-

Some financial institutions are looking at how to translate the complicated and document-heavy mortgage lending process into the digital world of voice-interactive personal assistants.

October 4 -

Some banks are looking at how to translate the complicated and document-heavy mortgage lending process into the digital world of voice-interactive personal assistants.

October 4 -

Kate Quinn has raised U.S. Bancorp's profile by emphasizing culture above all else.

October 3 -

Tim Welsh has spent his first two months on the job thinking about how to make U.S. Bank as central to consumers’ lives as Amazon, develop new personal financial management services, and expand into new cities.

September 29 -

The first-of-its-kind study was an acknowledgment that as consumers rely more on digital banking channels, the nation's largest banks are competing more against each other and less against smaller institutions.

September 28 -

Once a regional operation, U.S. Bank's corporate banking unit has grown into a national powerhouse under Leslie Godridge.

September 25 - Banking brands

When Andy Cecere took over as CEO of U.S. Bancorp in April, one of his first orders of business was to promote Kate Quinn to vice chairman and chief administrative officer.

September 25 -

Flush with cash, many commercial firms are also opting to pay down debt rather than take on new loans, and those seeking financing aren’t always turning to banks to meet their needs.

September 15 -

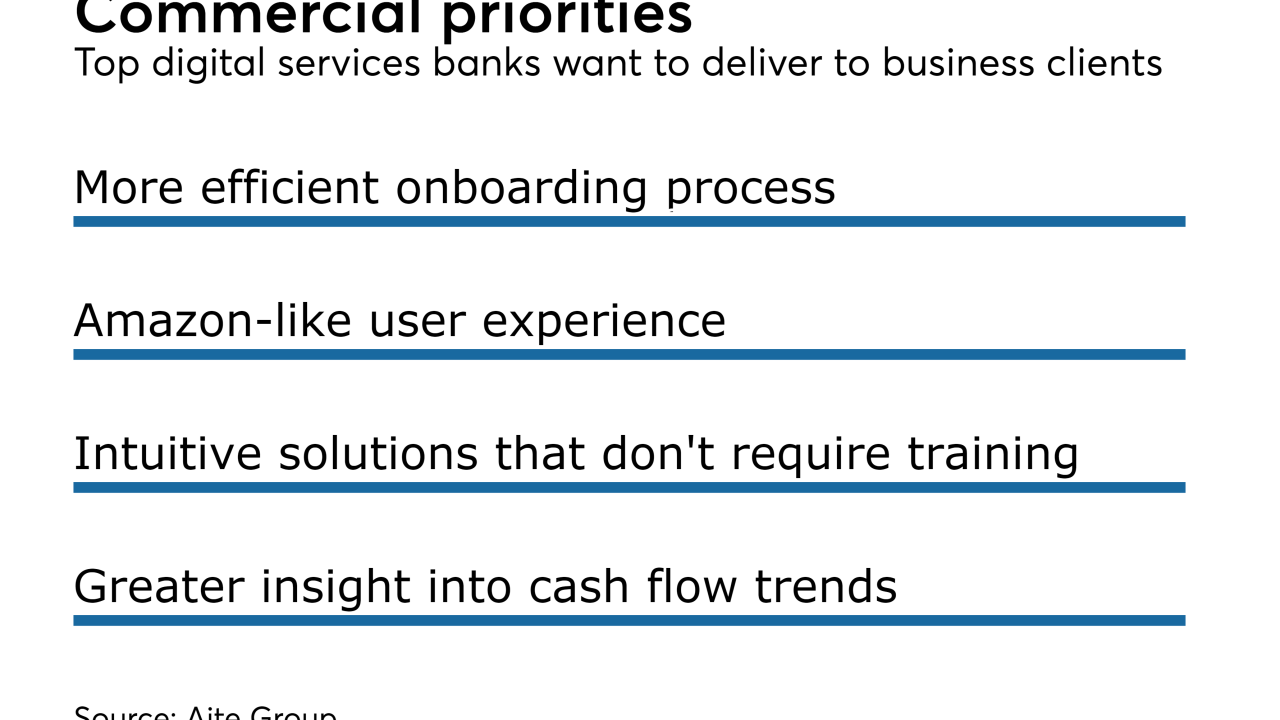

Systems that run cash management services were built decades ago and prioritized functionality over user experience. That is starting to change as banks invest more heavily in digital upgrades geared toward commercial customers.

September 13 -

Bank earnings rose nearly 11% in the second quarter, according to the FDIC; Goldman lobbying to kill or weaken the rule to boost its bond trading performance.

August 23 -

Six states and D.C. still charge in-network fees when unemployed workers cash in assistance delivered through prepaid cards.

August 2 -

U.S. Bank has begun using Einstein, Salesforce’s AI software, to give front-line staff insights into customer activity and recommendations. Other banks are likely to add similar tools.

July 20 -

Revenue growth in its merchant payments business is expected to be tepid in the foreseeable future. The Minneapolis company says it is looking to ramp up innovation to stay competitive in a business that has been upended by fintech firms and online shopping.

July 19 -

Declines in commercial products and mortgage banking fees at the Minneapolis company offset some of the benefits of higher interest rates.

July 19 -

Banks are making it easier to log in, adding expense trackers and simplifying payments as they try to get corporate clients to use mobile more.

June 26 -

The following are some of the noteworthy things we heard at American Banker’s Digital Banking 2017 conference held earlier this month in Austin, Texas.

June 26 -

Tim Welsh will succeed Kent Stone, who is retiring. In his new role, Welsh will oversee the bank’s overall consumer and small-business strategy, as well as digital activities.

June 19 -

The most innovative projects shared at Digital Banking 2017 involve embedding banking in popular devices and apps like Facebook Messenger and Amazon Echo.

June 15 -

An aggressive band of community, regional and investment banks is stepping into the commercial real estate void left by more cautious lenders, saying there are still good CRE loans to be made or bought.

June 2 -

The acquirer of the failed Milwaukee bank passed on assuming control of 107 in-store locations, but drawing a sweeping conclusion about the state of in-store banking from one story is difficult.

May 31