The payment company opened a new office in Dublin to battle rivals like Adyen, Stripe and PayPal.

Brian Moynihan, chairman and CEO of Bank of America, said the future of banking lies in tech.

-

The risk facing U.S. banks is not that stablecoins will suddenly siphon deposits through yield alone. It is that deposits will gradually follow utility as financial experiences improve elsewhere.

-

Pre- and post-purchase, buy now/pay later loans from Affirm will be available on Fiserv-issued debit cards. Last year, Affirm and FIS inked a deal to bring Affirm's BNPL loans to FIS-issued debit cards.

-

The bank technology seller closed the sale of its payment processor to Global Payments, which sold its card issuing unit to FIS. Helping banks get a handle on artificial intelligence is a big part of FIS' plan to reach banks.

Universal Commerce Protocol is an open standard that establishes a common language for AI agents and systems to work together, and will allow consumers to purchase products from retailers directly through Google's AI Mode in the browser or the Gemini app.

CEO Gunjan Kedia joined nearly 70 chief executives of Minnesota-based companies in calling for "an immediate de-escalation of tensions" in Minneapolis, where a second resident was fatally shot by federal immigration agents on Saturday.

The bill, known as the STOP Act, was introduced by State Sen. Samra Brouk and Assemblymember Steven Raga, and proposes that any wage or cash advance be considered a loan and subject to the state's 16% civil usury law.

-

Following President Trump's aggressive bank deregulation agenda, the FDIC and OCC, and occasionally the increasingly politicized Fed, are in a race to slash compliance requirements. Bankers should remember that the pendulum can always swing back.

-

As the Federal Reserve's quantitative tightening efforts fade into history, the major engine of economic growth in the U.S. will be bank lending. Regulators should keep a close eye on where those dollars are going.

-

Industrial loan companies play a vital role in local economies across the country, providing liquidity in areas that other banks overlook. Restricting the availability of ILC charters would be bad for business.

-

In keeping with its policy of outsourcing functions outside its core commercial and retail banking competency, Signature Bank near Chicago teamed with a larger trust company to fill a longstanding gap in its product set.

-

The Arkansas-based company pivoted to organic growth a few years ago, after making 14 bank acquisitions in less than a decade.

-

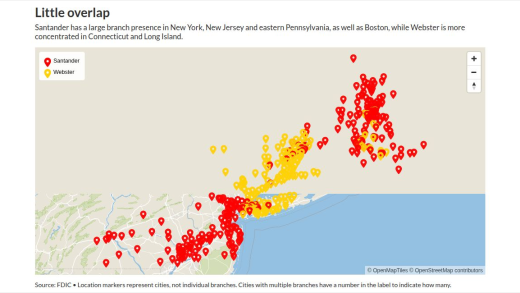

The combination of the banks is the latest in a trend of deals closing on speedier timelines, and signals the industry's hunt for scale.

-

When the Swiss banking giant bought rival Credit Suisse in 2023, it inherited an investigation over money the Nazis looted from European Jews. The issue now seems to be coming to a head in Washington.

-

The Chicago-based, $261 million-asset Metropolitan Capital Bank & Trust was placed in receivership and its assets sold to Detroit-based First Independence Bank, costing the Federal Deposit Insurance Corp.'s Deposit Insurance Fund an estimated $19.7 million.

-

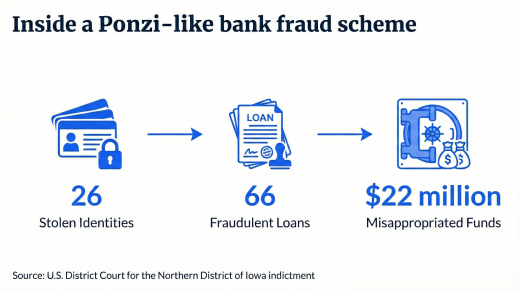

Court documents reveal how a teller used the drive-through window and work email to aid a scheme that bypassed TD's fraud defenses.

-

- Bank ThinkMonday, Wednesday, FridayProvocative and informed opinion on the business of financial services.

- Breaking NewsDelivered as neededGet notified on breaking news and events.

- Community BankingMondayM&A, small business, and commercial real estate lending.

The payment company opened a new office in Dublin to battle rivals like Adyen, Stripe and PayPal.

Friedman who became JPMorganChase's top lawyer in 2016, said it's important to separate out what's important from the daily noise swirling around.

- Sponsored by S&P Global

- Sponsored by S&P Global