-

The once confrontational relationship between fintech and traditional banking has clearly changed as both sides are finding ways to work together.

September 14 -

A long-term discussion about rethinking rules of the credit market is worth having, but for right now Congress should restore clarity by correcting the Second Circuit’s mistake.

September 14 Mercatus Center at George Mason University

Mercatus Center at George Mason University -

Mike Cagney’s eventual successor will have to decide whether to continue his focus on rapid growth. Also on the table are strategic decisions about when to go public and whether to pursue a bank charter.

September 12 -

The chief executive officer of Social Finance is stepping down before the end of the year amid sexual harassment accusations leveled at one of the most valuable financial technology startups.

September 12 -

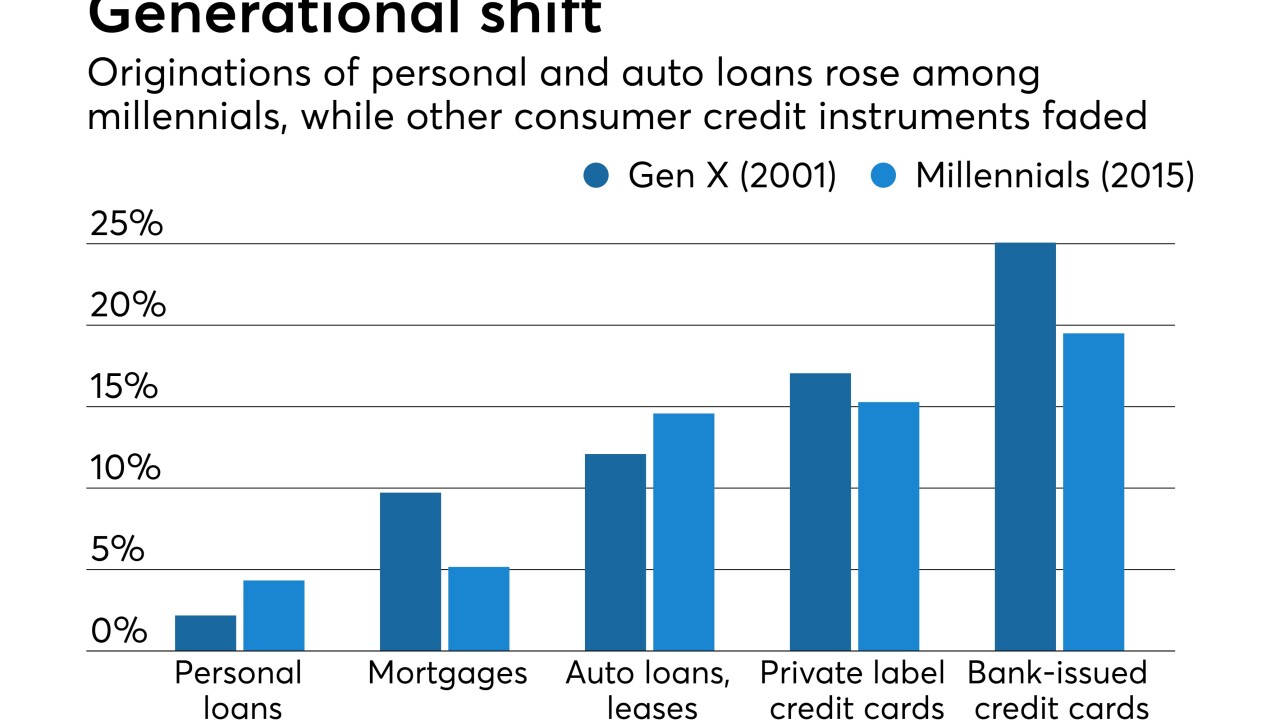

Millennials — many of whom joined credit unions in recent years as the movement's membership expanded — are relying more heavily on personal loans than their Gen X predecessors while paring back on credit cards and mortgages.

September 11 -

It’s highly debatable whether the artificial intelligence engines that online lenders typically use, and that banks are just starting to deploy, are capable of making credit decisions without inadvertent prejudices.

September 7 -

The Wall Street giant on Wednesday played up its customer service skills, saying that representatives of its Marcus personal-loan unit answer calls within 10 seconds.

September 6 -

Snap Finance provides credit at the point of sale, primarily to consumers with bad credit.

September 5 -

Sure, personal loans have a long way to go to catch up in market share with other forms of consumer credit, but millennials are relying more heavily on them than their Gen X predecessors while paring back on credit cards and mortgages. Online lenders are a big reason, and banks are exploring ways to adjust to changing habits.

August 30 -

The startup, which offered credit lines of up to $1,000, hoped to tap into the millennial generation's frustration with overdraft fees.

August 29 -

The $2.6 trillion-asset bank's recent commitment to digital lending augurs the development of a two-tier market for borrowers who want fast access to cash.

August 11 -

In a move to strengthen the PayPal Working Capital program, the online payments giant has agreed to acquire the small-business capital lender Swift Financial.

August 10 -

The largest banks are approving small-business loan applications at the fastest rate since the recession, a sign that that they are willing to assume more risk and taking seriously the threat of competition from online lenders.

August 9 -

Heather Tuason is now chief product officer of StreetShares, an online lending and investing platform.

August 9 -

Young businesses often prefer banks, especially community banks, over online lenders. However, traditional lenders need to make quicker decisions, simplify the application process and make other improvements, these customers say.

August 8 -

The online consumer lender reported a net loss of $25.4 million, bringing its red ink in the five most recent quarterly reports to more than $200 million.

August 7 -

The online lender said it is on track to hit its goal of becoming profitable by yearend. It also extended a partnership agreement with JPMorgan Chase.

August 7 -

It is the latest of several popular apps to close down in recent weeks.

August 4 -

The app, formerly known as BillGuard and a favorite of many fintech insiders, helped users protect their identities and monitor their credit scores.

July 31 -

The Riverwoods, Ill., company is trying to assure Wall Street that its higher chargeoff rates signal a return to normalcy, rather than a cause for alarm.

July 27