The 50 companies that made American Banker's annual list share insights into what makes their workplace culture enticing for potential new hires and current staff members.

The fintech topped American Banker's annual list this year. CEO Dave Buerger attributed the company's hands-off management style as one reason that draws in and keeps workers around.

Forty companies made the 2024 edition of American Banker's annual list of enviable workplace cultures in the financial technology space. Here is a look at some of what makes these firms employers of choice.

The core banking provider was No. 1 on American Banker's ranking of the Best Places to Work in Fintech this year. The company attributes this success to encouraging employees to hash out solutions to challenges.

The company has changed the dynamics of its meetings, created diversity metrics and deployed software to make job descriptions gender-neutral.

The company, which provides workplace investing programs to banks, is giving employees a say in some decisions and working with partners to recruit women and people of color.

The Texas fintech embraces a progressive culture and has taken steps during the pandemic to maintain a spirited vibe even as employees work remotely.

Top executives from the 49 companies that earned a spot in this year's ranking of the Best Fintechs to Work For cite the need for nimble shifts in business strategy, leadership style and recruiting tactics among the lessons they took away from the challenges of the coronavirus crisis.

Small, often intangible quality-of-life perks are a big part of what makes some fintechs the best ones to work for.

The Utah fintech encourages a playful attitude by devoting the first floor of its offices to entertainment and comfort with video games, Ping- Pong, a pool table and a lounge area.

Without its funhouse office, annual trips or volunteering events, the executive found ways to engage his staff virtually.

-

Italian technology firm Nexi has dedicated about $15 billion over the past two months to shore up its position in the European payment processing market, a local burst of consolidation that exists inside a larger wave of similar mergers globally.

November 17 -

Jobs will be harder to find for graduates, and there are new underwriting platforms that can better predict students' future income in their chosen field.

November 16 Climb Credit

Climb Credit -

Mastercard says it has been notified the Department of Justice has approved its planned acquisition of data aggregator Finicity, putting the card brand on track to close the deal before the end of the year.

November 16 -

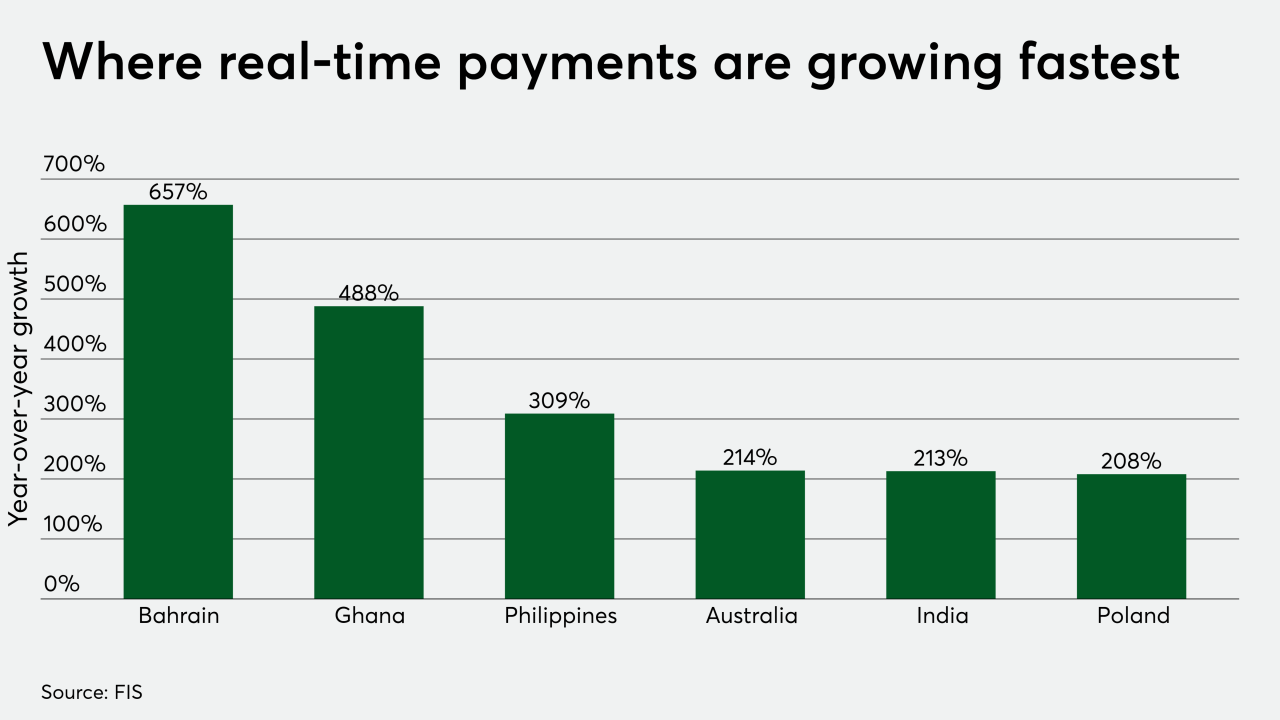

As futuristic as real-time digital payments can be, the concept is almost like a blast from the past for FIS’ Raja Gopalakrishnan.

November 16 -

The forthcoming measure could override staff opinions that helped certain deposit-gathering companies partner with banks.

November 13 -

President-elect Joe Biden’s victory has cleared uncertainty over White House policies that impact fintechs and payment firms, revealing clues as to how the regulatory environment will be different in 2021.

November 13 -

The fintech startup, which originally helped users cancel duplicate subscriptions, now wants to encourage healthier financial practices.

November 12