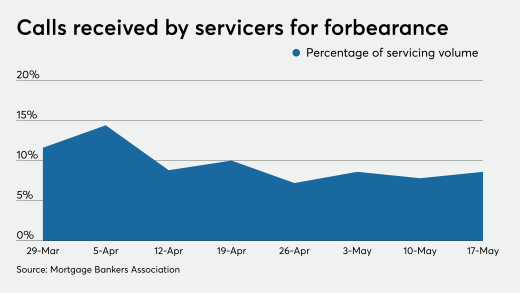

With no way of knowing just how many borrowers will need the mods after the coronavirus forbearance period ends, lenders are deploying artificial intelligence and servicing protocols to tame the ferocious piles of paperwork awaiting them.

Loan volumes were already slowing before the pandemic. New restrictions and changes in consumer behavior are likely to make growth in this portfolio even harder.

In addition to Apple and Google delivering smartphone apps that would alert users that they are near a person infected by the virus, various other government agencies and businesses are developing that type of technology to address the pandemic's spread.

The rescue bill enabled banks to protect loans in forbearance from an immediate hit to a borrower’s credit report, but experts say affected consumers may have trouble getting loans after the pandemic ends.

Acting Comptroller of the Currency Brian Brooks took the extraordinary step of wading into the debate over when it was appropriate to reopen businesses.

With the pandemic putting Plexiglas in short supply, Joe McDonald called up a local source: a former classmate.

Periods of significant loan defaults are tough on banks and force unpleasant choices. Here are steps to evaluate collateral in such uncertain times.

In the U.K., many policy researchers predict that the economic fallout of the pandemic in the U.S. could change attitudes toward the idea of basic income on both sides of the Atlantic.

-

With no way of knowing just how many borrowers will need the mods after the coronavirus forbearance period ends, lenders are deploying artificial intelligence and servicing protocols to tame the ferocious piles of paperwork awaiting them.

June 2 -

Loan volumes were already slowing before the pandemic. New restrictions and changes in consumer behavior are likely to make growth in this portfolio even harder.

June 2 -

In addition to Apple and Google delivering smartphone apps that would alert users that they are near a person infected by the virus, various other government agencies and businesses are developing that type of technology to address the pandemic's spread.

June 2 -

The rescue bill enabled banks to protect loans in forbearance from an immediate hit to a borrower’s credit report, but experts say affected consumers may have trouble getting loans after the pandemic ends.

June 1 -

Acting Comptroller of the Currency Brian Brooks took the extraordinary step of wading into the debate over when it was appropriate to reopen businesses.

June 1 -

With the pandemic putting Plexiglas in short supply, Joe McDonald called up a local source: a former classmate.

June 1 -

Periods of significant loan defaults are tough on banks and force unpleasant choices. Here are steps to evaluate collateral in such uncertain times.

June 1 Ludwig Advisors

Ludwig Advisors