-

A law firm hired by the New York Fed board concluded that Dudley’s error was "inadvertent," and that while it violated the reserve bank's own code of conduct, it did not violate federal statutes.

September 1 -

The exodus of chief executives from two of President Trump’s business advisory councils in the aftermath of the Charlottesville tragedy was a highly visible example of risk management and cultural principles in action.

August 17

-

The bank’s “reasonably possible” legal charges could surpass its reserves by $3.3 billion as of June 30, a Wells securities filing says.

August 4 -

Sen. Elizabeth Warren, D-Mass., sharply criticized the new acting head of the Office of the Comptroller of the Currency as part of a report Thursday detailing how industry executives and lobbyists have joined the Trump administration.

July 20 -

Wells Fargo's David Carroll, who had pay clawed back after the bank's fake-accounts scandal, will retire and be succeeded by Jonathan Weiss as wealth and investment management chief.

June 1 -

The rising regional player has also appointed new chairs for four board committees as it prepares for the retirement of several long-serving directors.

May 23 -

Greig, who orchestrated FirstMerit's sale to Huntington Bancshares, joined Opus' board last month.

May 3 -

While many shareholders are by now largely immune to the transgressions of the U.S. banking sector, Wells Fargo’s recent phony account scandal has given even the most hardened cynics pause.

April 21Sisters of St. Francis of Philadelphia -

The company appointed a representative of Stilwell Group to its board. Stilwell, meanwhile, agreed to back Delanco's board nominees and refrain from pushing for the company's sale.

April 12 -

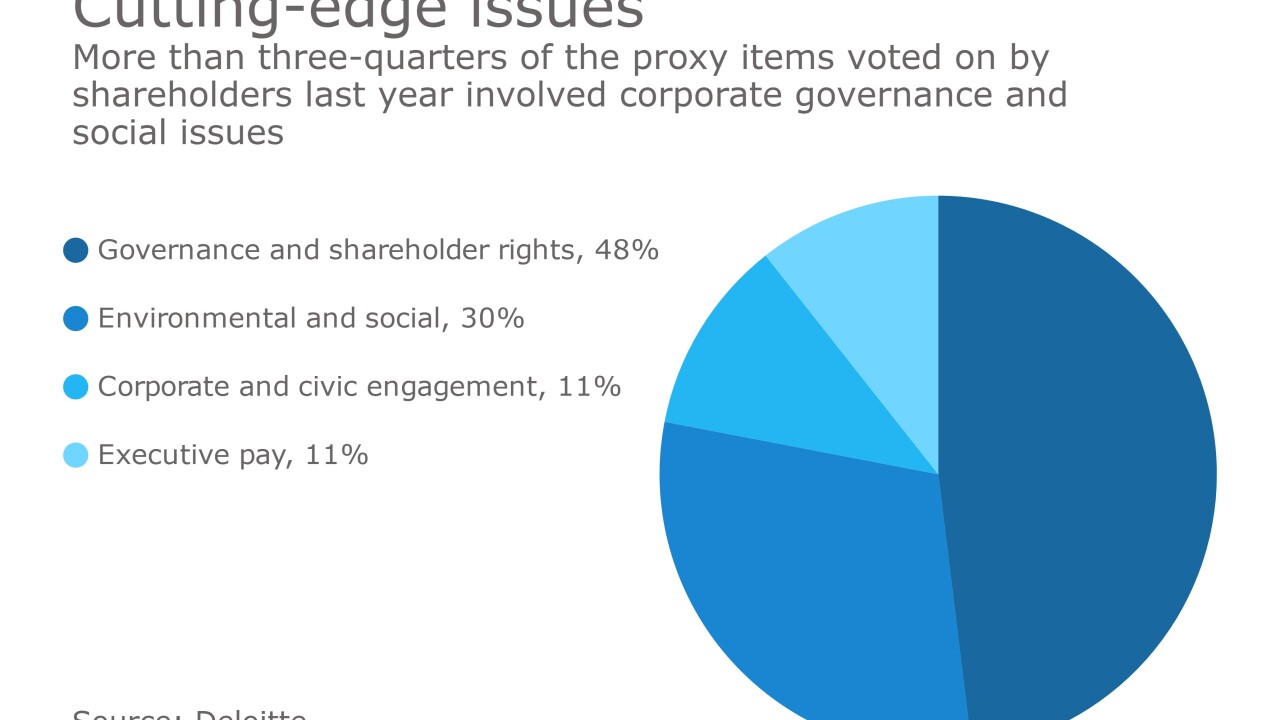

Investors concerned about the impact on banking of climate change, the pay gap and ethics matters are pushing back against a coalition of the heads of the biggest U.S. banks and other public companies that wants to limit small investors’ access to proxy ballots.

March 30 -

Proposals to split the chairman and CEO roles at banks have rarely succeeded. But new developments — including a proposal to require separate roles for the next generation of managers — are helping concerned shareholders slowly make inroads.

March 28 -

Banks like TD and U.S. Bancorp are suddenly taking public shots from current and former employees critical of their sales practices, a sign that the industry has not put behind it the questions raised months ago by the phony-accounts scandal at Wells.

March 17 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

March 17 -

A database that identifies wrongdoers could prevent banks from making bad hiring decisions, but can it ensure that former employees' rights are adequately protected?

March 10 -

The San Francisco bank also disclosed Wednesday that certain foreign banks that were using its software to conduct trade-related transactions in violation of U.S. sanctions.

March 1 -

Banks have maintained consumers' trust but must do better explaining to them what they signed up for, according to a J.D. Power survey.

March 1 -

The embattled bank said that the decision to withhold 2016 bonuses for CEO Tim Sloan and seven other executives was not based on any findings of improper behavior.

March 1 -

Alex Acosta played an instrumental role helping the bank raise capital and emerge from a 2011 regulatory order.

February 16