-

Green Bancorp has pivoted from the troubled energy-lending market to SBA loans, which are appealing to more small banks because they can be sold at a premium and are getting more support from Washington.

July 6 -

Readers weigh in on chatbots, Amazon’s physical footprint expansion plans, alternative credit data and more.

June 23 -

Oil prices are dropping again, but some lenders think now is the time to recommit to energy lending as long as they underwrite them a certain way for certain borrowers in certain regions.

June 20 -

MidSouth Bancorp in Louisiana, which faces a formal order from its regulators, will cut jobs, close branches and slash its dividend as it works to reduce its energy exposure.

June 8 -

The Louisiana company's board has made it clear that independence is "not a God-given right" and wants new management to address energy loan issues, underwriting, capital and expenses.

June 2 -

The Louisiana company also said that credit quality in its energy portfolio improved during the first quarter.

April 28 -

The Sun Belt lender also increased fee income and kept expenses down in the first quarter.

April 27 -

Zions beat expectations on several bits of good news, but it reported about $30 million of chargeoffs tied to a single commercial borrower.

April 24 -

Texas Capital Bancshares sharply reduced the size of its loan-loss provision as credit quality improved in its energy loan book. That helped the Dallas bank post a 77% rise in first-quarter profit.

April 19 -

The Mississippi company reported loan growth but a dip in profits after a first-quarter acquisition, and it warned that it is on alert for any new “lag” in the energy sector.

April 18 -

The Birmingham, Ala., company's profit climbed 8% as higher market interest rates and investment securities balances offset lower average loan balances.

April 18 -

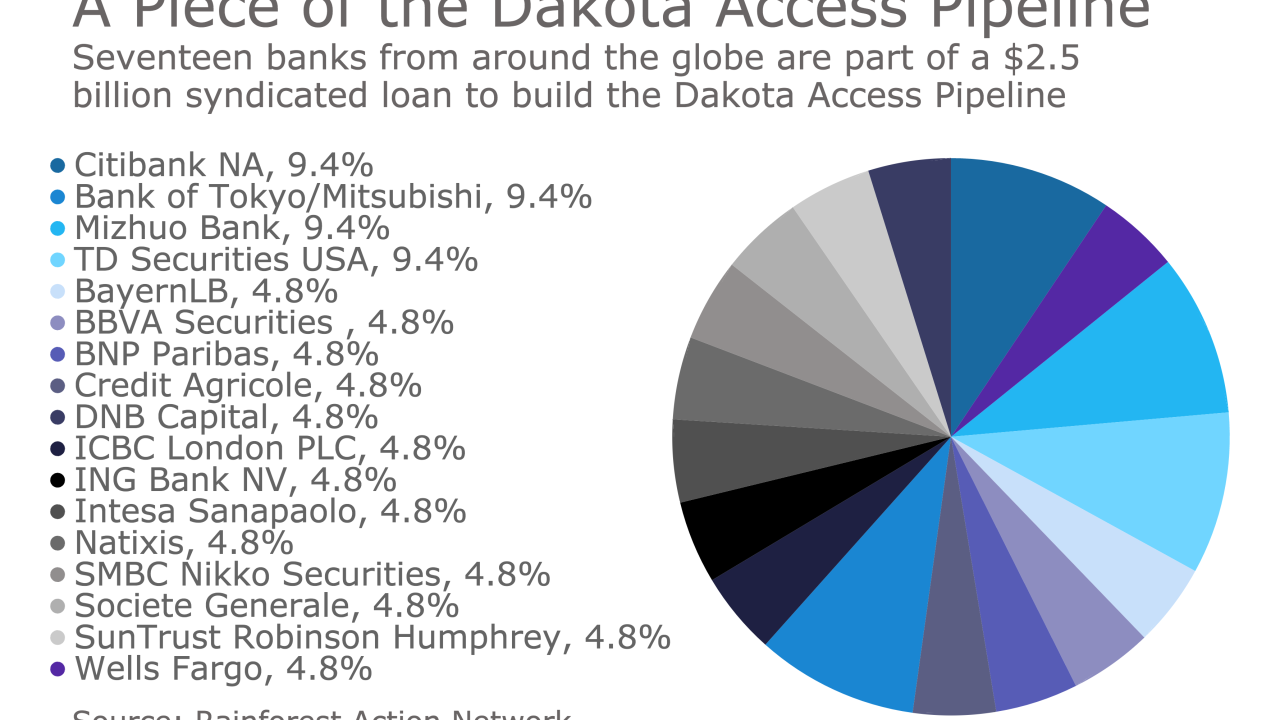

The French megabank has sold its $120 million stake in a $2.5 billion syndicated loan to build the controversial Dakota Access pipeline.

April 5 -

Bankers oppose legislation that would let local governments finance energy efficiency projects with liens ahead of the mortgage.

March 6 -

Activists are pressuring banks involved in financing the controversial Dakota Access pipeline to abandon the project. If banks remain committed, they risk alienating customers, but divestment could set a bad precedent.

February 17 -

The company continued to reduce its exposure to energy loans during the fourth quarter.

February 1 -

Even with some energy firms still struggling, bankers seemed confident that the Texas economy would remain one of the nation’s strongest in 2017.

January 25 -

Net income was also aided by a sharp drop in the provision for credit losses as chargeoffs on energy loans continued to decline.

January 23 -

An improving picture in the energy sector helped Hancock Holding in Gulfport, Miss., report a huge jump in fourth-quarter profit.

January 18