Honorees gathered at Tiffany's Landmark building in New York City, where American Banker interviewed them about the industry's trajectory and leadership lessons they've learned in their careers.

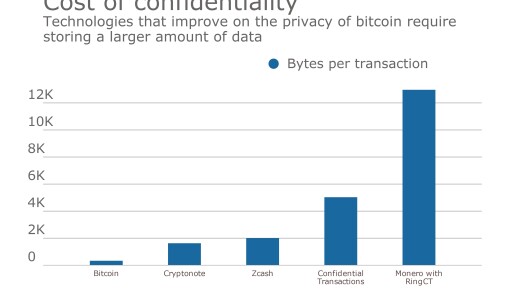

A previously unreleased paper lays out the pros and cons for banks of technologies designed to restore confidentiality on shared ledgers.

-

A punitive tax on payments sent overseas to the families of immigrants would have a cascading set of consequences — all of them bad.

-

The niche buy now/pay later firm is looking for differentiation in a crowded market with recognizable brands like Klarna, Affirm and Afterpay.

-

The contract gives the nation's oldest bank access to more than $3 billion in deposits a month. Comerica, the current administrator, has received a three-year extension of service to help with the transfer.

Facebook's plans to launch its Libra cryptocurrency dominated much of the discussion at American Banker's Digital Banking conference last week, but attendees also debated what big tech company might strike next and what future digital innovations are in store.

Banks seeking to offload CRE assets are finding a receptive marketplace while regulators have managed to keep the situation in balance, observers say.

Andrew Blassie, a former executive at Illinois-based Bank of O'Fallon, pleaded guilty to inflating bank accounts, defrauding retirees and abusing insider access, according to the Federal Deposit Insurance Corp. Office of the Inspector General.

-

As virtual assistants become central to banking, financial institutions of all sizes must embrace and leverage this transformation to redefine the customer experience.

-

Characterizing them as 'schemes' unfairly impugns a service that cash-strapped consumers value and have come to count on.

-

The biggest banks need to get creative about the kinds of products and services they offer, and their efforts to attract a broader customer base.

-

A national bank charter will help UBS Bank USA to expand offerings for wealth management clients, according a company memo.

-

The New York-based bank, which works with many Democratic campaigns, faces investor concerns that it might be targeted by the Trump administration. CEO Priscilla Sims Brown says the bank's "strong profitability" is its best shield from political threats.

-

The Ohio bank is working with Alloy Partners to build startups in fintech, payments and wealth management even as it acquires multiple banks this year.

-

Huntington's $7.4 billion acquisition of Cadence would give the Ohio-based bank a top-five market share in both Dallas and Houston. It comes just a week after Huntington closed its last Texas acquisition.

-

In an expanded partnership announced Monday, the card network and payment fintech will enable hundreds of millions of consumers and tens of millions of merchants to use new forms of artificial intelligence for shopping and payments.

-

The Arkansas-based company spent nearly four years on the M&A sidelines, grappling with asset quality issues and litigation tied to its 2022 acquisition of Texas-based Happy State Bank. Now it's signed a letter of intent to buy an unnamed bank.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

A group of European banks have formed Qivalis, which expects to launch its coin in early 2026 as a counter to the U.S. dollar-led market. Plus, Singapore regulators give Ripple permission to expand and other news in the global payments and fintech roundup.

The 23rd annual ranking of women leaders in the banking industry.

- Sponsored by S&P Global

- Sponsored by S&P Global

- Sponsored by S&P Global

-