-

Points about various exam and regulatory credit union issues were raised

September 29 -

Putting faith in its team of experts analyzing every loan application, the Arkansas bank is shrugging off warnings of a real estate downturn.

September 28 -

It’s not just consumers who are worried about identity theft. For the millions of business owners who rely on their personal credit to finance operations, damage to credit scores could have dire consequences.

September 27 -

The identity theft threat created by the Equifax hack and the growth of online lending have given software makers a platform to pitch products that rely on selfies, scans of driver’s licenses and other nontraditional ID methods.

September 27 -

Acting Comptroller of the Currency Keith Noreika on Monday gave a ringing endorsement to online lenders seeking to expand into banking, suggesting they should consider taking deposits and seek out national bank charters as they mature.

September 25 -

Diana Reid's real estate unit accounts for roughly one-third of PNC’s annual revenue.

September 25 -

A "transformational" capital raise led by CEO Mary Ann Scully set the stage for Howard Bank's largest-ever acquisition.

September 25 -

A pay hike for front-line employees is one example of how Karen Larrimer has shaken up the status quo in PNC’s retail banking division.

September 25 -

Barb Godin is one of two women on the 15-member operating committee at Regions Financial.

September 25 -

Bita Ardalan has been promoted four times over the past five years, most recently in 2015 when she was named head of commercial banking.

September 25 -

Once a regional operation, U.S. Bank's corporate banking unit has grown into a national powerhouse under Leslie Godridge.

September 25 -

Janet Garufis has spent of the past year working to ease the regulatory burden on community banks.

September 25 -

Under Michelle Di Gangi, small and midsize business lending has become a significant driver of profits at Bank of the West.

September 25 -

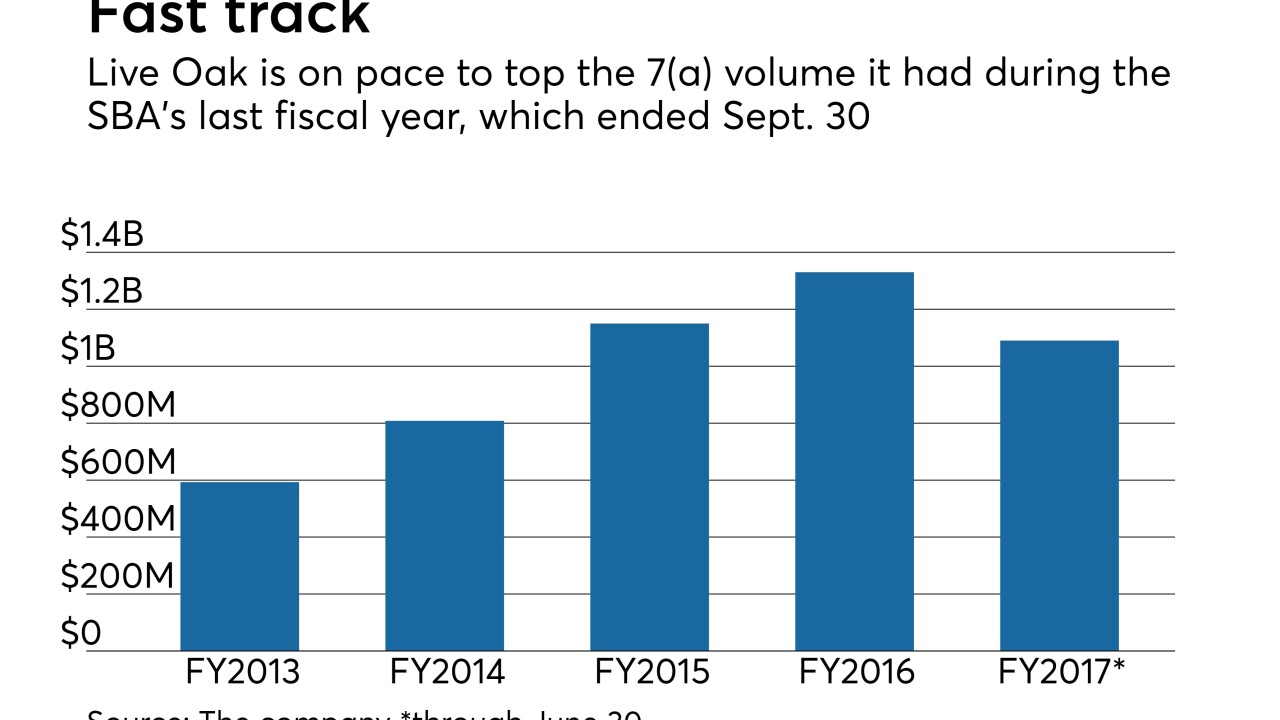

Live Oak Bancshares is used to finding ways to make small-business loans, but its new M&A operation was formed after two bankers pitched the plan to Live Oak's management.

September 22 -

Why Square says banks have nothing to fear in its bid for an ILC charter and IEX's Sara Furber explains why you should not fear the big jobs. Plus, workplaces women like and Lena Waithe on using your superpowers.

September 21

-

The agency and the National Association of Federally-Insured Credit Unions plan to boost efforts to get more credit unions involved with SBA lending.

September 20 -

China’s crackdown on cryptocurrency exchanges raises questions about the future of digital asset innovation, a movement that some bankers view as a threat and others embrace as a boon to payments, P-to-P lending and other activities.

September 20 -

The new business will advise Live Oak clients on how to structure and finance acquisitions.

September 20 -

LendingPoint, which caters to borrowers with damaged credit records, believes that traditional credit scores are overly pessimistic about the likelihood that certain borrowers will repay.

September 20 -

The Oregon bank has expanded the role of its chief credit officer to include oversight of risk management.

September 20