The first government shutdown since 2019 will slow flood insurance originations and new Small Business Administration loans, though self-funded banking regulators will continue operating as usual.

The rub is that the global messaging system's security is only as strong as the weakest link.

-

The Wyoming-based digital asset bank filed paperwork to challenge last month's district court ruling, which affirmed the Federal Reserve's view about its discretion over master account applications.

-

To build their executive presence in meetings and on video calls, junior employees should embrace flexible schedules — and possibly media training, Michelle Young of Worldpay and Anna Greenwald of MoneyGram International said at American Banker's Payments Forum.

-

Consumer spending slowed and charge-offs rose during the first quarter, but Bread Financial said a pending late-fee rule may not be as devastating to its revenue as the Columbus, Ohio-based firm initially feared.

Decision Intelligence uses artificial intelligence iin an attempt to increase the accuracy of real-time approvals of safe transactions and reduce false declines.

Toronto-Dominion Bank's expensive foray into the U.S. was supposed to supercharge its growth. Instead, it's become a drag on profitability and badly dented the lender's reputation.

The U.K. axed its payments regulator in an effort to reduce red tape as part of the prime minister's Plan for Growth. The move was lauded by industry, but some are concerned the FCA won't give payments the attention they deserve.

-

Federal officials should have protected both banks' uninsured depositors by following the law's carefully designed framework for dealing with failures of systemically important banks.

-

Federal officials should have protected both banks' uninsured depositors by following the law's carefully designed framework for dealing with failures of systemically important banks.

-

Main Street companies, particularly those owned by women and minorities, depend on the flexibility of community and regional banks for their survival.

-

The bank teamed up with Euronet Worldwide subsidiary Dandelion for cross-border payments to digital wallets in the Philippines, Indonesia, Bangladesh and Colombia in an optionality play.

-

S&T Bancorp is shuffling its board structure as Chairwoman Christine Toretti plans her departure; Philip Bohi is named general counsel of the American Financial Services Association; Coastal Community Bank appoints Brandon Soto as its new chief financial officer; and more in this week's banking news roundup.

-

The Olympia, Washington-based acquirer expects the all-stock acquisition of Kitsap Bank's holding company to close in the first quarter of 2026.

-

The Harrisburg, Pennsylvania, community bank agreed to acquire 1st Colonial Bancorp in Mount Laurel, New Jersey, in a $101 million deal that would help deepen its presence in greater Philadelphia.

-

Seven filings were submitted in response to President Donald Trump's request for the Supreme Court to remove barriers from ousting Federal Reserve Gov. Lisa Cook before litigation proceeds. Most filings argued for the Court to deny the president's application.

-

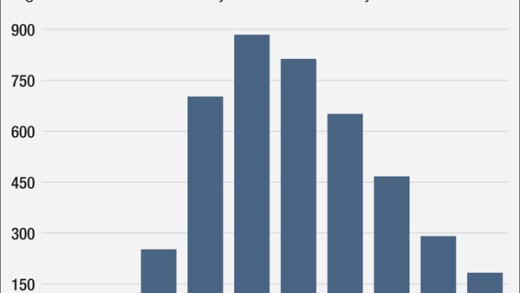

Personal income, which rose $95.7B in August, was overtaken by consumer spending, which jumped $129.2B, pushing the saving rate to 4.6% amid steady inflation and higher wages.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The Consumer Financial Protection Bureau ended a consent order earlier than expected against the credit bureau TransUnion, saying the company already paid a $5 million fine and $3 million to consumers.

The 23rd annual ranking of women leaders in the banking industry.

-

- Sponsor Content from SAS

-

-