The credit scoring agency's rollout comes after years of criticism from home lenders over its prices, with delivery costs rising over 40% in the past year.

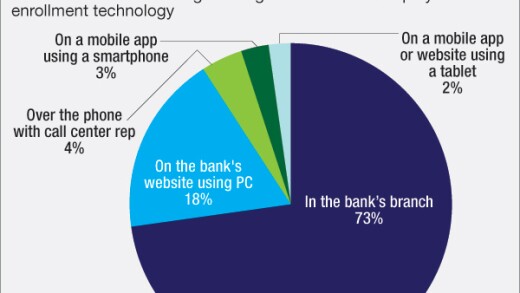

Consumers, especially millennials, increasingly prefer to do everything on their mobile devices, including signing up for services. But as banks start to open accounts for people whom their employees have never met, there are plenty of questions about whether they can tell real customers and crooks apart.

-

Big national retailers will capture all the financial benefits from proposed reductions in swipe fees, while consumers will be left with fewer benefits programs and less secure transactions.

-

Tighter merchant connections between Square and Cash App helped Block produce stronger-than-expected results during the first quarter, while Jack Dorsey said the firm will launch its first remittance product later this year leveraging decentralized finance.

-

The Federal Reserve has proposed that the two payments services run seven days a week, meaning they'd no longer close on weekends or holidays. The public has 60 days to comment.

The concept of digital payments doesn't often cross paths with the concept of robots moving autonomously through our world. But in a few cases, robots have been created to handle payments and deliver goods.

Lower interest rates could bolster loan demand, credit quality and securities portfolios. But they could also curb lending profitability faster than they ease deposit costs, crimping net interest margins and eating into near-term profits.

A Maryland judge temporarily halted mass layoffs of probationary employees at multiple agencies, citing legal violations and harm to states' ability to respond to unemployment needs.

-

The United States needs to follow the lead of other countries by letting fintech firms test innovative products at the national level. Failure to do so could send promising new ideas overseas.

-

Insured deposit caps are now practically meaningless, and current rules for setting deposit insurance premiums do little to block banks' excessive risk taking. There's a better way.

-

Besides negating the benefits of a central bank digital currency, the Federal Reserve's real-time payments system will bring about numerous positive changes, including helping consumers who live paycheck to paycheck.

-

A major financial services industry group focused on cybersecurity highlighted the need for planning ahead of 2030 and 2035 deadlines.

-

BayFirst Financial in St. Petersburg shuttered a national small-dollar 7(a) loan program in August. Now the $2.4 billion institution, which has been one of the nation's most active SBA lenders over the past decade, is making a clean break from the business.

-

A bipartisan bill offered Monday by Senate Banking Committee member Katie Britt, R-Ala., and Andy Kim, D-N.J., would force the Securities and Exchange Commission to update a 25-year-old threshold that holds small financial firms to higher regulatory standards.

-

The Treasury Department's Financial Crimes Enforcement Network is seeking public comment on a survey of anti-money-laundering compliance costs from a variety of nonbanks, including casinos, insurers, lenders and other nonbanks, a possible precursor to deregulatory proposals down the road.

-

Vis Raghavan's arrival last year has energized Citigroup's investment banking division, pushing his team to relentlessly pursue deals while cutting underperformers to make way for marquee hires.

-

After a slump of several years, there's been a renewal of payment and financial tech firms going public.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Federal Reserve Board Gov. Stephen Miran said the growth of stablecoins and cryptocurrencies will likely impact monetary policy and could lead to lower interest rates.

Existing law already provides the tools that would allow an across-the-board upgrade in digital identity verification, with benefits to banks and consumers alike. Regulators are the roadblock.

The 23rd annual ranking of women leaders in the banking industry.

-

- Sponsor content from Nutanix FIS

-

-