-

Serving on multiple boards while holding full-time executive positions weakens a director’s ability to fulfill the governance demands at complex institutions.

September 8

-

Credit unions are advised to stay in touch with local authorities and provide emergency contact information to examiners in advance of the storm.

September 7 -

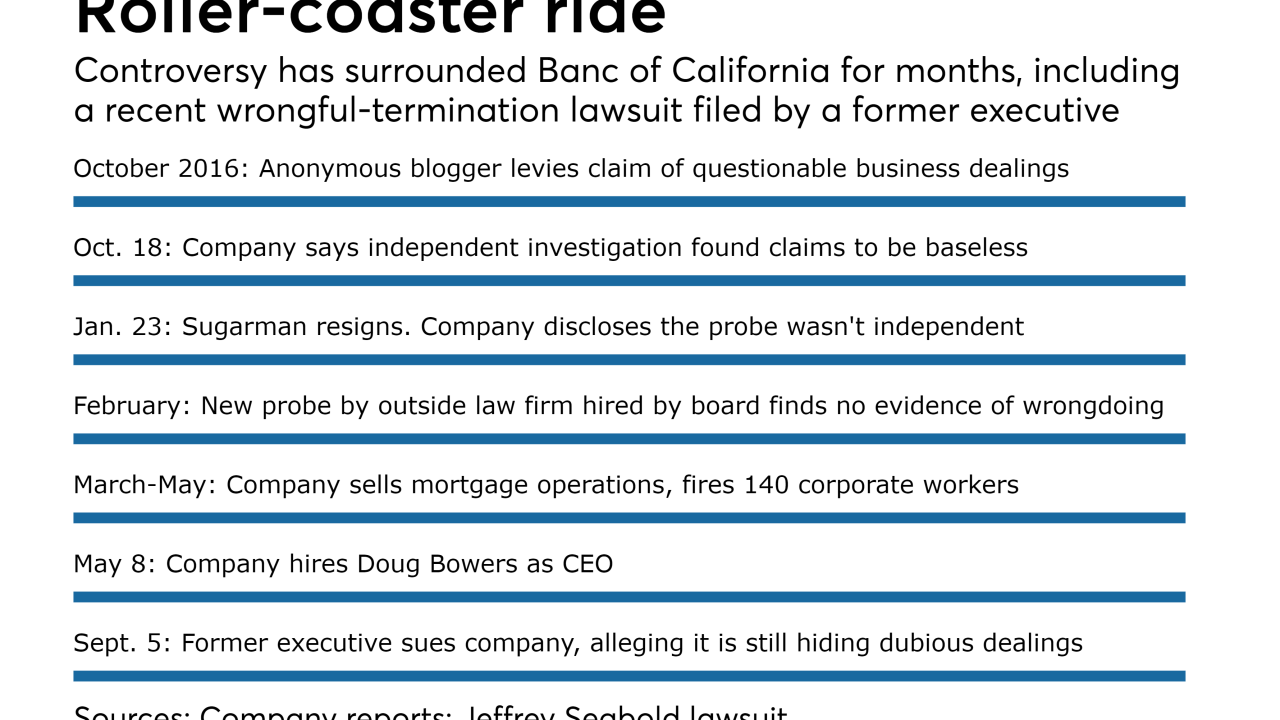

Jeffrey Seabold, Banc of California’s former vice chairman, alleges that he and ex-CEO Steven Sugarman were scapegoats for inappropriate behavior by certain directors and that the company manipulated its first-quarter earnings.

September 7 -

BankGuam, which is looking to sell $20 million of common stock, warned investors that North Korea represents a unique risk to its stock price.

September 7 -

The partnership -- the first of its kind for either organization -- is expected to bring new opportunities to First Tech members and the surrounding community

September 7 -

Given the scale of damage to the region’s homes and cars, bankers are guarding against an expected spike in missed payments by extending loan terms, deferring payments and making other concessions.

September 7 -

Messaging services, mobile banking and remote deposit capture are expected to help Florida FIs that aim to keep up with employees and offer uninterrupted service to consumers.

September 6 -

Messaging services, mobile banking and remote deposit capture are expected to help Florida banks that aim to keep up with employees and offer uninterrupted service to customers.

September 6 -

A growing number of credit unions are creating the position of chief innovation officer on the management team in order to better define and execute cross-departmental innovation strategies.

September 6 -

Proposed combination of General CU, Partners 1 FCU approved by both boards, member vote next.

September 6 -

The addition of John Stallings, who ran SunTrust's Virginia operations, is intended to make Union a more nimble institution, allowing CEO John Asbury to spend more time on strategic planning.

September 6 -

The acquisition will allow Eagle to expand into southwestern Montana.

September 6 -

Natural disasters like Hurricane Harvey reveal banks’ ability to lend a hand to communities in need, and to keep employees engaged and motivated for the initiatives that matter most.

September 6

-

Fast code changes and compliance approvals helped bank customers who couldn’t make it to a branch.

September 5 -

“You can’t serve the public if your employees are shell-shocked,” said one executive, comments echoed by other institutions dealing with the aftermath of Hurricane Harvey.

September 5 -

“You can’t serve the public if your employees are shellshocked,” said one top banker, comments echoed by other institutions dealing with the aftermath of Hurricane Harvey.

September 5 -

The long-term recovery for thousands of Texans whose homes were decimated by Hurricane Harvey rests with a Trump administration government outsider who wants his agency's budget cut by billions of dollars.

September 5 -

Brent Cockerham of Moody National Bank ferried stranded residents to safety in Friendswood, Texas, one of the communities hit hardest by the storm.

September 4 -

A law firm hired by the New York Fed board concluded that Dudley’s error was "inadvertent," and that while it violated the reserve bank's own code of conduct, it did not violate federal statutes.

September 1 -

The Wisconsin company plans to shutter half of Bank Mutual's branches, including seven in Milwaukee.

September 1