Rohrkemper attributes her success at the bank to her engineering and teamwork mindset.

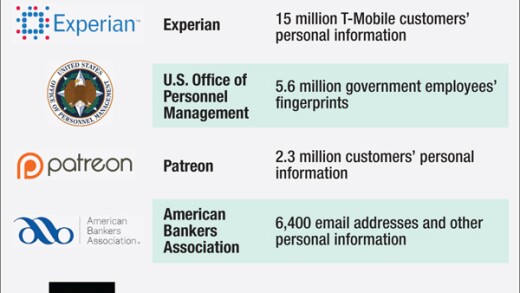

A server containing sensitive consumer information at Experian has been breached, with the records of as many as 15 million T-Mobile customers stolen, the companies said Thursday.

-

Commonwealth Bank of Australia has developed an advanced artificial intelligence tool that can spot harassment in transaction messages.

-

Early Warning Services, which operates the peer-to-peer network, is among the latest to take a creative approach to educating consumers about the relentless onslaught of fraud schemes.

-

In reality, central bank digital currencies would provide only some of the benefits of a real cryptocurrency and would have numerous drawbacks.

Federal Reserve Vice Chair Philip Jefferson said in a speech Friday that long-term productivity gains brought on by artificial intelligence could compel the central bank to maintain higher rates to keep prices stable.

After several quarters of slumping investment banking and trading fees, the Charlotte, North Carolina-based company reported a big uptick from that division, which helped compensate for a large decline in net interest income.

The Consumer Financial Protection Bureau rescinded a proposed rule on nonsufficient funds fees and a 2020 advisory opinion on earned wage access products.

-

For all of the regulators’ progress over the years, many are still relying on an internal technology framework that was built for 1992, not 2022.

-

To create sensible rules around decentralized finance, regulators have to have an open discussion with businesses in the industry. To do that, they must create a path for collaboration.

-

Widespread sharing of financial and other data creates enormous privacy risks for consumers, many of whom have no real understanding of the danger.

-

A Republican-led effort to raise Bank Secrecy Act reporting thresholds gains momentum amid debanking rhetoric as lawmakers eye must-pass defense authorization as vehicle for financial regulatory reform.

-

The Canadian institution plans a U.S. tokenized deposit, contending that it can help banks keep and grow deposits amid threats from fintech-issued cryptocurrency. Founder and President David Taylor is encouraging others to do the same.

-

Founder and executive chairman Edward Nigro will step back into the top executive spot after Ryan Sullivan informed the company he didn't plan to renew his employment contract.

-

The Bureau of Labor Statistics reported that the economy added 22,000 jobs in August, raising the unemployment rate to 4.3% and providing additional cover for the Federal Reserve to lower interest rates in September.

-

Fintechs are rolling out business financing tools that are packaged as buy now/pay later and earned wage access in the hopes of capturing momentum from the budding consumer finance industries.

-

Both Fannie Mae and Freddie Mac made similar changes to their policy when it comes to disclosures and retention rules for an appeal of a valuation.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The Dallas-based regional bank's return on average assets exceeded its goal of 1.1% for the first time, coming in at 1.3% for the third quarter. The bank has been in transformation mode since 2021.

Sasha Samberg-Champion is the special civil rights counsel of the National Fair Housing Alliance.

The 23rd annual ranking of women leaders in the banking industry.

-

- Sponsored by S&P Global

- Sponsored by S&P Global

- Partner Insights from Copado