-

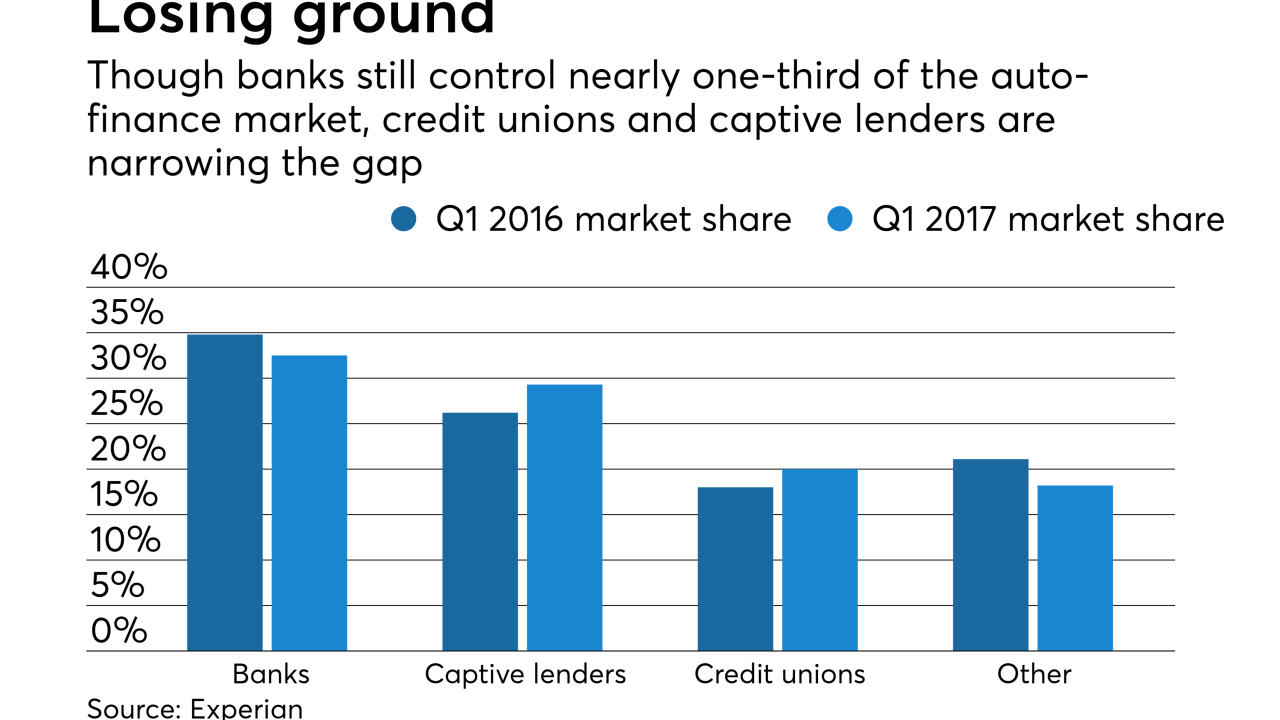

Large banks have scaled back lending as competition has intensified and credit unions and financing arms of car manufacturers are picking up the slack.

June 7 -

Despite the hype around self-driving cars and ride-hailing services, the automotive landscape remains much the same as ever. One thing that may be changing rapidly, however, is the way consumers buy their cars.

June 7 -

In the wake of allegations against subprime auto lender Santander Consumer, attendees of CU Direct’s DRIVE Conference discuss steps credit unions are taking to protect against fraud risks.

June 6 -

Reliance on asset-based loans protects banks as retail chains flounder; average FICO score hits record 700 while the percentage of those with scores below 600 hits new low.

May 30 -

The 'revolution' in auto financing, communication tips and the keys to member engagement were all topics of focus during the second day of CU Direct's annual DRIVE conference in Las Vegas.

May 26 -

As the annual DRIVE conference kicked off in Las Vegas, credit union leaders gathered for wide-ranging discussions on the future of auto lending.

May 25 -

The old record was set just before the Great Recession, and what may be most remarkable is that it took nearly nine years to reach a new milestone.

May 17 -

Steve Allocca is expected to play a key role in the online lender’s efforts to restart loan growth.

May 16 -

Loan origination system part of company’s lending technology push.

May 16 -

The Minnesota company recently announced that it would stop selling auto loans since credit quality concerns have slowed investor demand, but it is unclear whether its plan to keep all its car loans on its books is less risky.

May 15 -

The GOP is working on a plan that could extend the Congressional Review Act's reach so that it may overturn certain policies all the way back to 1996.

May 12 -

Executives at the embattled bank made clear Thursday that they are not discarding its long-standing strategy of selling additional products to existing customers.

May 11 -

Banks are increasingly tightening lending standards for commercial real estate loans and are likewise seeing a drop-off in demand, according to a report released Monday by the Federal Reserve Board.

May 8 -

The weakening car-loan market poses a big challenge for the Detroit-based lender, but it also could also present an opportunity, since other big banks are sharply reducing their exposure.

April 27 -

Depending whose money they're using, Wells Fargo and JPMorgan Chase either love subprime car loans or fear them.

April 27 -

The Consumer Financial Protection Bureau ordered an auto loan servicer on Wednesday to pay $2.4 million for failing to live up to the terms of a 2015 consent order.

April 26 -

Profits at the Dallas lender plunged as it slashed originations and edged up the credit spectrum.

April 26 -

The Cincinnati company’s 1Q profits were hurt as it scaled back in key consumer and commercial credits, paid higher severance and saw fee income fall.

April 25 -

Quarterly earnings at the Wayzata, Minn., company fell as gains from the sale of auto loans continued to slide.

April 24 -

A $26 million settlement by Santander Consumer is shining a light on the hard-to-measure problem of auto dealer fraud, while also raising questions about the adequacy of lenders' efforts to combat bad behavior.

April 21