Consideration of whether each job can be done remotely is part of Payrailz's holistic approach to developing its workforce. Currently, about two-thirds of the staff works remotely.

Companies that scored highest in this year’s Best Fintechs to Work For ranking go beyond the basics of strong pay packages, generous benefits and effective leadership to take a more holistic interest in their employees’ lives, according to the data.

Metrics and strategy are key at YCharts. So is the Oreo flavor of the week.

The companies on our third annual list of Best Fintechs to Work For (a ranking compiled by our parent company, Arizent) share an ability to create personal connections with employees, and offer top-tier benefits like generous sabbaticals, fully paid insurance, and parental leave on day one.

Creating an environment that employees love and recruiting a diverse workforce isn't easy. Here's how some Best Fintechs to Work For do it.

These fintechs know how to have a good time. Novel employee benefits from the companies that made SourceMedia's 2019 list include cooking classes, weekly dance parties and free trips.

Employees at Carson Group love the outdoors and regularly participate in events like the Spartan Race, a course filled with treacherous obstacles.

Nap pods and beanbag chairs are nice, but what employees really care about are personal respect and generous compensation. Oh, and it helps to be dog-friendly.

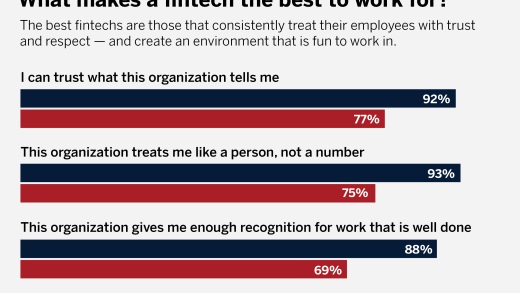

A look at the difference in responses between employees working for companies that made the list and those that did not.

When Redtail Technology moved into its new building 18 months ago, CEO Brian McLaughlin ensured it had homey touches, like comfortable seating, a basketball court and slides.

Some companies on SourceMedia’s Best Fintechs to Work For list offer their employees extra time off to live boldly.

Three years ago, the New York-based fintech started organizing a monthly gathering for its female employees. The meetings have helped participants find role models.

-

Everything from company culture to data security concerns is hamstringing the pace of automation in financial services, per new American Banker research.

August 19 -

Banks want to reclaim their position as the central node in the customer relationship by charging fintechs and data aggregators for access to permissioned customer data. How the legal questions about this are resolved will be a telling moment for all concerned.

August 18 Ludwig Advisors

Ludwig Advisors -

Medallion Financial CEO Andrew Murstein sees more growth on the horizon for the New York lender's fintech banking operation, which saw activity spike in the first half of the year.

August 15 -

The former head of resolutions at the FDIC has high hopes for a bank that's been embroiled in the Synapse disaster.

August 14 -

New data from American Banker finds that use cases for intelligent automation are growing across banks and credit unions alike, such as fraud and lending.

August 13 -

The crypto-focused firm's OCC trust bid would shift supervision from New York to Washington at a time when regulators are signaling openness to fintechs engaging in banking

August 12 -

The Consumer Financial Protection Bureau has been investigating the failed banking-as-a-service fintech and is preparing to file a complaint accusing it of unfair acts or practices.

August 8