JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4 trillion in assets. It is organized into four major segmentsconsumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management.

-

Equifax's data breach may be the most serious, given that it covered 143 million consumers and involved reams of confidential information, but it wasn't the largest. Following are the biggest to date.

September 20 -

JPMorgan Chase is partnering with another fast-growing technology firm, this time to help business clients eradicate paper checks.

September 19 -

TSYS has expanded its relationships with ISOs or entered into joint ventures with companies such as super ISO Central Payment. TSYS has been gradually increasing its stakeholder share in Central Payment as part of the collaboration.

September 19 -

Marbue Brown will oversee customer experience in Chase’s branch network, call centers and digital and mobile platforms.

September 18 -

Agency confirms it’s investigating the credit bureau; regulator gives green light to Upstart Network to use cellphone payments, etc., to underwrite loans.

September 15 -

Bankers in Florida and Texas are dusting off their disaster-recovery playbooks, which focus on retrieving customers' valuables, ensuring employee safety and minimizing the bank's own legal exposure.

September 14 -

More than 100 suits have been filed since the company revealed the massive data breach last week; price of digital currency is down 25% since hitting a record high a week ago.

September 14 -

JPMorgan Chase CEO Jamie Dimon predicted Tuesday that the market for bitcoin is on the verge of crashing, saying it was even worse than the infamous Dutch Tulip bubble.

September 12 -

Serving on multiple boards while holding full-time executive positions weakens a director’s ability to fulfill the governance demands at complex institutions.

September 8 -

Credit bureau says records of 143 million consumers were compromised; state agency penalizes Habib Bank for enabling terror financing.

September 8 -

Company is third fintech firm in the past few months to seek its own bank charter; vice chair’s departure gives Trump four vacancies to fill on the Federal Reserve Board.

September 7 -

JPMorgan Chase and Bank of America were among those institutions speaking out about President Trump's plan to terminate legal protections for young, undocumented immigrants who arrived in the country as children.

September 5 -

PayPal is among the top non-bank financial brands, though that may soon change as other challengers gain ground, writes Hannu Verkasalo, founder and CEO of Verto Analytics.

September 1 -

Financial institutions increasingly depend on large tech companies such as Google and Apple for infrastructure, said the group that runs the World Economic Forum, stopping well short of recommending regulatory changes.

August 22 -

The money will be split between the Southern Poverty Law Center and the Anti-Defamation League.

August 21 -

A Fed committee studying Libor’s replacement has dwelled heavily on the potential impact to the derivatives market. Loans may become a bigger part of the conversation later this year, but the panel plans to leave a lot of the specifics up to lenders.

August 17 -

Credit card issuers have been trying to outdo each other to offer the best rewards program. And it shows, as customer satisfaction rates with many (but not all) of their banks have never been higher in a yearly J.D. Power study. But they may not last forever.

August 17 -

The CEO of JPMorgan Chase served on President Trump's strategic and policy forum, one of two councils that are now being dissolved, and had drawn criticism for sticking with it.

August 16 -

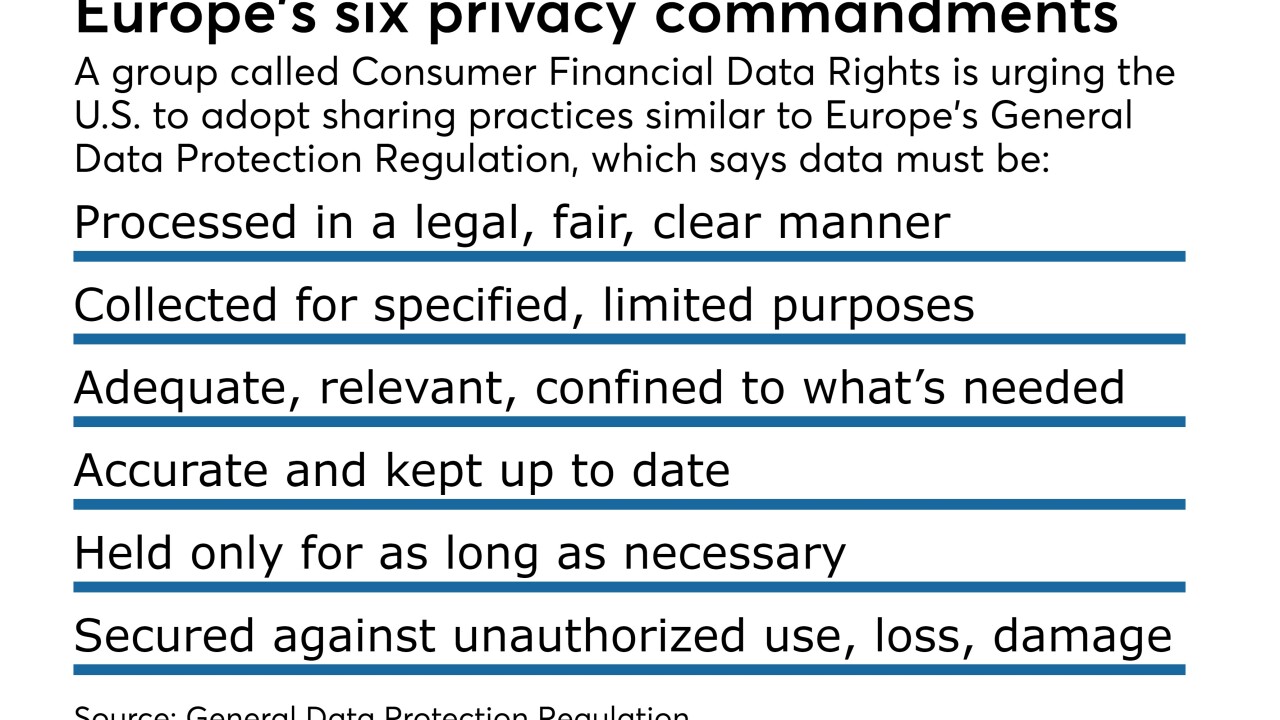

The Consumer Financial Data Rights group, representing aggregators and fintechs, says banks still aren’t forking over enough customer data. The group is meeting with bank regulators and trying to get consumers to petition regulators on its behalf.

August 15 -

JPMorgan Chase Chief Executive Jamie Dimon joined U.S. corporate leaders in denouncing racial intolerance as the pressure heats up on them to challenge President Trump on social and other policy matters. However, Dimon remains on a key presidential advisory group.

August 15