-

The SEC had sued the cryptocurrency exchange for allegedly operating as an unregistered securities exchange, broker, dealer and clearing agency. The case was dropped with prejudice.

March 28 -

Fintech firm Mercury, which provides banking services to businesses, says it now has 200,000 customers after raising $300 million in C-round funding.

March 28 -

The personal consumption expenditures index showed headline inflation flat at 2.5%, but the details of the report explain the Federal Reserve's reluctance to adjust interest rates.

March 28 -

The trading app provider has debuted wealth management services, and will be rolling out banking and new AI-powered investment tools later in the year.

March 27 -

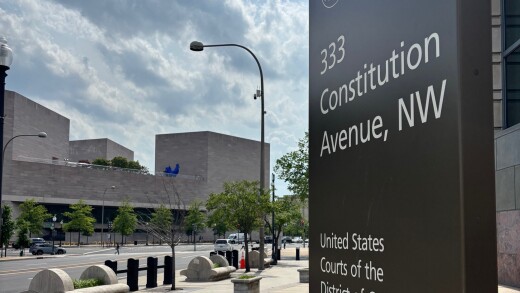

Democratic lawmakers signed an amicus brief with the D.C. District Court supporting a preliminary injunction to stop mass firings by the Trump administration at the Consumer Financial Protection Bureau.

March 27

Among banks with between $10 billion and $50 billion of assets, those that targeted narrow lending markets rose to the top.

Growing loans was a tall order in 2024, but banks that could do just that were able to outperform their peers.

Seven of the 20 top-performing banks with $2 billion to $10 billion of assets last year were based in Texas. But it's not about being bigger.

Investors face yet another bumpy start to the trading week, although it's mounting concern over US debt rather than tariffs likely generating the volatility this time.

Almost 15 months after its announcement, Capital One Financial Corp.'s takeover of Discover Financial Services was officially completed on Sunday, creating the largest credit-card issuer by loan volume in the US.

Firing 90% of the Consumer Financial Protection Bureau's staff and stripping it down to "the statutory studs" is lawful, an attorney for the CFPB told an appeals court.

Investors face yet another bumpy start to the trading week, although it's mounting concern over US debt rather than tariffs likely generating the volatility this time.

Almost 15 months after its announcement, Capital One Financial Corp.'s takeover of Discover Financial Services was officially completed on Sunday, creating the largest credit-card issuer by loan volume in the US.

Firing 90% of the Consumer Financial Protection Bureau's staff and stripping it down to "the statutory studs" is lawful, an attorney for the CFPB told an appeals court.

Bankers are concerned about stablecoins gaining traction due to the passage of the GENIUS Act, and also continue to sound the alarm about the failure to resolve check fraud disputes, according to the latest quarterly survey from IntraFi.

Pulaski Savings Bank's failure will cost the FDIC's Deposit Insurance Fund 57.6% of its total assets.

The CEO of First Northwest Bancorp is promising to fight a lawsuit claiming the lender helped a client perpetrate a Ponzi scheme that bilked a hedge fund out of more than $100 million.

Most Influential Women in Payments honorees say the dramatic expansion in technology presents new opportunities and challenges as employers evolve away from traditional business models.

Honorees from American Banker's Most Influential Women in Payments discuss spotting tangible uses for innovation, rather than buying into hype.

Each year, American Banker recognizes the women who are advancing the payments industry in banking, retail, acquiring, processing and more.

-

John Buran shares how his New York bank and its small business customers are faring with tariff uncertainty — and how some have quickly changed suppliers and modified business plans — in the latest American Banker podcast.

July 15 -

Staking activities and stablecoins are two of the possible ways banks could have a role in decentralized finance, said Margaret Butler, head of the financial services practice at the law firm BakerHostetler and Kristiane Koontz, director of Treasury Services and Payments at Zions Bank, in interviews recorded at the Digital Banking Conference in June.

July 1

-

The veto aligns with President Trump's executive order on AI, which focuses on innovation and leadership rather than consumer protection.

March 27 -

The Senate voted 52-48 to overturn the Consumer Financial Protection Bureau's rule that would cap overdraft fees at many banks at $5.

March 27 -

After eight years of delay, the Consumer Financial Protection Bureau could still make last-minute changes to the payday rule, which sweeps in the buy now/pay later industry.

March 27 -

The Connecticut bank disclosed that Nasdaq waived a shareholder approval requirement so it could urgently raise more than $50 million. Patriot also said its finance chief would step down.

March 27 -

The Trump administration's plans for student loans could open the door for banks to grab market share as borrowers seek alternatives.

March 27