-

Investigation will include possible insider trading by company executives; “broad clampdown” on buying and selling digital currency.

September 19 -

The chief information officer and top security officer are retiring in the wake of the massive data hack; Mike Cagney is leaving the student loan lender.

September 18 -

Agency confirms it’s investigating the credit bureau; regulator gives green light to Upstart Network to use cellphone payments, etc., to underwrite loans.

September 15 -

More than 100 suits have been filed since the company revealed the massive data breach last week; price of digital currency is down 25% since hitting a record high a week ago.

September 14 -

The cryptocurrency has been declared dead more times than Rasputin, yet it keeps going higher.

September 13 -

Lenders aren’t happy with the way the credit bureau has responded to the data breach; JPM chief calls digital currency “a fraud.”

September 13 -

JPMorgan Chase CEO Jamie Dimon predicted Tuesday that the market for bitcoin is on the verge of crashing, saying it was even worse than the infamous Dutch Tulip bubble.

September 12 -

China plans to ban trading of bitcoin and other virtual currencies on domestic exchanges, dealing another blow to the $150 billion cryptocurrency market after the country outlawed initial coin offerings last week.

September 11 -

The FBI and at least two states are looking into the data breach; Harvey shut lots of banks, but mobile banking apps keep customers operating.

September 11 -

The legislation introduced by Reps. Jared Polis, D-Colo., and David Schweikert, R-Ariz., would allow cryptocurrency users to make transactions of up to $600 without paying taxes.

September 7 -

The existing state laws create a gray area for bitcoin-related businesses, according to Rob Viglione of ZenCash and Scott Nelson of Sweetbridge.

September 6 ZenCash

ZenCash -

CFPB director gives political speech but avoids saying if he will run for governor in Ohio; Treasury is looking into getting rid of the "too big to fail" label.

September 5 -

CFPB and OCC are looking at auto lenders’ policies regarding so-called GAP insurance; banks want greater collateral from retailers.

August 29 -

Fed chair says post-crisis financial reforms have strengthened the banking system and the economy; consumers again comfortable borrowing against their home equity.

August 28 -

Society has accepted central banks’ monopoly over creating and controlling the flow of money, but history and current technological innovations point to alternative approaches.

August 25

-

Alternative currency investments are volatile. Another way to look at the market's sustainability is the willingness of participants to stick with this new mode of payments, writes Mariam Nishanian, a representative for Dentacoin, a virtual currency for the dental industry.

August 24 Dentacoin

Dentacoin -

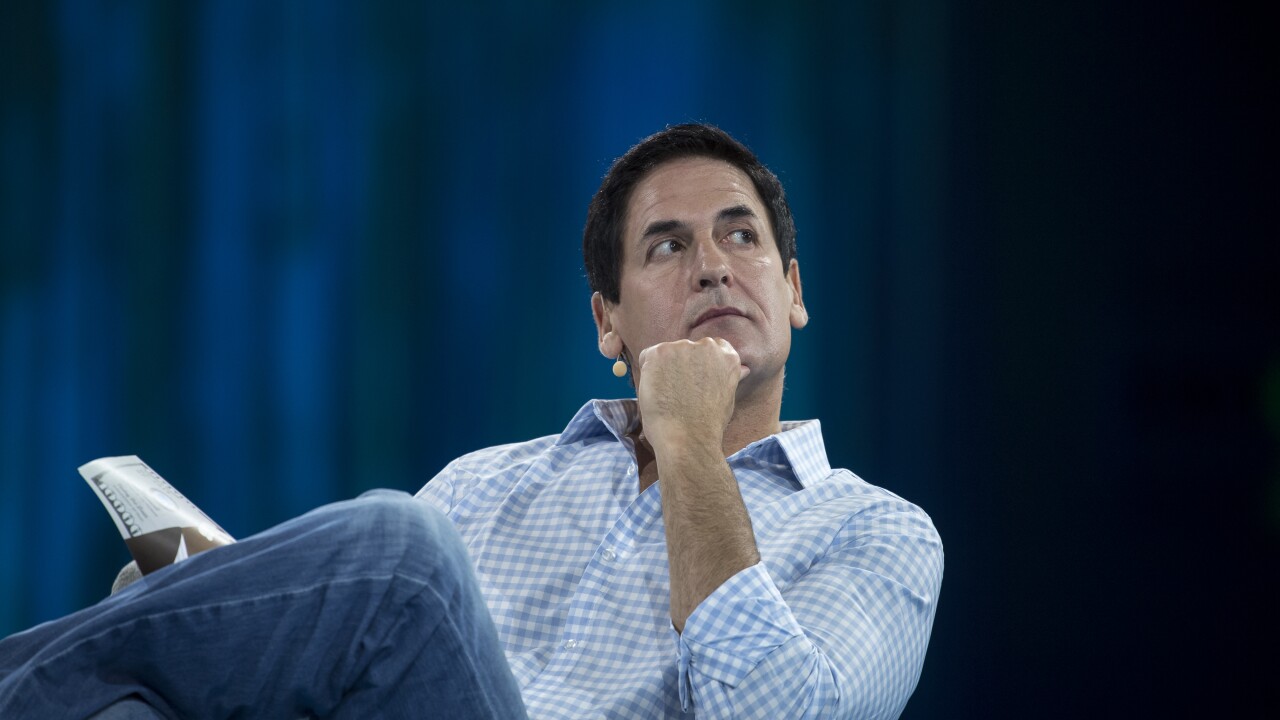

Mark Cuban wants in on the cryptocurrency boom even if it turns out he’s right that bitcoin is in a bubble.

August 22 -

Where existing money and payment systems are wanting, mutually consenting adults are resourceful in finding ways to transact, notwithstanding government restrictions.

August 22

-

Prodigy Finance, a London-based graduate student lender, gets $240 million in new funding round; Bitcoin Cash value soars.

August 21 -

The simple act of moving money can have a big impact on any political movement, so banks and payment networks are often caught up in issues of national importance. Here are some recent instances where payments and politics came head-to-head.

August 18