-

The Florida bank started researching the business after Ken LaRoe, its chairman, saw how medical marijuana had helped his wife cope with a severe injury. First Green is now turning a profit on this business a year after adding its first pot-related client.

September 21 -

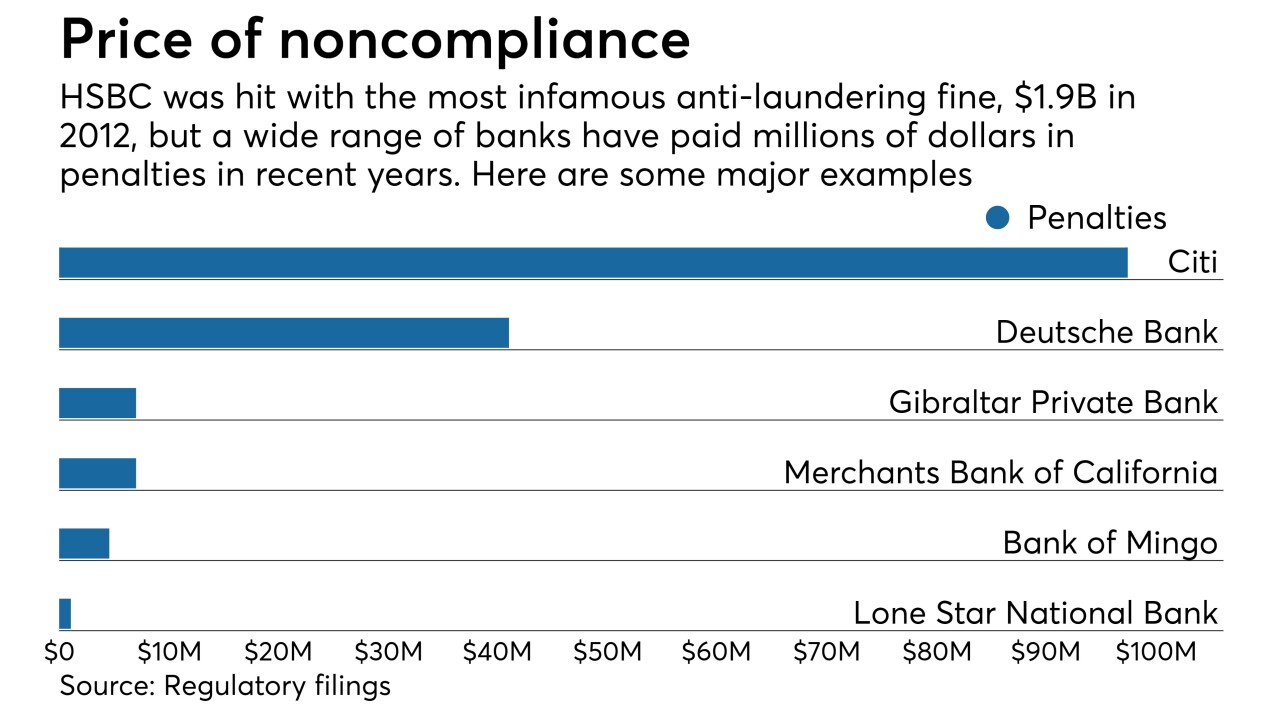

Unlike a visiting sports team, foreign banks can't just blame local referees they perceive as biased for penalties or fines.

September 21 IBM Global Business Services

IBM Global Business Services -

Armed heists are becoming less common, but the overall number of robbery attempts has ticked back up in recent years. The opioid epidemic is a likely reason, according to an industry expert.

September 19 -

By replacing human judgment with other identity technologies, higher levels of verification accuracy can be achieved in a fraction of the time, writes Romana Sachová, co-chair of the Security and Biometrics Workgroup at Mobey Forum.

September 14 Mobey Forum

Mobey Forum -

Credit bureau says records of 143 million consumers were compromised; state agency penalizes Habib Bank for enabling terror financing.

September 8 -

New York’s banking regulator ordered Habib Bank Ltd. to pay $225 million and surrender its license to operate in the state, effectively removing Pakistan’s largest lender from the U.S. financial system.

September 7 -

Husband and wife claim they were fired for raising concerns about the bank’s sales practices; commercial mortgage-backed securities on pace to top last year’s volume.

September 6 -

Nothing like revelations of a client’s Ponzi scheme that lead to your bank paying $4 million in anti-money-laundering fines. That’s what happened at Gibraltar Private Bank & Trust, but its CEO argues its compliance overhaul has given the bank a competitive advantage in cosmopolitan New York and South Florida.

September 5 -

The 3-year-old order was related to Discover Bank’s programs for combating money laundering. A related agreement with the Federal Reserve Bank of Chicago remains in effect.

August 30 -

A data-driven approach to money laundering prevention can help increase profits and improve regulatory compliance, writes Edmund Tribue, risk and regulatory practice leader at NTT Data Services.

August 30 NTT Data Consulting

NTT Data Consulting -

CFPB and OCC are looking at auto lenders’ policies regarding so-called GAP insurance; banks want greater collateral from retailers.

August 29 -

Wells Fargo CEO Tim Sloan has told employees that a third-party review of unauthorized accounts will be published “within a few weeks.”

August 23 -

Hackers are stealing enthusiasts’ phone numbers, then changing the passwords to clean out their financial accounts; bank makes pledge to human rights groups.

August 22 -

Payment processors and banks are being called on to cut off funds to white supremacist groups, but there are practical and legal limits to what firms can do.

August 17 -

Basel Institute says enforcement is the problem; wealth adviser says bank steered clients away from her to white colleagues and blocked her promotion.

August 17 -

The Commonwealth Bank of Australia money-laundering scandal has damaged the public's perception of the whole banking sector, according to the head of the industry's lobby group.

August 15 -

Democrats sent a letter to House Financial Services Committee Chairman Rep. Jeb Hensarling, R-Tex., asking that he investigate potential financial ties between President Trump and Russia.

August 11 -

Stephen Sanger is expected to leave as nonexecutive chairman; Barry Rodrigues, a former Citigroup and American Express executive, will join the British bank in November.

August 11 -

Chairman Stephen Sanger could step down ahead of the embattled bank's next annual meeting, according to a news report, clearing the way for the elevation of Duke, the current vice chairman and a former Fed governor and banking executive.

August 10 -

Special counsel Robert Mueller is said to be drawing on ongoing investigations, including one by federal prosecutors into whether former Trump campaign manager Paul Manafort laundered money from eastern Europe into New York properties.

August 10