A regional view of bank M&A

Overall, the total number of bank mergers increased by roughly 6% from a year earlier, to 256, according to data compiled by Keefe, Bruyette & Woods and S&P Global Market Intelligence. The total value of those transactions rose more than 3%, to $26.2 billion, based on deals where pricing was disclosed.

Much of the merger activity between banks took place early in the year after the 2016 presidential election triggered a remarkable surge in stock prices. Banks such as Sterling Bancorp, Pinnacle Financial Partners and Iberiabank announced large deals in the first quarter; all of the year's 10 biggest deals were inked by late July.

Some parts of the country clearly had more consolidation than others. For instance, deals announced across the Southeast accounted for nearly half of the industry's total volume in 2017. The region was also home to seven of the year's 10 biggest bank mergers. The Midwest, meanwhile, had the most deals, though many of them involved smaller institutions.

For those curious about 2018 so far, activity has been relatively slow with just 48 deals announced and none with a value above $1 billion. The Midwest has accounted for more than half of the year’s bank mergers, while the Southeast still has a commanding lead in terms of volume.

Here is a look at the regional trends in bank M&A for 2017.

CORRECTION: An earlier version of this slideshow misstated the name and headquarters city of the bank that Columbia Banking System agreed to buy early last year. It was Pacific Continental in Eugene, Ore.

High-volume region

Sellers tended to be rather large, averaging $910 million in assets.

Much of the consolidation was due to

Three of 2017's five biggest bank deals by price — First Horizon's

Busy year in the Midwest

Those transactions had an average price to tangible equity of 160.9%.

The region is home to states such as Kansas and Nebraska that have a large number of small, privately held institutions — the average seller only has $339 million in assets. That translates into more potential sellers.

Still, the year's fifth-biggest deal took place in the Midwest when First Financial Bancorp in Cincinnati

Home of the biggest deal

The five-state region had 28 bank deals totaling $3.9 billion, with a 145.3% average price to tangible equity. The average seller had $956 million in assets, though the numbers were skewed by the sale of the $14 billion-asset Astoria.

Another notable deal announced in the region was OceanFirst Financial's

California leads the West

The region's biggest deal took place in California, where PacWest Bancorp

The West was also where one of the year's priciest deals took place. Columbia Banking System agreed early in the year to buy Pacific Continental in Eugene, Ore., for more than $600 million — a price that valued the seller at more than 300% of its tangible equity.

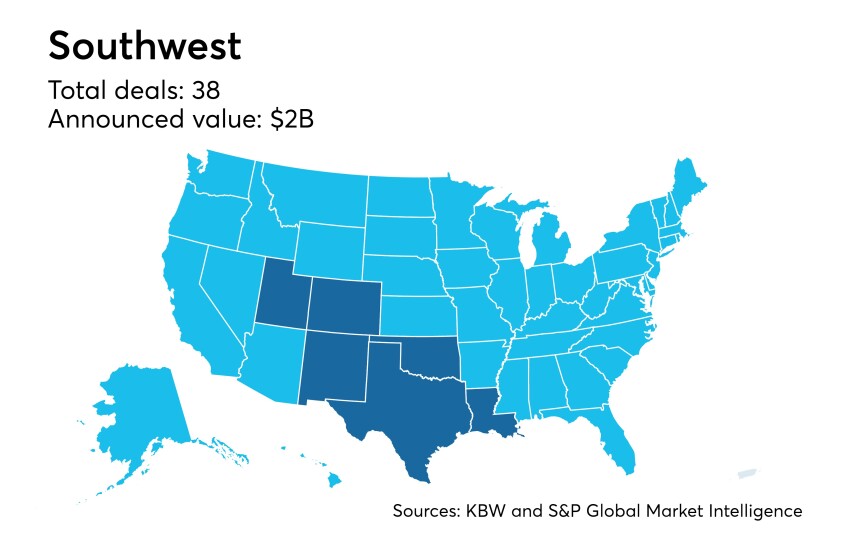

Highest premiums in the Southwest

The average deal in the Southwest priced sellers at 183% of tangible equity. That was the highest regional mean even though the average seller only had $337 million in assets.

While concerns over oil prices, along with Hurricane Harvey, briefly slowed the pace of consolidation in Texas, the state has still seen a fair share of activity. In Houston, for example,

Small region has fewest mergers

Those transactions had an average price to tangible equity of 150.4%. The average seller had $398 million in assets.

Berkshire Hills Bancorp's