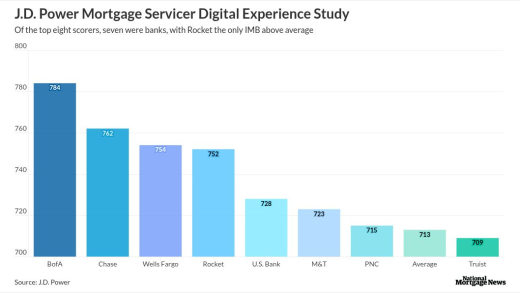

Bank of America was the leader in this study, with Rocket as the only nonbank mortgage lender which got a score higher than the industry average.

Community banks are spending on technology to expand without having to build new branches.

-

New York State Gov. Kathy Hochul has codified how buy now/pay later lending will operate in the state, taking a heavier hand as the Consumer Financial Protection Bureau loosens its grip under President Trump.

-

Chargebacks are a growing problem, but there are steps banks can take to keep losses from spinning out of control.

-

The 29 companies that made this year's list offered flexible work schedules, generous amounts of paid time off and fun activities to keep employees happy.

Bankers show a lot of interest in advanced AI, as well as a daunting list of challenges, according to American Banker's innovation readiness survey.

The Dallas-based company's broker-dealer arm, Texas Capital Securities, has also made several recent hires as it continues to expand its capabilities.

Federal Reserve Bank of Chicago President Austan Goolsbee said the Fed is not tied to Wall Street or political interests and that independence is necessary to prevent inflation.

-

It won't be cryptocurrencies or central bank digital coins that revolutionize global finance, but rather banks offering deposit tokens that have many of the benefits of both.

-

The Consumer Financial Protection Bureau is in the business of promoting economic justice. A second Trump administration might permanently damage the agency's ability to deliver for American consumers.

-

Around the world, low-income communities are routinely cut off from modern payment infrastructures, causing serious economic harm. We must work toward a future in which they are included.

-

Financial institutions see an opportunity to nab scale after years of tepid dealmaking, but investors are pushing back against such efforts out of concerns about shareholder value.

-

The global bank created an educational campaign designed to alert customers to the risk of AI-generated scam advertisements on social media.

-

The Wisconsin-based regional bank plans to acquire American National Corp. in an all-stock transaction valued at $604 million. It is Associated's first acquisition announcement since Andy Harmening became CEO in 2021.

-

After Citizens CEO Bruce Van Saun announced a company-wide AI makeover, Chief Information Officer Michael Ruttledge told American Banker about what's happening under the hood.

-

The Consumer Financial Protection Bureau and its union filed legal briefs Friday after a district court judge asked if a preliminary injunction aimed at preventing a mass layoff is still in effect.

-

The latest linkup with the software provider Wave gives Fundbox access to more than 350,000 potential borrowers. It's the fourth major partnership that Texas-based Fundbox has announced in 2025.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Noelle Acheson shares her top 4 stablecoin trends of 2025 and what they taught us about the changing nature of money.

The 23rd annual ranking of women leaders in the banking industry.