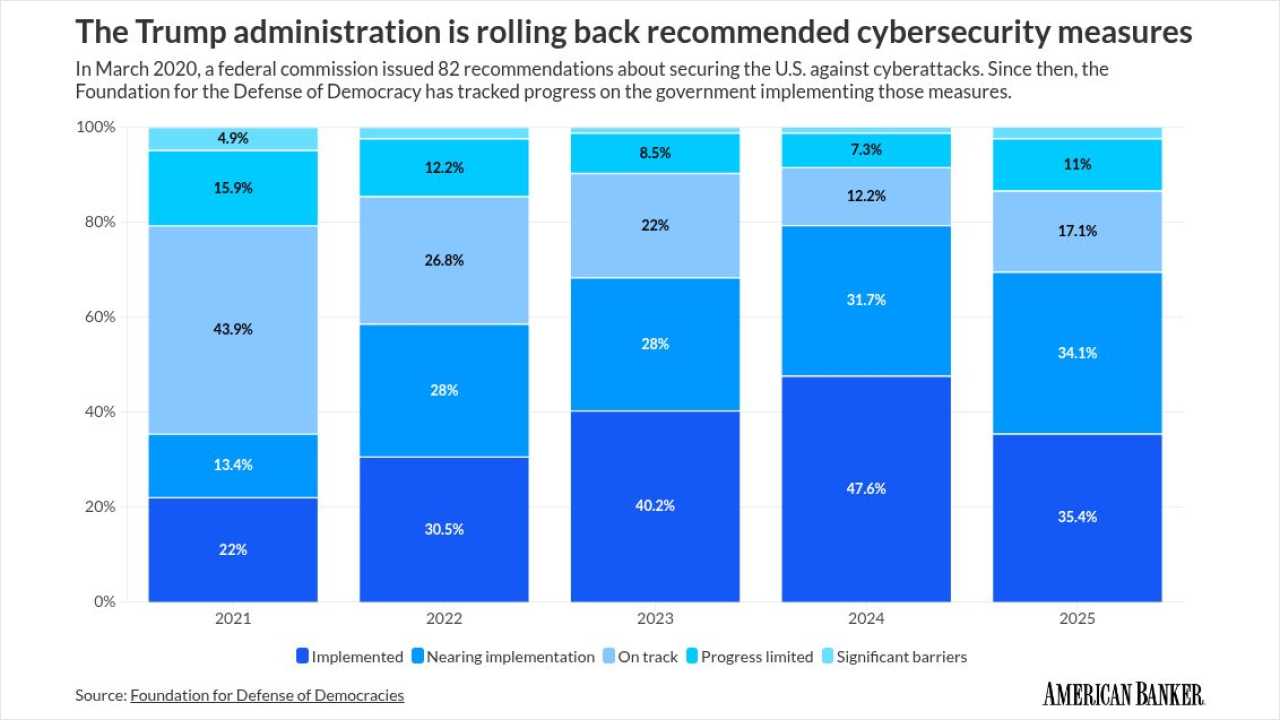

A think tank report details setbacks in U.S. cyber strategy, from shuttered partnerships and staff cuts to the expiration of key info-sharing laws.

-

Needham and Provident banks received all regulatory approvals and merge date; JPMorganChase hired veteran tech dealmaker Kevin Brunner from Bank of America; RBC Capital Markets will expand its presence in the equity derivatives market with two senior hires from UBS; and more in this week's banking news roundup.

-

The Federal Reserve Friday issued a set of proposed changes to its stress testing program for the largest banks that would disclose the central bank's back-end stress testing models, a move that the Fed had long opposed out of fear of making the tests easier for banks to pass.

-

Robert Hartheimer's arrest comes at a time when the bank is trying to recover from a consent order and the Synapse mess.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

South Plains Financial agreed to pay $105.1 million in stock to acquire a seven-year-old Houston community bank in its first M&A foray since 2019.

The 23rd annual ranking of women leaders in the banking industry.

-

- Sponsored by S&P Global

- Sponsored by S&P Global

- Sponsored by S&P Global