Community Financial in Syracuse has made its biggest investment ever in an outside company, taking a $37.4 million equity stake in an insurance provider that focuses on the rental housing market.

The core-processing vendor FIS wants to dream big like fintech startups when it comes to developing future services, but it also seeks to be large enough to offer multiple services in an era when banks are cutting back on third-party providers.

-

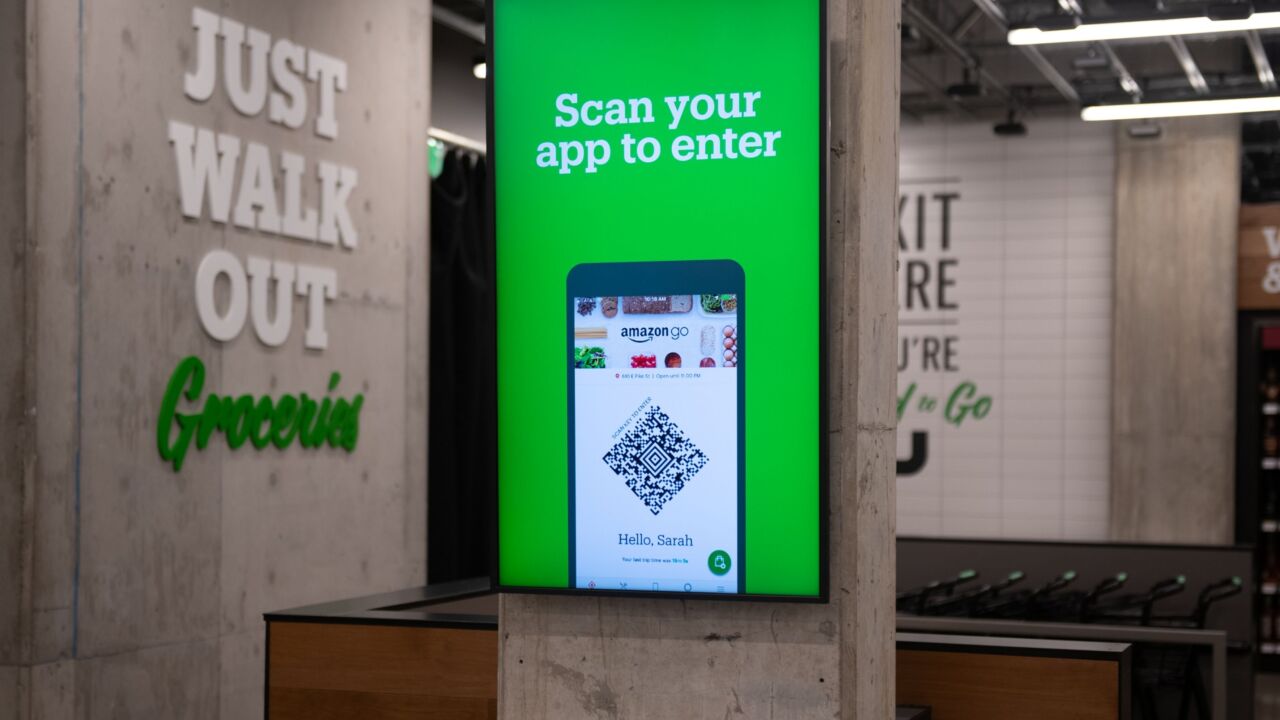

When the e-commerce giant designs and revises new store models like Just Walk Out, it faces a challenge: How do you train technology that requires real-world data that doesn't yet exist?

-

Payments fraud is the most expensive kind, at $450B; anti-financial-crime execs are the most worried about real-time payments, a survey from Nasdaq and Oliver Wyman found.

-

Companies such as SeatGeek, a ticketing provider that requires its employees to do a lot of travel, find that artificial intelligence can help manage a large amount of data tied to travel and expenses.

Federal Reserve Vice Chair Philip Jefferson said in a speech Friday that long-term productivity gains brought on by artificial intelligence could compel the central bank to maintain higher rates to keep prices stable.

Community banks are in the early days of experimenting with AI and the earlier days of writing policies to govern its usage. It's key to do both at once.

The president directed Treasury Secretary Scott Bessent and Howard Lutnick, the nominee for Commerce secretary, to create the fund, following through on an idea Trump floated during his campaign.

-

The agency's invitations to "Come in and talk" often precede investigations and subpoenas.

-

Regulators are starting to look at bank-fintech partnerships as a source of systemic risk, but the real problem is the lack of consistent prudential rules outside of banking.

-

The Biden administration's Property Appraisal and Valuation Equity Task Force is working to eliminate race-based bias in the assessment of home values.

-

Bill Pulte, director of the Federal Housing Finance Agency, may have violated federal privacy laws by releasing personal information on mortgages taken out by Federal Reserve Gov. Lisa Cook — actions that served as a basis for President Trump's efforts to remove her from office late last month.

-

Taylan Turan, who was previously HSBC Holdings' global CEO of retail banking, will join the Canadian bank later this month as chief operating officer.

-

Tricolor Holdings had been showing some cracks leading up to its bankruptcy filing Wednesday. Fifth Third, which had funded the company, said that the problem is a "one-off."

-

From FedNow to Venmo, banks are tapping QR codes for speed and security. Scammers are also exploiting the blind trust they elicit.

-

The Senate Banking Committee voted 13-11 to favorably recommend Stephen Miran's nomination for the Federal Reserve Board to the full Senate.

-

The U.K.-based super app expanded its partnership with Google Cloud as it looks to advance account-to-account payments; Global Payments launches Genius platform in the U.K.; and more in this week's global payments roundup.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Customers today have high expectations for companies to provide an end-to-end experience.

Huntington's $7.4 billion acquisition of Cadence would give the Ohio-based bank a top-five market share in both Dallas and Houston. It comes just a week after Huntington closed its last Texas acquisition.

The 23rd annual ranking of women leaders in the banking industry.

-

- Sponsor Content from Feedzai

-

- Partner Insights from Appway