The 50 companies that made American Banker's annual list share insights into what makes their workplace culture enticing for potential new hires and current staff members.

The fintech topped American Banker's annual list this year. CEO Dave Buerger attributed the company's hands-off management style as one reason that draws in and keeps workers around.

Forty companies made the 2024 edition of American Banker's annual list of enviable workplace cultures in the financial technology space. Here is a look at some of what makes these firms employers of choice.

The core banking provider was No. 1 on American Banker's ranking of the Best Places to Work in Fintech this year. The company attributes this success to encouraging employees to hash out solutions to challenges.

The company has changed the dynamics of its meetings, created diversity metrics and deployed software to make job descriptions gender-neutral.

The company, which provides workplace investing programs to banks, is giving employees a say in some decisions and working with partners to recruit women and people of color.

The Texas fintech embraces a progressive culture and has taken steps during the pandemic to maintain a spirited vibe even as employees work remotely.

Top executives from the 49 companies that earned a spot in this year's ranking of the Best Fintechs to Work For cite the need for nimble shifts in business strategy, leadership style and recruiting tactics among the lessons they took away from the challenges of the coronavirus crisis.

Small, often intangible quality-of-life perks are a big part of what makes some fintechs the best ones to work for.

The Utah fintech encourages a playful attitude by devoting the first floor of its offices to entertainment and comfort with video games, Ping- Pong, a pool table and a lounge area.

Without its funhouse office, annual trips or volunteering events, the executive found ways to engage his staff virtually.

-

Under the partnership with Fundation, Fifth Third will offer loans and credit lines up to $100,000 that can be funded in as little as a day.

February 20 -

Akoya has been building a data-sharing network that gives fintechs access to bank account data through application programming interfaces as an alternative to screen scraping. JPMorgan Chase, Bank of America and Capital One are among its new owners.

February 20 -

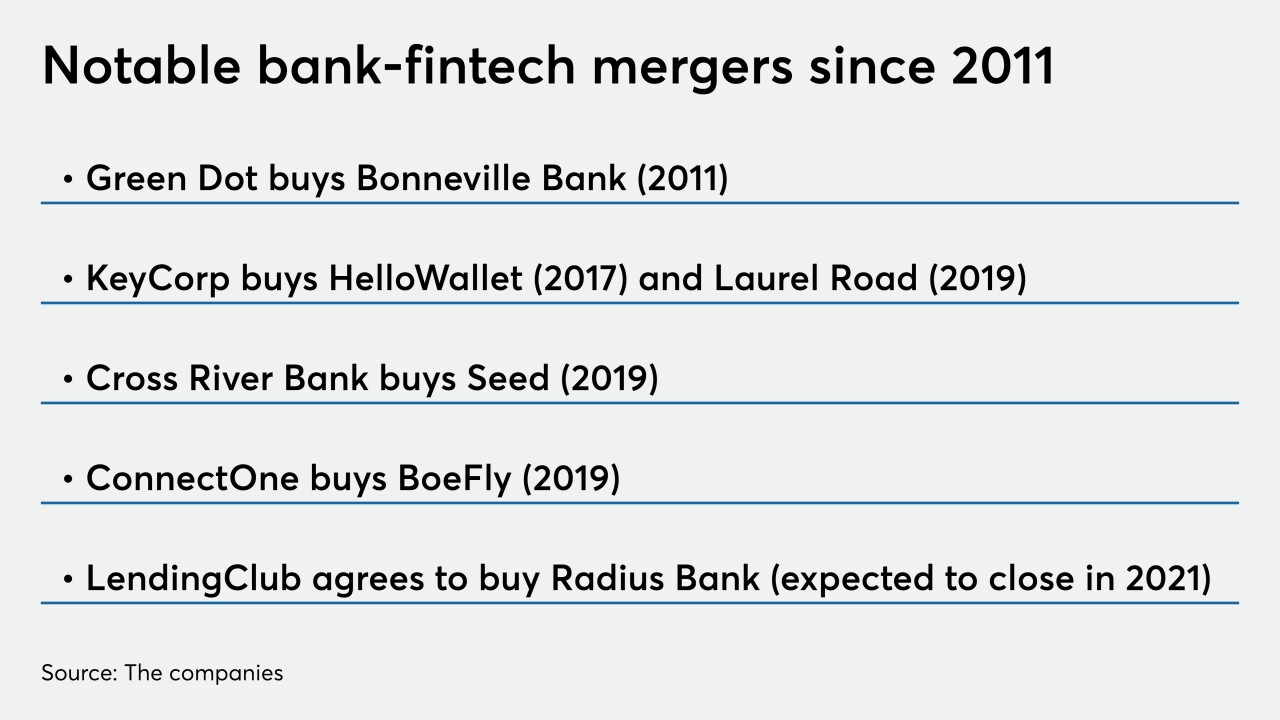

LendingClub and Varo Money are making inroads into the traditional financial system, but other fintechs still face long odds.

February 20

-

Some institutions say the combination of chatbots and social media could entice new borrowers, but burdensome legacy systems may limit their effectiveness.

February 20 -

The challenge for other fintechs will be to find banks that are as compatible as Radius Bank, an online-only lender, is for LendingClub.

February 19 - AB - Technology

The move comes as the fintech tries to shake off criticism that its main products are payday loans by another name.

February 19 -

When established card networks such as Visa, American Express and Mastercard start investing in fintech lending platforms such as Divido and ChargeAfter — as well as in the fintech lenders themselves such as Klarna and Vyze — it’s a clear signal that the future of unsecured personal loans may not be delivered by banks.

February 19