-

The bank said it plans to use proceeds from the placement to expand its operations.

January 30 -

Burned by a 2007 deal in Florida, Park National in Ohio had several years to reflect on lessons learned before agreeing to buy NewDominion Bank in Charlotte, N.C.

January 24 -

Much like small businesses, small banks can't take on huge IT projects and rely more on targeted deployments to build a user base for future technology.

January 24 -

NewDominion, which has completed an improbable turnaround, is the last community bank based in Charlotte, N.C.

January 23 -

Highlights at the North Carolina bank included deposit service charges, CRE lending and wider margins, which all offset one-time costs related to tax reform.

January 18 -

The company, which bought BNC Bancorp to enter North Carolina last year, recorded $19.1 million in merger-related expenses and an $8.3 million pretax loss tied to investment securities.

January 16 -

If Congress doesn’t take the lead on protecting consumers from data breaches, states are more than ready to offer their own fixes. Bankers will also be keeping close tabs on bills related to marijuana, PACE loans and elder financial abuse.

January 11 -

NewDominion Bank and M&F Bank are among the institutions willing to leave the industry's comfort zone to reach younger prospects.

January 11 -

Banks, especially smaller institutions, will be forced to find more ways to differentiate, Bryan Jordan said in an interview that also covered his company's recent purchase of Capital Bank and how tax reform will immediately stimulate the economy.

January 4 -

The planned purchase of Home BanCorp will nearly double the size of First Citizens' branch network in the Sunshine State.

December 18 -

The Tennessee company also set high expectations for revenue opportunities while projecting it will deliver a 15% return on equity in 2019.

December 5 -

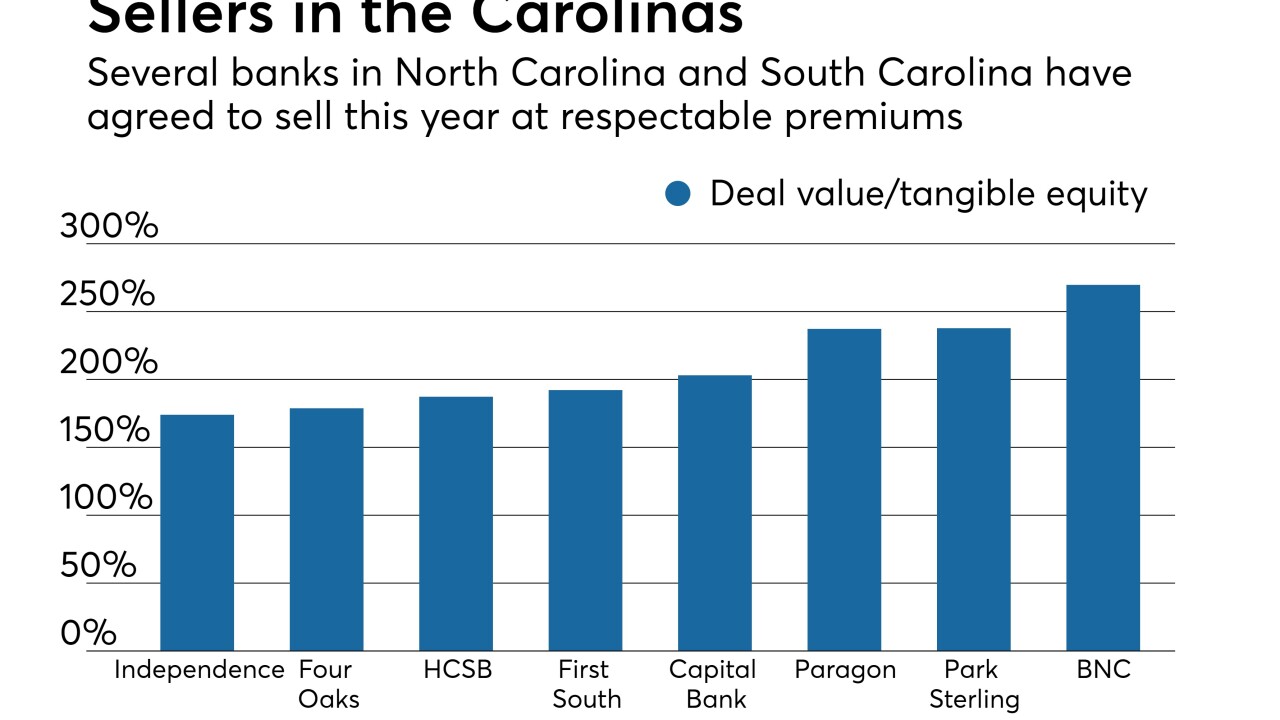

First Reliance in South Carolina, which recently announced its first bank acquisition, is angling to take advantage of disruption caused by bigger mergers in the Carolinas.

October 19 -

The company, which agreed to buy Independence Bancshares, also brought in $25 million by selling common and preferred stock.

September 26 -

Coastal FCU CEO Chuck Purvis was recognized this year by the Credit Union Executives Society for his commitment to the movement

September 21 -

The new business will advise Live Oak clients on how to structure and finance acquisitions.

September 20 -

Lynn Harton was finally named CEO of United Community Bank after a five-year apprenticeship, though Jimmy Tallent remains CEO of the parent company. The executives have long touted an ability to bounce ideas off each other as a reason for United's success.

August 17 -

The Pittsburgh company, pleased with employee and client retention from its March purchase of Yadkin Financial, is looking to hire lenders from other institutions.

July 20 -

KS Bancorp initially chided First Citizens for its aggressive moves before deciding to mull the offer over.

July 19 -

The Tennessee company reported higher profit that reflected its June purchase of BNC Bancorp and nearly $670 million of organic loan growth during the second quarter.

July 19 -

Buying Capital Bank puts the company on a fast track for more regulatory scrutiny. Executives are identifying ways to boost revenue and taking other measures so it can handle the change.

July 14