Fintech

Fintech

-

The total includes donations to community groups helping low-income people, support for the development of financial coaching programs and investment in the creation and testing of fintech tools that can help underserved people.

May 15 -

The Clearing House's Real-Time Payments Network has been slow out of the gate, but it's getting some much needed adoption via a collaboration between personal financial management fintech Digit and JPMorgan Chase.

May 14 -

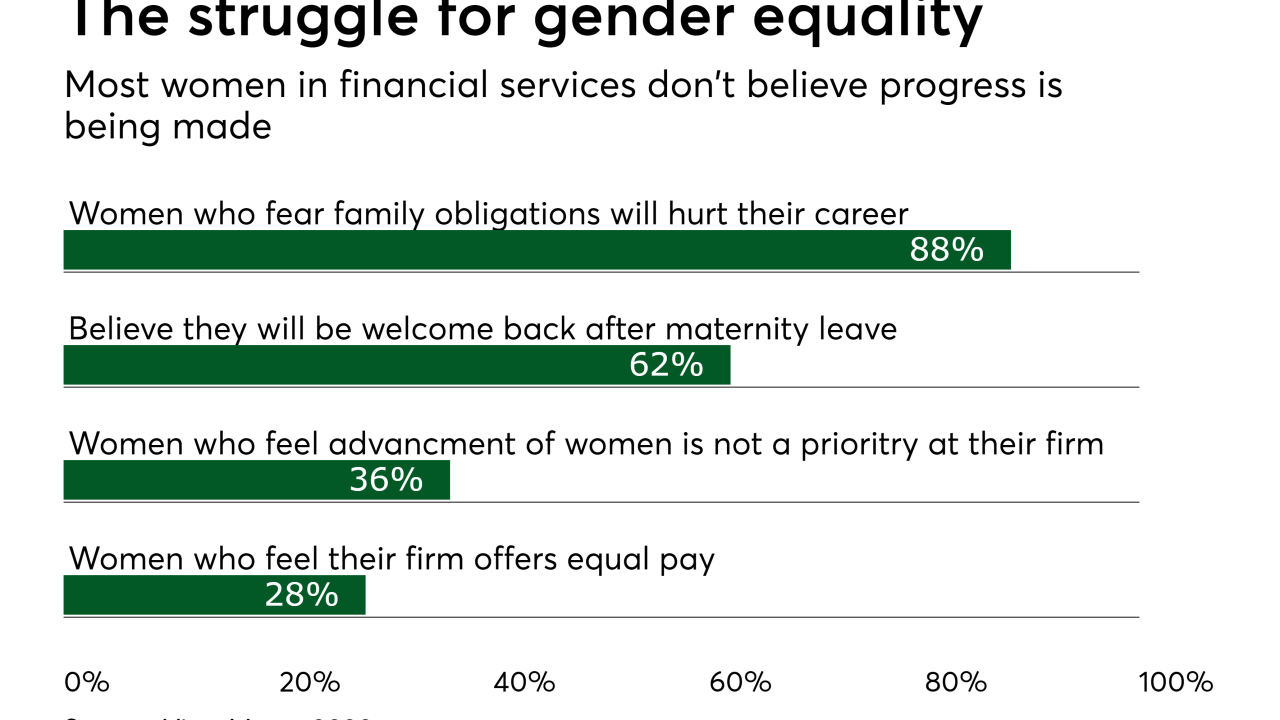

We must challenge ourselves with transparency by neutralizing gender-specific language in company job advertisements to reach a more diverse pool of candidates and drive responses, writes Nicole Baxby, an account director at Featurespace.

May 14 -

Petal's getting aggressive with its incentive marketing by approaching consumers with limited credit histories, and it's betting artificial intelligence can handle the higher risk.

May 14 -

The forces reshaping small-business lending are also leading to “a moment of reckoning” for small banks, says former SBA head Karen Mills.

May 14 -

Manuel Alvarez, who became commissioner of the Department of Business Oversight on Monday, is the former general counsel and chief compliance officer at the online lender Affirm.

May 13 -

Banks must remain accountable for their use of artificial intelligence by continuing to employ a level of human oversight.

May 10 -

The Financial Stability Oversight Council first wanted to target individual nonbanks that are economically risky. Now it wants to target activities instead. Is that a good idea or a political ploy?

-

Plinqit, led by a former banker, was developed specifically for community banks as a way to appeal to young customers.

May 9 -

Departments across large institutions remain siloed, which leads to poor customer service. Fintechs are poised to take business from unhappy consumers unless banks address this problem.

May 8 -

The Atlanta company reported a first-quarter revenue increase of 22%, and it has established a more aggressive target for the full year.

May 7 -

The investment money’s flowing into fintech that’s flexible and broad enough to build a bridge between issuers and merchants. For PayU’s investment wing, that’s a $500 million blanket covering cross-border commerce, open tools and markets in dire need of a digital revolution.

May 7 -

In his first extensive interview since taking the job this year, Javier Rodriguez Soler talks about banking as a service, how to keep customers happy and where he sees AI and other tech innovations heading.

May 6 -

New initiatives could give a boost to an already widely charitable industry, but fickle consumers and uncertain economic waters could prove a challenge.

May 6 -

There are emerging payment innovations and strategies, such as card controls and online payment technology and analysis, that can help banks and other financial institutions connect with small businesses, writes Erik De Kroon, CEO and co-founder of Yordex.

May 6 -

Aging tech systems have become a "pain point" in financial services, and VC firms have backed newcomers trying to push aside traditional vendors and win over banks and credit unions.

May 3 -

Changing demographics and cultural trends are making bank CEOs think beyond profitability and toward addressing what they stand for.

-

Transaction fraud, attacks, compliance and political uncertainty are a toxic mix, argues Ian Stone, CEO of Veualta.

May 3 -

The investments that Rana Yared's team makes in startups help Goldman Sachs in two ways: Besides earning a profit, the company also uses a lot of the technology the startups develop as part of its internal digital transformation.

May 2 -

The head of the agency's innovation office said the program will be available only to OCC-regulated institutions.

May 2