Fieldpoint Private Bank & Trust and its parent company entered a written agreement with state and federal supervisors pledging to address several compliance issues.

Some traditional bankers are unsettled by the wave of crypto and fintech banks getting bank charters. This Nashville bank CEO sees opportunity.

-

Siam Commercial Bank is partnering with Ripple to provide instant cross-border payments for small and medium size enterprises (SMEs).

-

The trend toward cashless is inevitable, and could be accelerated by current events. But a gradual transition is key to avoid alienating those people who depend on cash as their primary payment method.

-

With coronavirus driving more merchants to promote electronic payments over cash — and contactless payments over cards — many are still asking their customers to share a potentially virus-laden pen to sign a receipt or screen at the point of sale.

Federal Reserve Vice Chair Philip Jefferson said in a speech Friday that long-term productivity gains brought on by artificial intelligence could compel the central bank to maintain higher rates to keep prices stable.

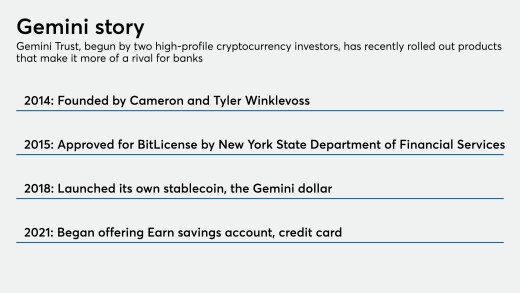

Gemini Trust now offers a credit card and an uninsured savings account for bitcoin holders that pays 7.4% interest. It is the latest example of a cryptocurrency company marketing banklike products.

Vocal in their opposition to some restrictive state laws in recent years, most institutions are silent on similar laws being pursued today. Why?

-

After some modest success pushing companies to add women to boards, State Street is raising the bar; a few key departures have left the world’s central bankers even more male-dominated; and why Caitlin Long went from Wall Street to Wyoming.

-

As it gives its small-dollar lending regulation another look, the agency must consider borrowers who have no other credit options.

-

A combination of software, operating system and development tools can turn in-vehicle "informatainment" systems into payment gateways, according to Jim Carroll, chief technology officer at Mobica.

-

The Federal Reserve's inspector general says the reserve bank CEO did not trade on confidential information or have conflicts of interest, but did violate central bank rules and policies.

-

The latest inflation news is almost sure to result in a 25 basis point cut next week, but some are still hoping for 50 basis points, as well as reductions totaling almost 200 basis points through the end of 2025, Wolters Kluwer found.

-

Lower inflation doesn't equate to lower prices, and costs of living may still be higher than pre-pandemic, especially rents. But the varying cooldown could help.

-

Banks and consumers report fraud at higher rates than they did before the pandemic, and those cases have continued getting costlier.

-

As banks deploy AI to cut costs, some face pressure to define long-term value, Finovate speakers said this week.

-

The regional bank has already seen a large reduction in "criticized" loans, and it expects that trend to pick up as lower borrowing costs alleviate the pain in the commercial real estate sector.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Amid troubling news of tariffs and layoffs, dropping delinquencies offer a rare sign of consumer health.

The session will explore the merging of influencer-driven short-form video

The 23rd annual ranking of women leaders in the banking industry.

-

- Sponsored by S&P Global

- Sponsored by S&P Global

- Partner Insights from Copado