-

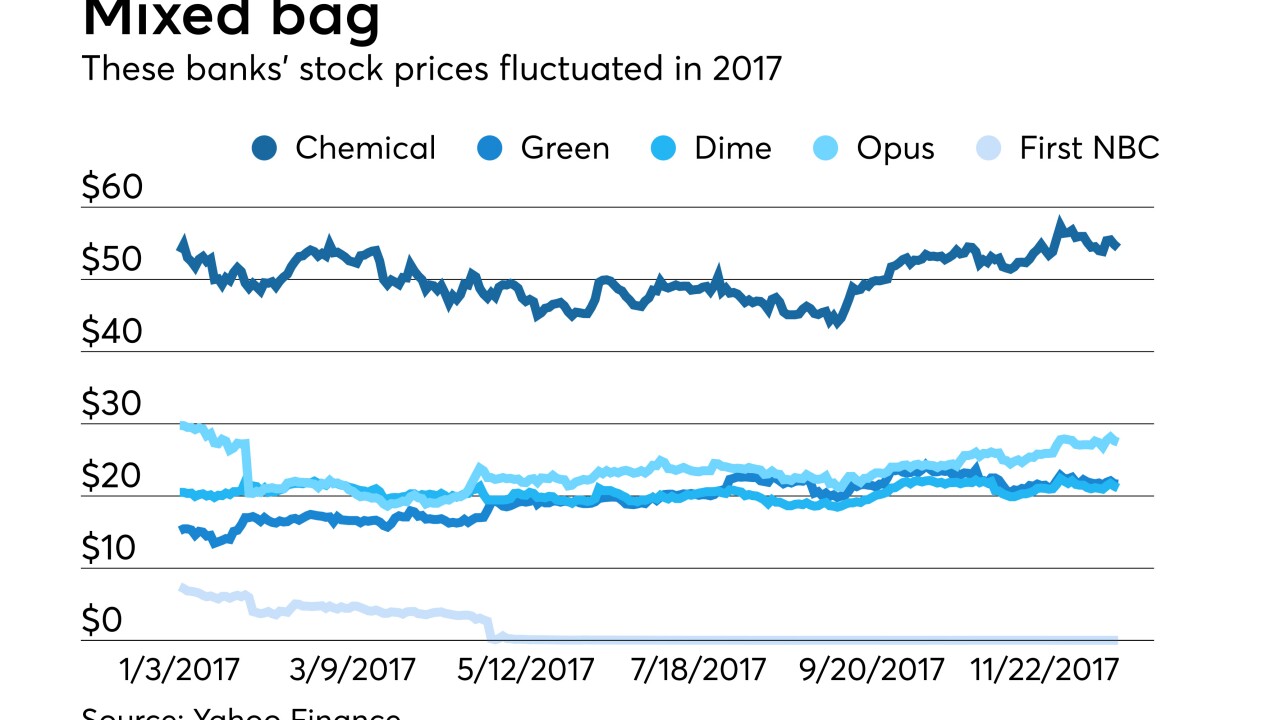

We never promised the news would be good for all these community bankers, and it wasn’t. One couldn’t stop a failure, and another quit soon after an acquisition. The rest have their banks at different points on the comeback trail.

December 22 -

Readers sound off on Mick Mulvaney’s plan to hire political appointees at the Consumer Financial Protection Bureau, question what’s behind the failure of Washington Federal Bank for Savings in Chicago, react to an argument that Equifax must endure, and more.

December 21 -

Washington Federal in Chicago, which had a clean balance sheet and plenty of capital on Sept. 30, was shuttered shortly after the death of its CEO and regulators' discovery of "substantial dissipation of assets."

December 18 -

For the first time in nearly nine years, an acquirer of a failed bank agreed to purchase only the institution’s insured deposits, making it likely that some customers will not recoup all of their uninsured funds.

December 15 -

The Federal Deposit Insurance Corp. has forged a pact with the European Union-based entity that handles failed-bank cleanups to share information and collaborate on planning for cross-border resolutions.

December 14 -

Alabama-based CU had operated under conservatorship since June.

December 5 -

Palisades FCU will assume the New York City-based credit union’s members, shares and loans.

October 27 -

Farmers and Merchants State Bank of Argonia, Kan., was the seventh institution to fail this year.

October 13 -

A recent failed-bank resolution in Europe may serve as a harbinger of how new authorities could cause problems in the U.S. and highlights the potential need for a modified bankruptcy process.

September 20 House Subcommittee on Regulatory Reform, Commercial and Antitrust Law

House Subcommittee on Regulatory Reform, Commercial and Antitrust Law -

Banco Santander stepped in to take over stricken rival Banco Popular Espanol in a deal brokered by regulators that imposes billions of losses on investors.

June 7 -

The acquirer of the failed Milwaukee bank passed on assuming control of 107 in-store locations, but drawing a sweeping conclusion about the state of in-store banking from one story is difficult.

May 31

-

The bank is the second failure in Illinois so far in 2017. Seaway Bank was closed in late January.

May 26 -

Readers sound off on the use of AI in underwriting, the reasons for the failure of a Milwaukee bank, U.S. banks’ progress in adopting APIs, and more.

May 12 -

The acquirer of the failed Guaranty Bank took a pass on the latter’s 107 in-store branches, leading to their shutdown and a disruption in service for many low-income customers.

May 9 -

The top executives at Guaranty Bank said that, after years of struggles, the $1 billion-asset bank was a month or two away from raising the capital it needed to survive.

May 9 -

Guaranty Bank & Trust in Milwaukee was shut down by federal regulators Friday, just a week after one of the costliest failures since the crisis.

May 5 -

As Treasury Department officials review the Financial Stability Oversight Council’s designation process, they should also re-examine how the Dodd-Frank Act defines systemic risk.

May 5 American Enterprise Institute

American Enterprise Institute -

Entegra Financial disclosed that it held First NBC subordinated debt. An impairment charge tied to the bank's failure will lower Entegra's first-quarter profit by $441,000.

May 3 -

Christy Romero, the special inspector general for the Troubled Asset Relief Program, and two other government entities were involved in a probe that led Lamar Cox, former chief operating officer at Tennessee Commerce Bank, to plead guilty to misleading the FDIC.

April 25 -

The number of U.S. banks has fallen by 24% since the end of 2010, a result of mergers, failures and a dearth of de novo activity. Here are the 10 states with the biggest declines as a percentage of total banks headquartered in the state, according to Federal Deposit Insurance Corp. data.

April 13