-

How most banks obtain deposits has changed radically over the past 30 years, thanks in part to innovation. It is time for regulators to rethink their notion of what constitutes a quality deposit portfolio.

September 27 MainStreet Bank

MainStreet Bank -

In a July order, the FDIC fined a former Oklahoma banker $125,000 and banned him from banking, prompting questions by Rep. Elijah Cummings, D-Md., over whether he is fit to serve as a top adviser at the EPA.

September 21 -

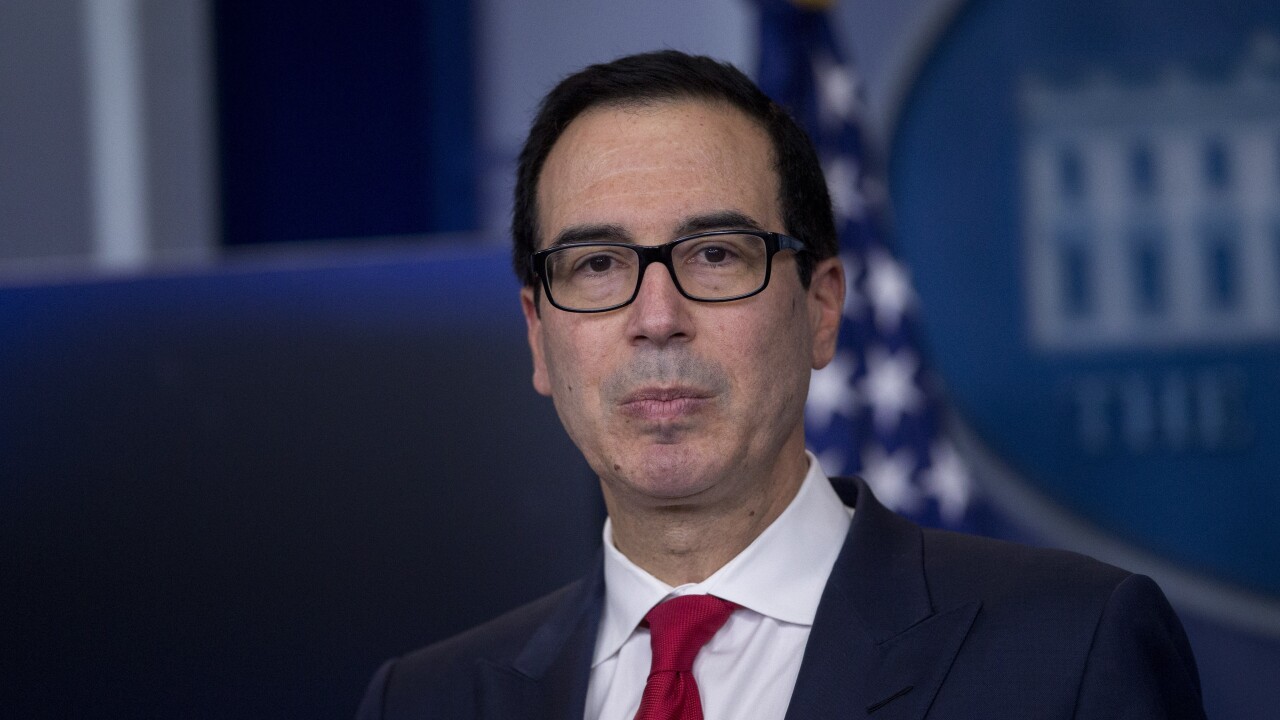

The Trump administration is prepping recommendations to address shortcomings in the capital markets in a report to be released next month, a top Treasury Department official said Monday.

September 18 -

The House passed an appropriations bill that on the surface advanced key regulatory relief provisions sought by banks, but it could also open the door to higher examination fees, particularly for state-chartered banks.

September 15 -

David Dotherow, CEO of the newly formed Winter Park National Bank, stresses the need for strong management and a straightforward business plan when applying for a charter.

September 15 -

The Independent Community Bankers of America had initially called for a moratorium in response to SoFi's application, and says now that Square's bid "has significantly increased our concerns."

September 15 -

Few lawmakers have stated positions on fintech applications for industrial loan company charters. It may not stay that way.

September 13 -

Square became the third fintech firm in recent months to seek out a bank charter. Others are likely to follow.

September 11 -

Revenue from overdrafts keeps rising, according to new FDIC data, even though the controversial product still has a bull’s-eye on its back. Clearer disclosures and higher consumer confidence are the big reasons.

September 8 -

The company's application, which is expected to be announced as early as Thursday, comes after the online lender SoFi applied in June for an industrial loan charter. The bank is expected to be led by a former Green Dot executive.

September 6 -

The Office of the Comptroller of the Currency and Federal Deposit Insurance Corp. have signed off on an abbreviation of the settlement cycle for securities to two days from three days.

September 1 -

The rule limiting the largest U.S. banks’ ability to enter into contracts with early termination clauses is intended to forestall a liquidity crunch if the bank is under stress.

September 1 -

Bank undercounted fake accounts and says it also opened more than 500,000 bill-pay accounts; CFPB director provides “no further insights” on his future.

September 1 -

The Federal Reserve’s plan to stop a bank bailout before it starts hasn’t been taken up more than five years since it was proposed.

August 31 -

The 3-year-old order was related to Discover Bank’s programs for combating money laundering. A related agreement with the Federal Reserve Bank of Chicago remains in effect.

August 30 -

Acting Comptroller of the Currency Keith Noreika is questioning the sincerity of recent steps by the FDIC to encourage de novo applications.

August 25 -

The idea that the trading ban burdens community banks and prevents them from investing in fintech opportunities is misleading.

August 24 -

In anticipation of future changes, bank regulators will allow all but the largest banks to avoid a planned phase-in of 2013 capital rules.

August 23 -

The banking industry had mostly good news in the FDIC's Quarterly Banking Profile, with higher profits helped by interest income. But there were worrying signs too, including a big jump in credit card chargeoffs.

August 22 -

Higher net interest income and modest growth in expenses helped boost bank earnings by 10.7%, the FDIC said in its Quarterly Banking Profile.

August 22