The Birmingham-based lender is opening its first branch in Houston, following a wave of banks rushing into the Lone Star State as its economy continues to boom.

AriseBank said it was the first crypto platform to buy a traditional bank. But there’s no evidence it did anything of the kind — and its founder now says it has been raided by the FBI.

-

The volunteer firefighting crew in Kerr County was the target of impersonation scams on the digital payments platform for donations to relief efforts.

-

Research from Cornell University suggests that people assign different levels of social status to others depending on how they choose to pay for goods and services.

-

As AI and digital assets become mainstream, banks are spotting new opportunities to integrate payments with other activities.

Companies are taking vastly different approaches to how they implement generative AI, whether it's to empower employees or to overhaul the way they bring products to market.

The Missouri bank surveyed consumers about what kind of financial management tools they use, then built its My Finance360 tool in response.

Federal Reserve Chair Jerome Powell said there was a "high degree of unity" among committee members during this week's Federal Open Market Committee vote. Out of 12 FOMC members, 11 voted for a 25 basis point cut.

-

To effectively reduce fraud, banks must transition to proactive, integrated strategies encompassing robust risk management and asset liability management.

-

Women in the payments industry are using the advent of real-time payment networks to help underserved women around the world gain access to vital financial services.

-

Banking relies far too much on human relationships and trust for it to hand over essential questions about perception and judgement to artificial intelligence. The need for human bankers will always exist.

-

The Office of the Comptroller of the Currency Friday approved national trust charter applications for five crypto firms, affirming the administration's push to allow crypto companies the ability to take deposits.

-

Kansas City Federal Reserve President Jeffrey Schmid and Chicago Fed President Austan Goolsbee said in statements Friday that their dissents from this week's interest rate decision were spurred by inflation concerns and a lack of sufficient economic data.

-

As shoppers embrace new forms of AI, crypto and alternative financing, payment experts say financial institutions will need to reassess traditional payment products.

-

Leading Democrats on the Senate Banking Committee sent a letter to Chair Tim Scott, R-S.C., pointing out the as-yet unsatisfied legal requirement for prudential regulators to appear in Congress semiannually.

-

Treasury Secretary Bessent said FSOC is readjusting its approach to avoid stifling growth in moves with implications for capital, technology and mortgages.

-

The Federal Reserve Board of Governors voted Wednesday to reappoint 11 sitting regional Fed presidents, without any dissents. The move precludes any effort the White House might have made to pressure the board to deny reappointments.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

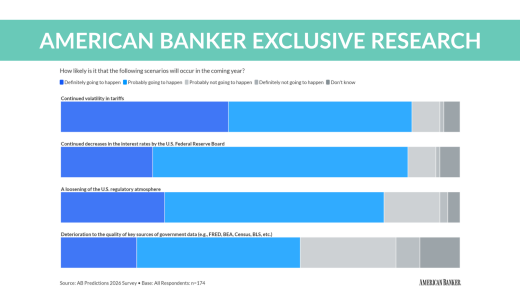

American Banker research highlights growing concerns about an economic downturn, regulatory volatility and open-banking risks.

Matt Bucklin is the founder of

The 23rd annual ranking of women leaders in the banking industry.

- Sponsored by S&P Global

-

- Sponsor Content From Refine Intelligence

- Sponsored by Epiq