-

We entrust tech firms with vast amounts of information about our daily lives, with an expectation that they will safeguard it. But have we become too casual in the trust we place with them in exchange for more personalized experience and convenience?

December 13 AARP

AARP -

We entrust tech firms with vast amounts of information about our daily lives, with an expectation that they will safeguard it. But have we become too casual in the trust we place with them in exchange for more personalized experience and convenience?

December 8 AARP

AARP -

After two century-old community institutions merged in 2010, they never suspected it would take seven years before their operating systems got along.

December 6 -

A lot of lenders say they're dedicated to customer service, but here are six instances when Amarillo National Bank — whose CEO is one of our Banker of the Year award winners for 2017 — went above and beyond the normal call of duty.

November 30 -

When a coder locked $150 million of digital currency stored in Parity digital wallets last week, many bankers probably saw it as another reason to ignore cryptocurrencies. Instead they should recognize the business opportunity (key custody) that the incident presents.

November 13 -

As use of smartphone apps begins to surpass online channels at some institutions, banks are facing pressure to offer clients more robust services.

November 9 -

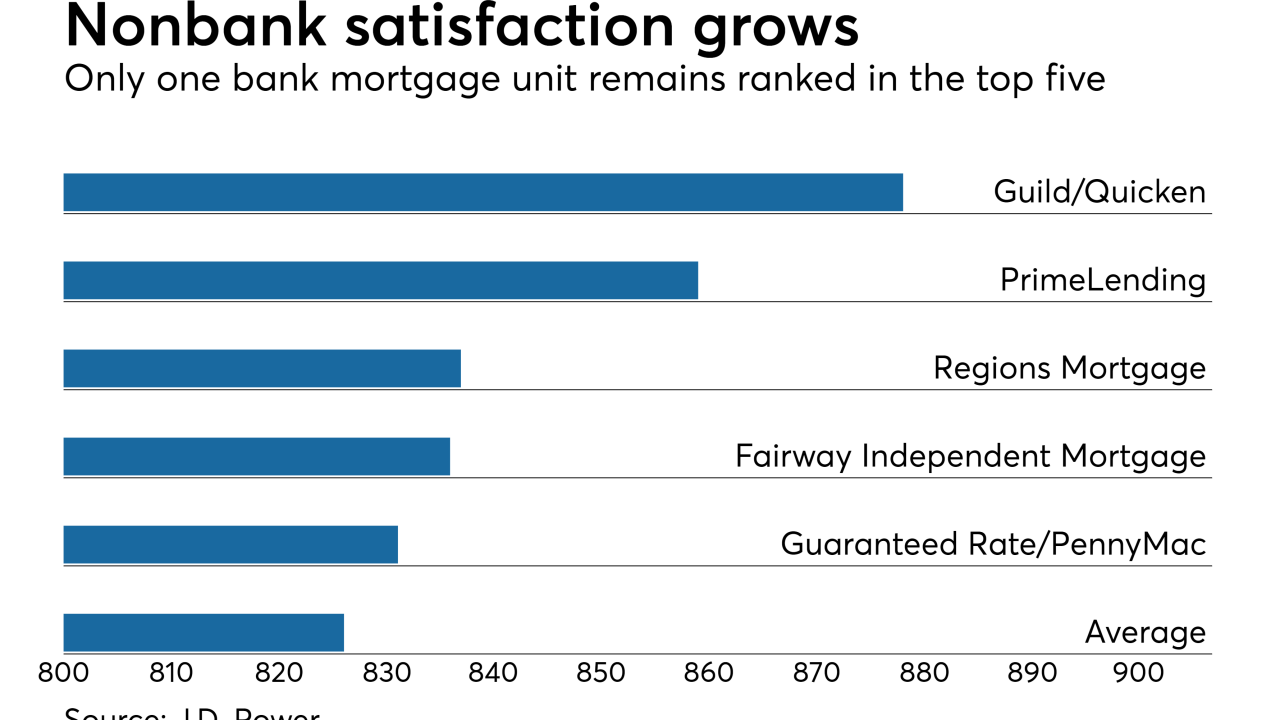

Despite digital mortgage advances, borrowers think it still takes too long to get a loan, J.D. Power finds in its annual customer satisfaction ranking of originators.

November 9 -

The regional bank’s first-year CEO is doing some expected things, like offering more products through digital channels, and making a few surprising moves, like inviting all credit card customers to switch to lower-rate loans.

November 8 -

The Canadian payment system is evolving into something almost completely different, an evolution that's birthing new ideas to handle authentication.

November 2 -

Banks tout their small-business lending services, but J.D. Power survey results suggest something's amiss. The solution is easy and old-school — but it costs money.

October 26 -

The Midwest bank said that digital usage rose 400% after a makeover of online and mobile banking platforms that was meant to make them more customer-friendly and more competitive.

October 23 -

While the advent of the Internet offered the possibility of increased global connectivity, blockchain has the potential to take this advancement to the next level, writes Sergey Ponomarev, the CEO of SONM.

October 20 SONM

SONM -

"I’m not going to step aside because I’m an asset for this company," Tim Sloan said Wednesday, rejecting arguments by some Senate Democrats that he is too tied to the phony-accounts scandal.

October 18 -

Banks such as Citigroup, Regions and TD have decided they need to offer mobile customers truly customized experiences. They are experimenting with different ways of doing so that come across as helpful without being intrusive.

October 12 -

Yolande Piazza explains Citi Fintech's unique process for getting customer feedback on new apps. She also talks about overcoming the challenges of innovating inside a large company like Citigroup and winning over those who are resistant to change.

October 10 -

Some financial institutions are looking at how to translate the complicated and document-heavy mortgage lending process into the digital world of voice-interactive personal assistants.

October 4 -

Some banks are looking at how to translate the complicated and document-heavy mortgage lending process into the digital world of voice-interactive personal assistants.

October 4 -

Verba's two-decade career at one of the East Coast's fastest-growing banks began with an old-fashioned letter to a local bank when she was in her late 40s and an epiphany about work-life balance.

October 4 -

The first-of-its-kind study was an acknowledgment that as consumers rely more on digital banking channels, the nation's largest banks are competing more against each other and less against smaller institutions.

September 28 -

The identity theft threat created by the Equifax hack and the growth of online lending have given software makers a platform to pitch products that rely on selfies, scans of driver’s licenses and other nontraditional ID methods.

September 27