-

Prepaid card users have waited a long time for the basic protections that debit card customers take for granted. Congress should not throw them under the bus.

April 19 National Consumer Law Center

National Consumer Law Center -

Lawmakers from both political parties are increasingly interested in forcing lenders that offer loans to upgrade home heating and cooling systems to issue better disclosures, a prospect that has some in the industry nervous.

April 18 -

President Donald Trump plans to nominate Randal Quarles, a senior Treasury official in the Bush administration, to be the Federal Reserve's top banking regulator, according to a person familiar with the selection process.

April 17 -

The 110-page document offers plenty of new details about what went wrong at the megabank but may leave many wanting a truly independent investigation.

April 14 -

The 110-page document offers plenty of new details about what went wrong at the megabank but may leave shareholders wanting a truly independent investigation.

April 12 -

President Trump has been in office for nearly 12 weeks, but he still hasn’t nominated several critical positions among financial services regulators. Following is a guide to what’s vacant now, and when other posts will be available.

April 10 -

President Trump has been in office for nearly 12 weeks, but he still hasn’t nominated several critical positions among financial services regulators. Following is a guide to what’s vacant now, and when other posts will be available.

April 10 -

Elevate Credit in Fort Worth, Texas, debuted Thursday at half the price the company had been targeting. Investors may have been spooked by the possibility of rising losses.

April 6 -

The bill from three GOP senators would require Truth in Lending Act disclosures for so-called Property Assessed Clean Energy loans, which are currently exempt from the law.

April 6 -

Digital lenders have been partnering with banks to get around state-by-state usury caps, but that approach is facing tougher scrutiny.

April 5 -

The publication won the Neal award for best news coverage and Washington Bureau Chief Rob Blackwell received the prestigious Timothy White award for editorial leadership.

April 5 -

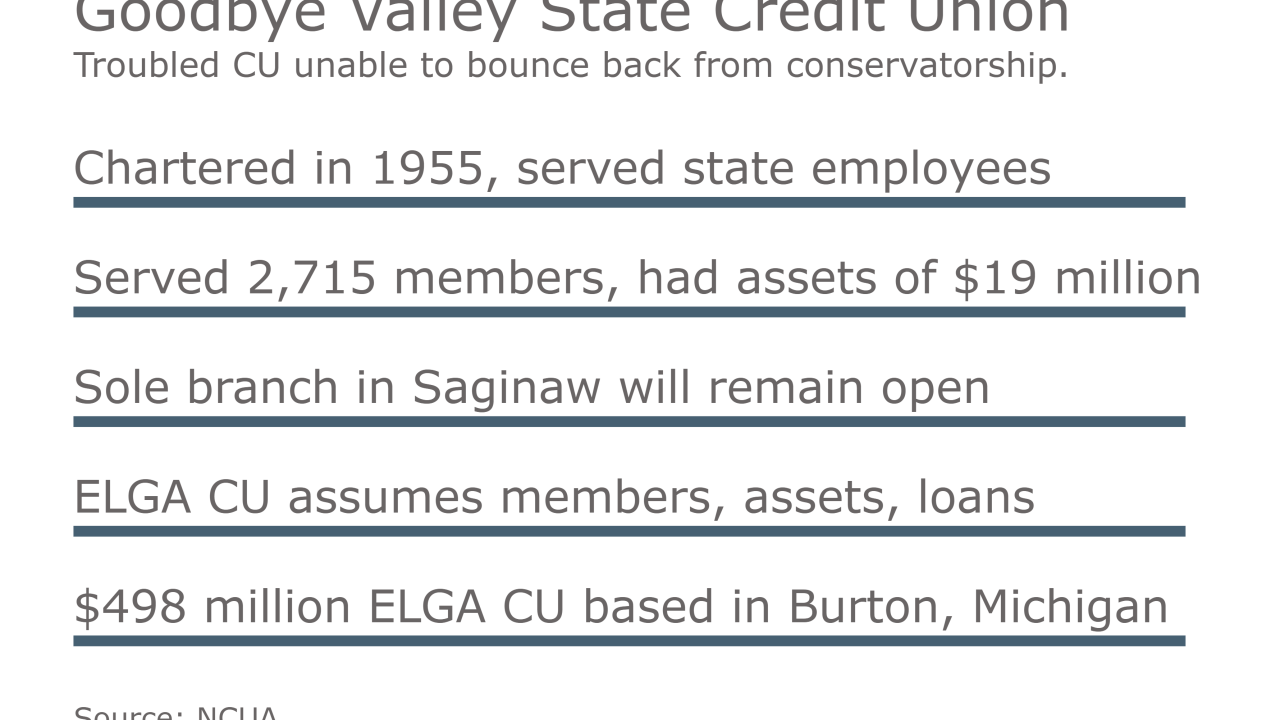

The $19 million CU entered into conservatorship in August 2016

April 3 -

The report in the New York Post alleges that the bank violated anti-money-laundering laws by filing incorrect call reports to hide loans made to foreign nationals.

March 31 -

Low scores make it harder for banks to get regulatory OKs to expand, but Wells is in retrenchment mode anyway.

March 29 -

The Federal Housing Finance Agency is facing criticism from bankers and credit unions over its planned pilot program to allow Fannie Mae and Freddie Mac to securitize manufactured housing loans.

March 28 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

March 24 -

Bankers and housing advocates say many low-income housing projects simply won't get built if the White House and Congress move to eliminate two federal block grant programs.

March 15 -

Better access to credit, an improving revenue picture and promises of regulatory relief are bolstering the confidence of small-business owners.

March 13 -

A database that identifies wrongdoers could prevent banks from making bad hiring decisions, but can it ensure that former employees' rights are adequately protected?

March 10 -

The debt is costing taxpayers $4 billion a year, but rather than forgive it Republicans remain focused on creating a private flood insurance market.

March 9