Laura Alix is a reporter at American Banker.

-

When Zions Bancorp. in Salt Lake City decided to consolidate its seven bank charters into one, executives knew they would have to work hard to retain their most talented employees amid all the disruption.

By Laura AlixSeptember 25 -

In recruiting for its commercial bank, BMO Financial is increasingly looking at the athletic rosters of Big Ten colleges. Here's what it has learned.

By Laura AlixSeptember 25 -

The San Francisco bank has pulled in 10,000 new households with loan products geared toward young professionals.

By Laura AlixSeptember 21 -

The Massachusetts company hired banking veteran Mark Thompson, who recently scrapped an effort to buy a struggling bank in Boston, as its bank president.

By Laura AlixSeptember 20 -

Marbue Brown will oversee customer experience in Chase’s branch network, call centers and digital and mobile platforms.

By Laura AlixSeptember 18 -

Flush with cash, many commercial firms are also opting to pay down debt rather than take on new loans, and those seeking financing aren’t always turning to banks to meet their needs.

By Laura AlixSeptember 15 -

TransUnion Chief Financial Officer Todd Cello said Tuesday the firm kept call centers open through the weekend to deal with the flood of calls from anxious consumers.

By Laura AlixSeptember 12 -

CIBC's Victor Dodig has big plans for the U.S., but other bank execs speaking at an investor conference Monday warned of risks in certain sectors.

September 11 -

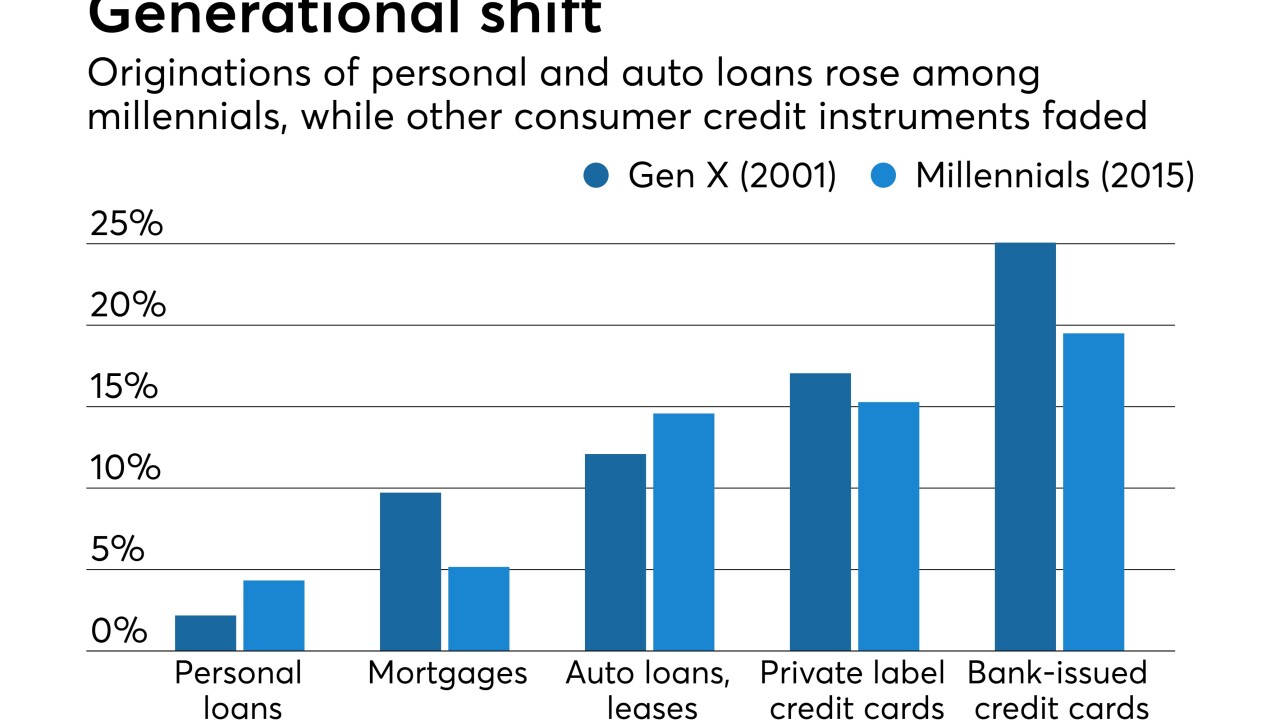

Millennials — many of whom joined credit unions in recent years as the movement's membership expanded — are relying more heavily on personal loans than their Gen X predecessors while paring back on credit cards and mortgages.

By Laura AlixSeptember 11 -

BankGuam, which is looking to sell $20 million of common stock, warned investors that North Korea represents a unique risk to its stock price.

By Laura AlixSeptember 7 -

Sure, personal loans have a long way to go to catch up in market share with other forms of consumer credit, but millennials are relying more heavily on them than their Gen X predecessors while paring back on credit cards and mortgages. Online lenders are a big reason, and banks are exploring ways to adjust to changing habits.

By Laura AlixAugust 30 -

To head off ethical concerns often raised by university-corporate partnerships, Bank of the West is not paying kickbacks for accounts. Instead it is cultivating student input and chipping in for scholarships, internships and emergency food assistance.

By Laura AlixAugust 22 -

Balances 90 days past due are noticeably higher in 2017, new N.Y. Fed data shows. Though the trend has a lot to do with positives like economic expansion and easier access to credit, officials say it deserves careful attention.

By Laura AlixAugust 15 -

People’s United recently won the deposit business of the states of Massachusetts and Vermont, punctuating a multiyear plan to expand in government banking. But it’s a hard niche to succeed in, and, as other banks can attest, it can invite controversy.

By Laura AlixAugust 15 -

Young businesses often prefer banks, especially community banks, over online lenders. However, traditional lenders need to make quicker decisions, simplify the application process and make other improvements, these customers say.

By Laura AlixAugust 8 -

The global bank’s U.S. unit has bounced back, aided by growth in deposits and wealth management profits as well as a focus on international customers. A $125 million investment in tech and branches hasn’t hurt either.

By Laura AlixAugust 4 -

Insurers are seeing modest gains in market share as banks, facing increased scrutiny from regulators, lightly tap the brakes.

By Laura AlixAugust 1 -

Core deposit growth might be the best indicator of which banks will have true staying power in the years ahead.

By Laura AlixAugust 1 -

Lustig, Glaser & Wilson often harassed the wrong consumers, demanded amounts that were not owed, bullied consumers into paying from exempt income, and failed to obtain legitimate documentation of those debts, state officials said.

By Laura AlixJuly 27 -

The Miami Lakes company’s chargeoffs of medallion loans increased fivefold, but profits rose thanks to gains in C&I, CRE and other types of loans.

By Laura AlixJuly 26